Question: answer the following ABC Company is considering two mutually exclusive projects. The company's cost of capital is 10%. The net present value (NPV) profiles of

answer the following

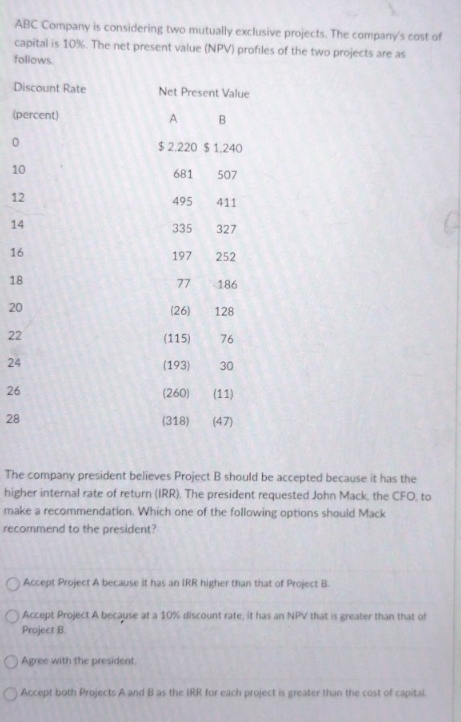

ABC Company is considering two mutually exclusive projects. The company's cost of capital is 10%. The net present value (NPV) profiles of the two projects are as follows. Discount Rate Net Present Value (percent) A B O $ 2,220 $ 1.240 10 681 507 12 495 411 14 335 327 16 197 252 18 77 186 20 (26) 128 22 (115) 76 24 (193) 30 26 (260) (11) 28 (318) (47) The company president believes Project B should be accepted because it has the higher internal rate of return (IRR). The president requested John Mack, the CFO, to make a recommendation, Which one of the following options should Mack recommend to the president? Accept Project A because it has an IRR higher than that of Project B. Accept Project A because at a 10%% discount rate, it has an NPV that is greater than that of Project B. Agree with the president Accept both Projects A and B as the IRR for each project is greater than the cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts