Question: Answer the following and provide the complete solution and explanation. substance. Gorman also received 12,000 cash. Assume that the last fiscal period ended on December

Answer the following and provide the complete solution and explanation.

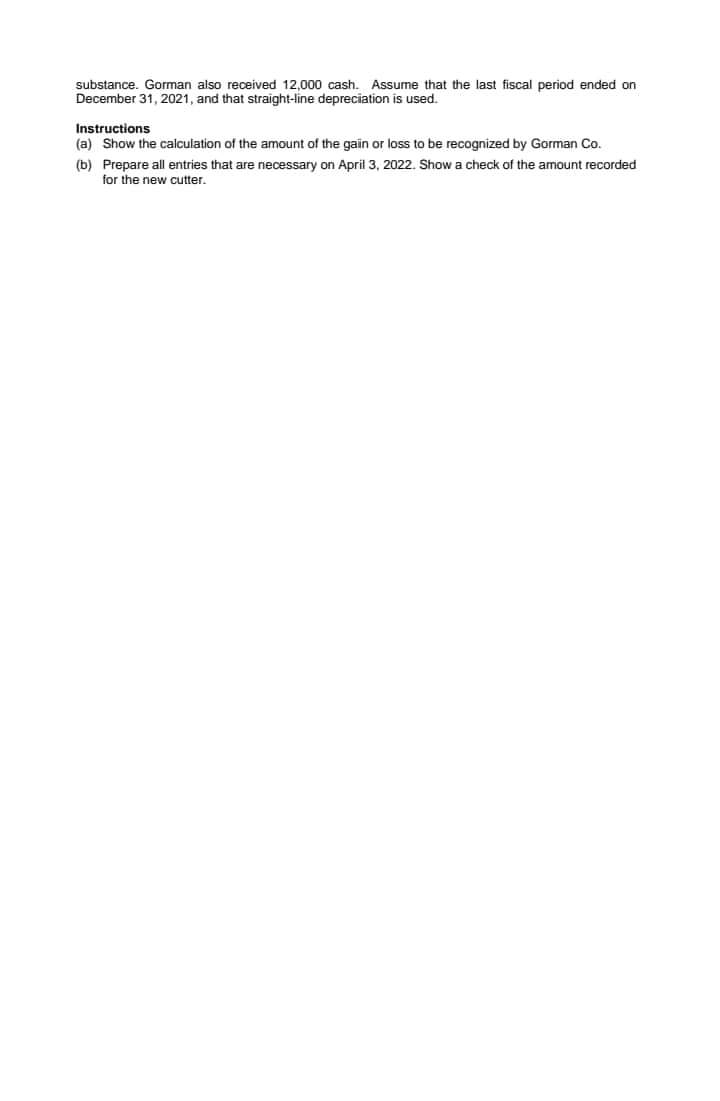

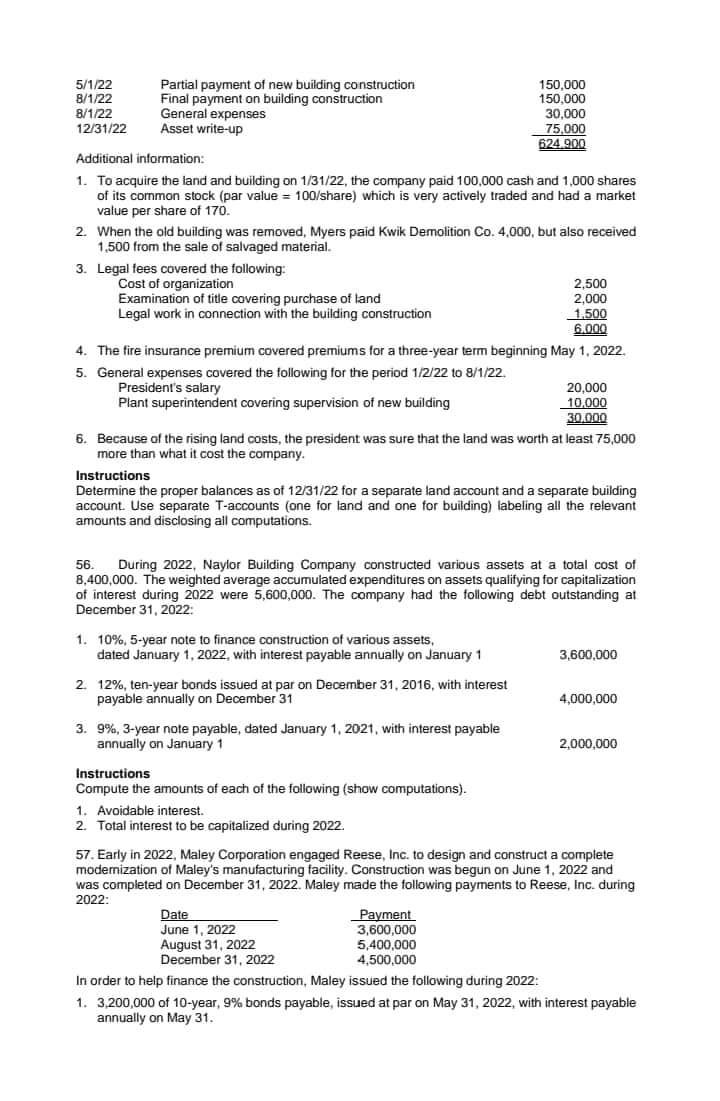

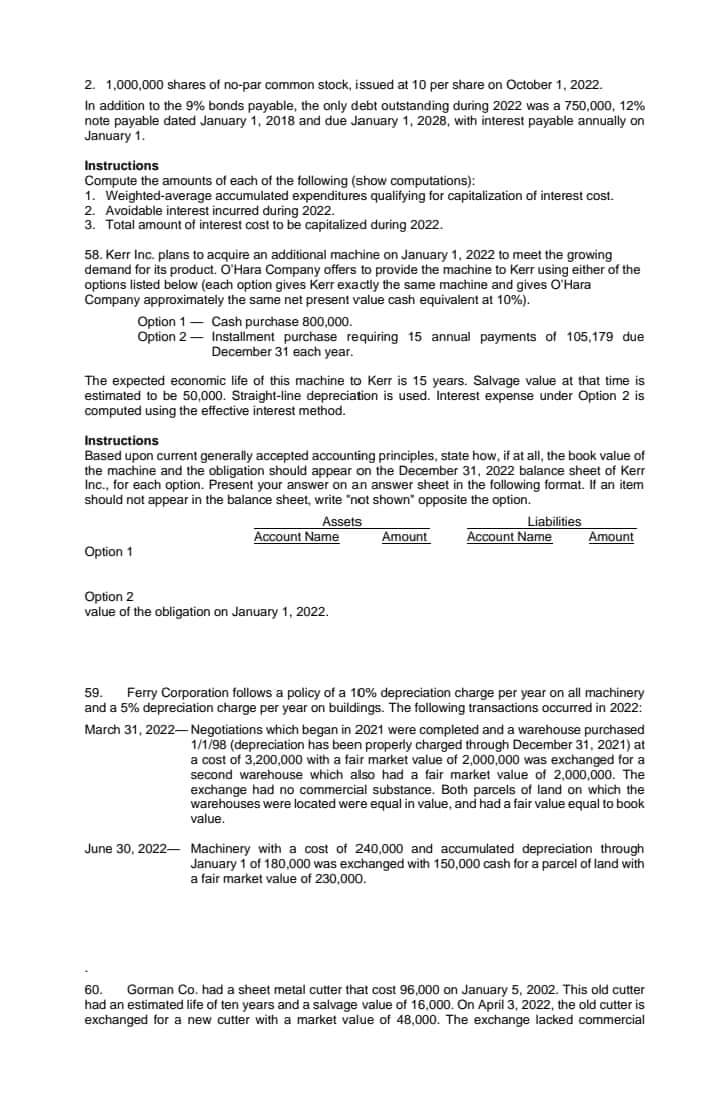

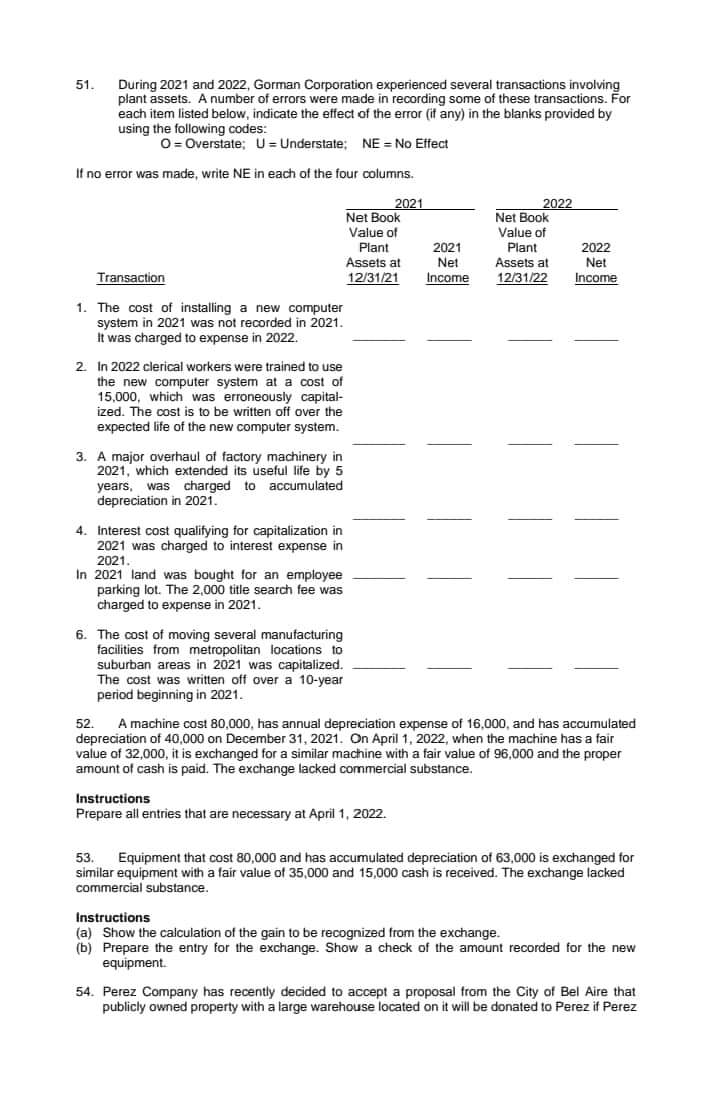

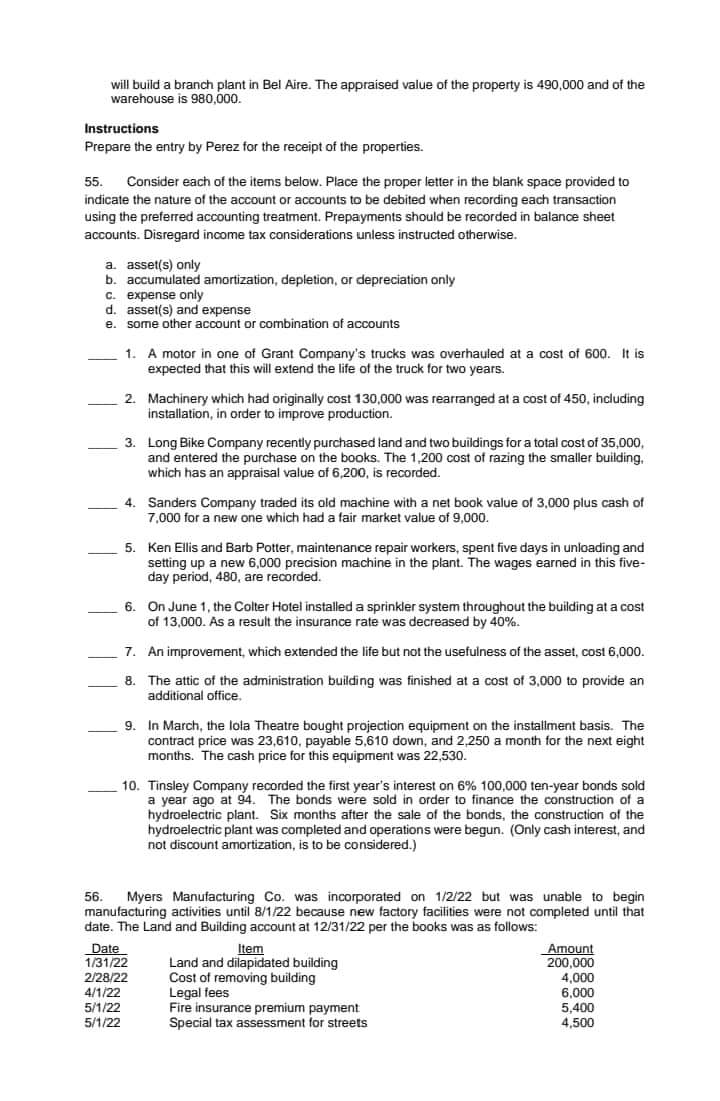

substance. Gorman also received 12,000 cash. Assume that the last fiscal period ended on December 31, 2021, and that straight-line depreciation is used. Instructions (a) Show the calculation of the amount of the gain or loss to be recognized by Gorman Co. (b) Prepare all entries that are necessary on April 3, 2022. Show a check of the amount recorded for the new cutter.5/1/22 Partial payment of new building construction 150,000 8/1/22 Final payment on building construction 150,000 8/1/22 General expenses 30,000 12/31/22 Asset write-up 75,000 624.900 Additional information: 1. To acquire the land and building on 1/31/22, the company paid 100,000 cash and 1,000 shares of its common stock (par value = 100/share) which is very actively traded and had a market value per share of 170. 2. When the old building was removed, Myers paid Kwik Demolition Co. 4,000, but also received 1,500 from the sale of salvaged material. 3. Legal fees covered the following: Cost of organization 2,500 Examination of title covering purchase of land 2,000 Legal work in connection with the building construction 1.500 6.000 4. The fire insurance premium covered premiums for a three-year term beginning May 1, 2022. 5. General expenses covered the following for the period 1/2/22 to 8/1/22. President's salary 20,000 Plant superintendent covering supervision of new building 10.000 30.000 6. Because of the rising land costs, the president was sure that the land was worth at least 75,000 more than what it cost the company. Instructions Determine the proper balances as of 12/31/22 for a separate land account and a separate building account. Use separate T-accounts (one for land and one for building) labeling all the relevant amounts and disclosing all computations. 56. During 2022, Naylor Building Company constructed various assets at a total cost of 8,400,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2022 were 5,600,000. The company had the following debt outstanding at December 31, 2022: 1. 10%, 5-year note to finance construction of various assets, dated January 1, 2022, with interest payable annually on January 1 3,600,000 2. 12%, ten-year bonds issued at par on December 31, 2016, with interest payable annually on December 31 4,000,000 3. 9%, 3-year note payable, dated January 1, 2021, with interest payable annually on January 1 2,000,000 Instructions Compute the amounts of each of the following (show computations). 1. Avoidable interest. 2. Total interest to be capitalized during 2022. 57. Early in 2022, Maley Corporation engaged Reese, Inc. to design and construct a complete modemization of Maley's manufacturing facility. Construction was begun on June 1, 2022 and was completed on December 31, 2022. Maley made the following payments to Reese, Inc. during 2022: Date Payment June 1, 2022 3,600,000 August 31, 2022 5,400,000 December 31, 2022 4,500,000 In order to help finance the construction, Maley issued the following during 2022: 1. 3,200,000 of 10-year, 9% bonds payable, issued at par on May 31, 2022, with interest payable annually on May 31.2. 1,000,000 shares of no-par common stock, issued at 10 per share on October 1, 2022. In addition to the 9% bonds payable, the only debt outstanding during 2022 was a 750,000, 12% note payable dated January 1, 2018 and due January 1, 2028, with interest payable annually on January 1. Instructions Compute the amounts of each of the following (show computations): 1. Weighted-average accumulated expenditures qualifying for capitalization of interest cost. 2. Avoidable interest incurred during 2022. 3. Total amount of interest cost to be capitalized during 2022. 58. Kerr Inc. plans to acquire an additional machine on January 1, 2022 to meet the growing demand for its product. O'Hara Company offers to provide the machine to Kerr using either of the options listed below (each option gives Kerr exactly the same machine and gives O'Hara Company approximately the same net present value cash equivalent at 10%). Option 1 - Cash purchase 800,000. Option 2- Installment purchase requiring 15 annual payments of 105,179 due December 31 each year. The expected economic life of this machine to Kerr is 15 years. Salvage value at that time is estimated to be 50,000. Straight-line depreciation is used. Interest expense under Option 2 is computed using the effective interest method. Instructions Based upon current generally accepted accounting principles, state how, if at all, the book value of the machine and the obligation should appear on the December 31, 2022 balance sheet of Kerr Inc., for each option. Present your answer on an answer sheet in the following format. If an item should not appear in the balance sheet, write "not shown" opposite the option. Assets Liabilities Account Name Amount Account Name Amount Option 1 Option 2 value of the obligation on January 1, 2022. 59. Ferry Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2022: March 31, 2022-Negotiations which began in 2021 were completed and a warehouse purchased 1/1/98 (depreciation has been properly charged through December 31, 2021) at a cost of 3,200,000 with a fair market value of 2,000,000 was exchanged for a second warehouse which also had a fair market value of 2,000,000. The exchange had no commercial substance. Both parcels of land on which the warehouses were located were equal in value, and had a fair value equal to book value. June 30, 2022- Machinery with a cost of 240,000 and accumulated depreciation through January 1 of 180,000 was exchanged with 150,000 cash for a parcel of land with a fair market value of 230,000. 60. Gorman Co. had a sheet metal cutter that cost 96,000 on January 5, 2002. This old cutter had an estimated life of ten years and a salvage value of 16,000. On April 3, 2022, the old cutter is exchanged for a new cutter with a market value of 48,000. The exchange lacked commercial51. During 2021 and 2022, Gorman Corporation experienced several transactions involving plant assets. A number of errors were made in recording some of these transactions. For each item listed below, indicate the effect of the error (if any) in the blanks provided by using the following codes: O = Overstate; U = Understate; NE = No Effect If no error was made, write NE in each of the four columns. 2021 2022 Net Book Net Book Value of Value of Plant 2021 Plant 2022 Assets at Net Assets at Net Transaction 12/31/21 Income 12/31/22 Income 1. The cost of installing a new computer system in 2021 was not recorded in 2021. It was charged to expense in 2022. 2. In 2022 clerical workers were trained to use the new computer system at a cost of 15,000, which was erroneously capital- ized. The cost is to be written off over the expected life of the new computer system. 3. A major overhaul of factory machinery in 2021, which extended its useful life by 5 years, was charged to accumulated depreciation in 2021. 4. Interest cost qualifying for capitalization in 2021 was charged to interest expense in 2021. In 2021 land was bought for an employee parking lot. The 2,000 title search fee was charged to expense in 2021. 6. The cost of moving several manufacturing facilities from metropolitan locations to suburban areas in 2021 was capitalized. The cost was written off over a 10-year period beginning in 2021. 52. A machine cost 80,000, has annual depreciation expense of 16,000, and has accumulated depreciation of 40,000 on December 31, 2021. On April 1, 2022, when the machine has a fair value of 32,000, it is exchanged for a similar machine with a fair value of 96,000 and the proper amount of cash is paid. The exchange lacked commercial substance. Instructions Prepare all entries that are necessary at April 1, 2022. 53. Equipment that cost 80,000 and has accumulated depreciation of 63,000 is exchanged for similar equipment with a fair value of 35,000 and 15,000 cash is received. The exchange lacked commercial substance. Instructions (a) Show the calculation of the gain to be recognized from the exchange. (b) Prepare the entry for the exchange. Show a check of the amount recorded for the new equipment. 54. Perez Company has recently decided to accept a proposal from the City of Bel Aire that publicly owned property with a large warehouse located on it will be donated to Perez if Perezwill build a branch plant in Bel Aire. The appraised value of the property is 490,000 and of the warehouse is 980,000. Instructions Prepare the entry by Perez for the receipt of the properties. 55. `Consider each of the items below. Place the proper letter in the blank space provided to indicate the nature of the account or accounts to be debited when recording each transaction using the preferred accounting treatment. Prepayments should be recorded in balance sheet accounts. Disregard income tax considerations unless instructed otherwise. a. asset(s) only b. accumulated amortization, depletion, or depreciation only c. expense only d. asset(s) and expense e. some other account or combination of accounts A motor in one of Grant Company's trucks was overhauled at a cost of 600. It is expected that this will extend the life of the truck for two years. 2. Machinery which had originally cost 130,000 was rearranged at a cost of 450, including installation, in order to improve production. 3. Long Bike Company recently purchased land and two buildings for a total cost of 35,000, and entered the purchase on the books. The 1,200 cost of razing the smaller building. which has an appraisal value of 6,200, is recorded 4. Sanders Company traded its old machine with a net book value of 3,000 plus cash of 7,000 for a new one which had a fair market value of 9,000. 5. Ken Ellis and Barb Potter, maintenance repair workers, spent five days in unloading and setting up a new 6,000 precision machine in the plant. The wages earned in this five- day period, 480, are recorded. 6. On June 1, the Colter Hotel installed a sprinkler system throughout the building at a cost of 13,000. As a result the insurance rate was decreased by 40%. 7. An improvement, which extended the life but not the usefulness of the asset, cost 6,000. 8. The attic of the administration building was finished at a cost of 3,000 to provide an additional office, 9. In March, the lola Theatre bought projection equipment on the installment basis. The contract price was 23,610, payable 5,610 down, and 2,250 a month for the next eight months. The cash price for this equipment was 22,530. 10. Tinsley Company recorded the first year's interest on 6% 100,000 ten-year bonds sold a year ago at 94. The bonds were sold in order to finance the construction of a hydroelectric plant. Six months after the sale of the bonds, the construction of the hydroelectric plant was completed and operations were begun. (Only cash interest, and not discount amortization, is to be considered.) 56. Myers Manufacturing Co. was incorporated on 1/2/22 but was unable to begin manufacturing activities until 8/1/22 because new factory facilities were not completed until that date. The Land and Building account at 12/31/22 per the books was as follows: Date Item Amount 1/31/22 Land and dilapidated building 200,000 2/28/22 Cost of removing building 4,000 4/1/22 Legal fees 6,000 5/1/22 Fire insurance premium payment 5,400 5/1/22 Special tax assessment for streets 4,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts