Question: Answer the following and present your solution in a comprehensive manner. Upload file/s picture/s of your answer. 1. The XYZ Company's existing sales are P1,800,000.

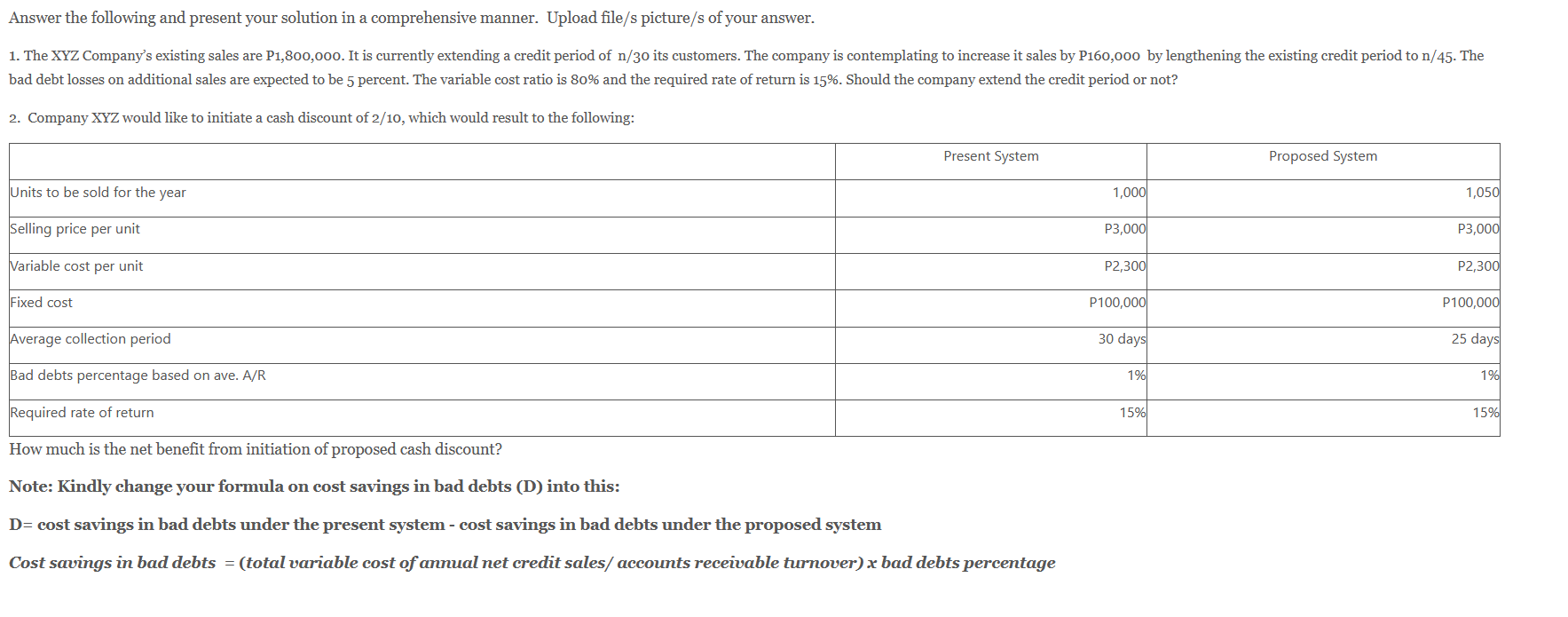

Answer the following and present your solution in a comprehensive manner. Upload file/s picture/s of your answer. 1. The XYZ Company's existing sales are P1,800,000. It is currently extending a credit period of n/30 its customers. The company is contemplating to increase it sales by P160,000 by lengthening the existing credit period to n/45. The bad debt losses on additional sales are expected to be 5 percent. The variable cost ratio is 80% and the required rate of return is 15%. Should the company extend the credit period or not? 2. Company XYZ would like to initiate a cash discount of 2/10, which would result to the following: Present System Proposed System Units to be sold for the year 1,000 1,050 Selling price per unit P3,000 P3,000 Variable cost per unit P2,300 P2,300 Fixed cost P100,000 P100,000 Average collection period 30 days 25 days Bad debts percentage based on ave. A/R 1% 1% Required rate of return 15% 15% How much is the net benefit from initiation of proposed cash discount? Note: Kindly change your formula on cost savings in bad debts (D) into this: D= cost savings in bad debts under the present system - cost savings in bad debts under the proposed system Cost savings in bad debts = (total variable cost of annual net credit sales/ accounts receivable turnover) x bad debts percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts