Question: Answer the following b . Suppose you are considering two podsible investment opportunities: a 1 2 - pear Treasury hond and a 7 - pear,

Answer the following

b Suppose you are considering two podsible investment opportunities: a pear Treasury hond and a pear, Arated corporate bond. The current real riskfree rabe is and inflation is expected bs be for the next yeark, for the following, peank, and thereafter. The aturlty fisk premium is estimabed by this formula: MRP The liquidity premium Ul lor the corporite bond is entimated ba be h You mar determine the defaut risk premium DAP gheen the company's bons rating, from the fullowing table, liemember to subtract the bond's LP from the corporabe spreas glven is the table to arrive at the bohd's Dep.

Cerporate Bend Yield

tableRate,Spread a D LU Treapury,Ah corporate,

d Based on the information about the corporate bond provided in part b calculate yields and then construct a new yield curve graph that shows both the Treasury and the corporate bonds. Round your answers to two decimal places.

tableYearsTreasury yield,Acorporate yield

Excel Activity: Bond Waluation

Cimord Cart is a recent rellret mho is interested in inveating some of his savings in corporabe bonds. His financial planser has sugpetied the follof bonds!

Bond A has a annual coupon, matures in years, and has a $ face value.

Bond has an snmual eoupor, matares in years, and has a $ face vatue.

Bond C has a annual coupon, mahures in years, and has a $ foce valut.

Each bond has if yeled to maturity of

The data has been colected in the Miorosot Excel fie below, Doenload the spreadsheet and pertorm the required analysis to answer the quescons is De not round intermediate calculationa. Use a misus sign to enter negative values, any. an ansmer is reng, enter g

Domnloed soreadrheet: Band Yaluationefchet xiss

a Before calculaing the friken of the bonds, indicate whether each bond a triding at a premiutr, at a ducbunc, or at par

Bend A is selling it because its oeupen rate is the going interest rate.

Rond is seliny at beckuve its geupen rate is the poing liferent rate.

Rond ia selinag at thentise at isurpen rete is f the geing inderent rate.

Eecel Artivity Bund Wriubion bende:

Fach bund has byale ne meturty of s

En

finel a min tiliny an

Ifer nem merset nex.

Hond Bis velling et

Find Cis wexling ar Seckute tis empen rive is

P

Each bond has a yield to maturity of

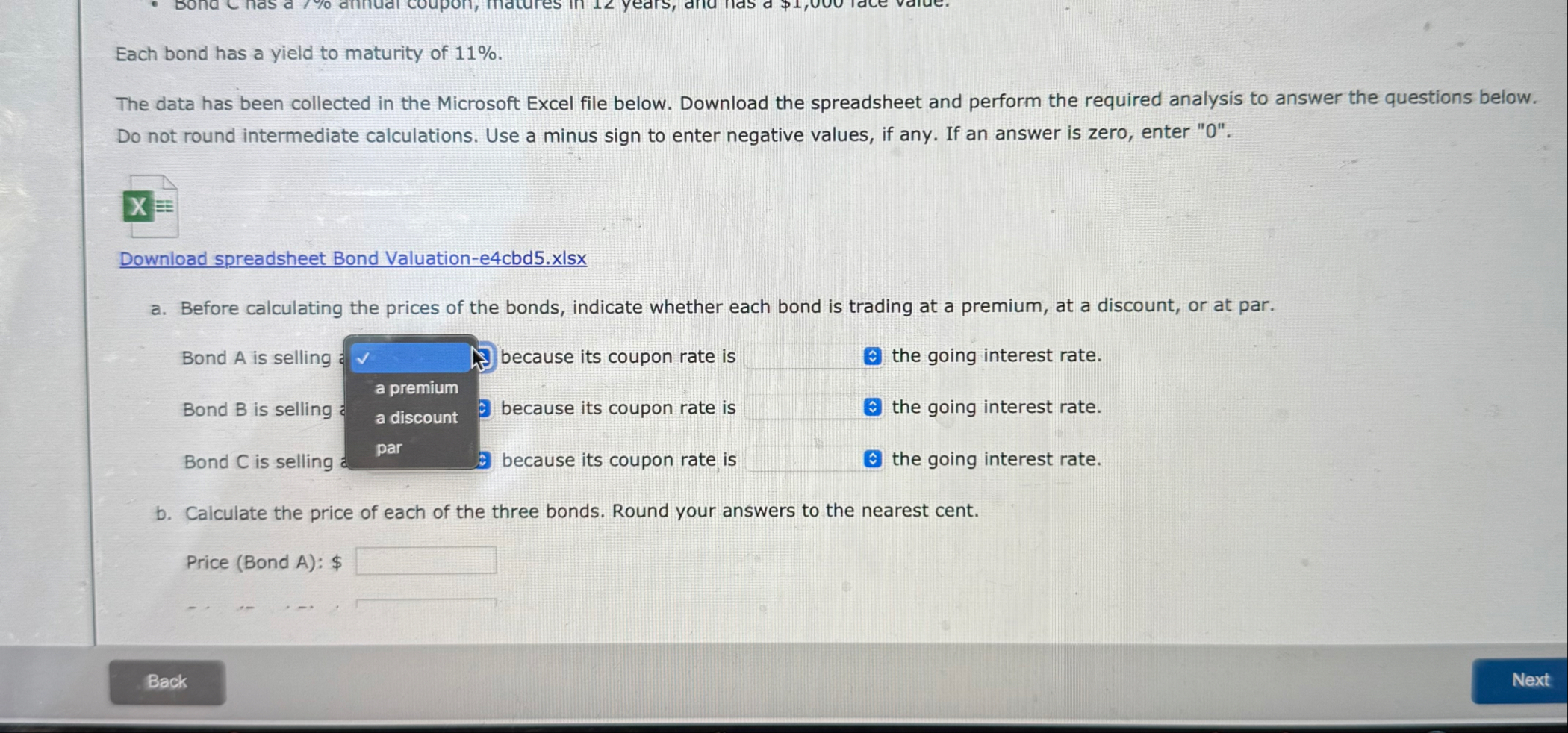

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter

Downioad spreadsheet Bond Valuationecbdxsx

a Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par.

Bond A is selling because its coupon rate is the going interest rate.

Bond is selling a premium a discount because its coupon rate is the going interest rate.

Bond C is selling par because its coupon rate is the going interest rate.

b Calculate the price of each of the three bonds. Round your answers to the nearest cent.

Price Bond A: $

b Calculate the price of each of the three bonds. Round your answers to the nearest cent.

Price Bond A: $

Price Bond B: $

Price Bond C: $

c Calculate the current yield for each of the three bonds. Hint: The expected current yield is calculated as the annual interest divided by the price of the bond. Round your answers to two decimal places.

Current yield Bond :

Wh

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock