Question: Answer the following. CURRENT LIABILITIES Multiple Choice Identify the choice that best completes the statement or answers the question. A1. A legal obligation is an

Answer the following.

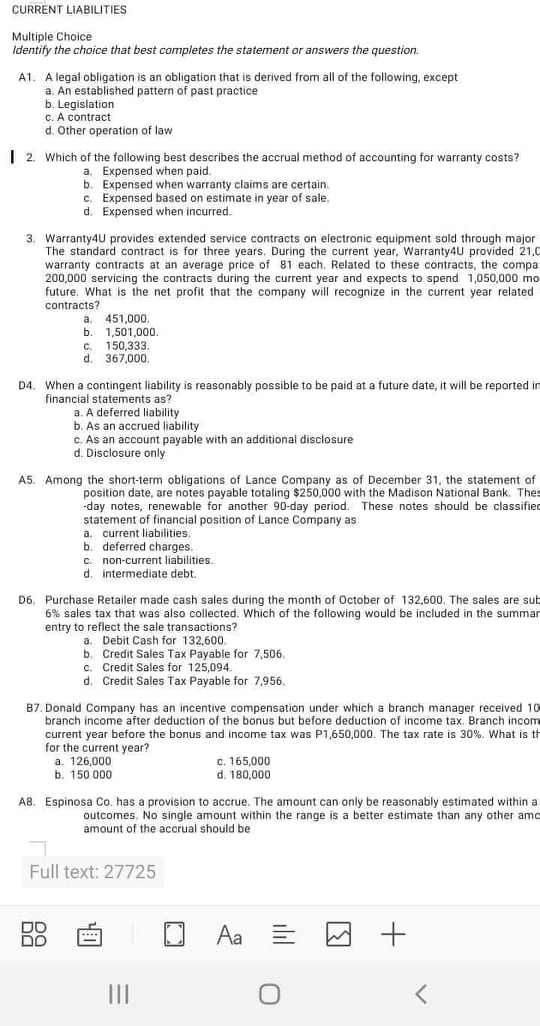

CURRENT LIABILITIES Multiple Choice Identify the choice that best completes the statement or answers the question. A1. A legal obligation is an obligation that is derived from all of the following, except a. An established pattern of past practice b. Legislation C. A contract d. Other operation of law | 2. Which of the following best describes the accrual method of accounting for warranty costs? a. Expensed when paid. b. Expensed when warranty claims are certain. c. Expensed based on estimate in year of sale. d. Expensed when incurred. 3. Warranty4U provides extended service contracts on electronic equipment sold through major The standard contract is for three years. During the current year, Warranty4U provided 21.0 warranty contracts at an average price of 81 each. Related to these contracts, the compa 200,000 servicing the contracts during the current year and expects to spend 1,050,000 mo future. What is the net profit that the company will recognize in the current year related contracts? a. 451,000. b. 1,501,000 C. 150,333 d. 367,000. D4. When a contingent liability is reasonably possible to be paid at a future date, it will be reported in financial statements as? a. A deferred liability b. As an accrued liability C. As an account payable with an additional disclosure d. Disclosure only A5. Among the short-term obligations of Lance Company as of December 31, the statement of position date, are notes payable totaling $250,000 with the Madison National Bank. The -day notes, renewable for another 90-day period. These notes should be classified statement of financial position of Lance Company as a. current liabilities b. deferred charges. c. non-current liabilities. d, intermediate debt. D6. Purchase Retailer made cash sales during the month of October of 132,600. The sales are sub 6% sales tax that was also collected. Which of the following would be included in the summar entry to reflect the sale transactions? Debit Cash for 132,600. b. Credit Sales Tax Payable for 7.506. c. Credit Sales for 125,094. d. Credit Sales Tax Payable for 7,956. 87. Donald Company has an incentive compensation under which a branch manager received 10 branch income after deduction of the bonus but before deduction of income tax. Branch incom current year before the bonus and income tax was P1,650,000. The tax rate is 30%. What is t for the current year? a. 126,000 C. 165,000 b. 150 000 d. 180,000 AB. Espinosa Co, has a provision to accrue. The amount can only be reasonably estimated within a outcomes. No single amount within the range is a better estimate than any other am amount of the accrual should be Full text: 27725 DO DO Aa E III O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts