Question: Answer the following detailed 04-FE001 wp When using present worth to evaluate the attractiveness of a single investment alternative, what value is the calculated PW

Answer the following detailed

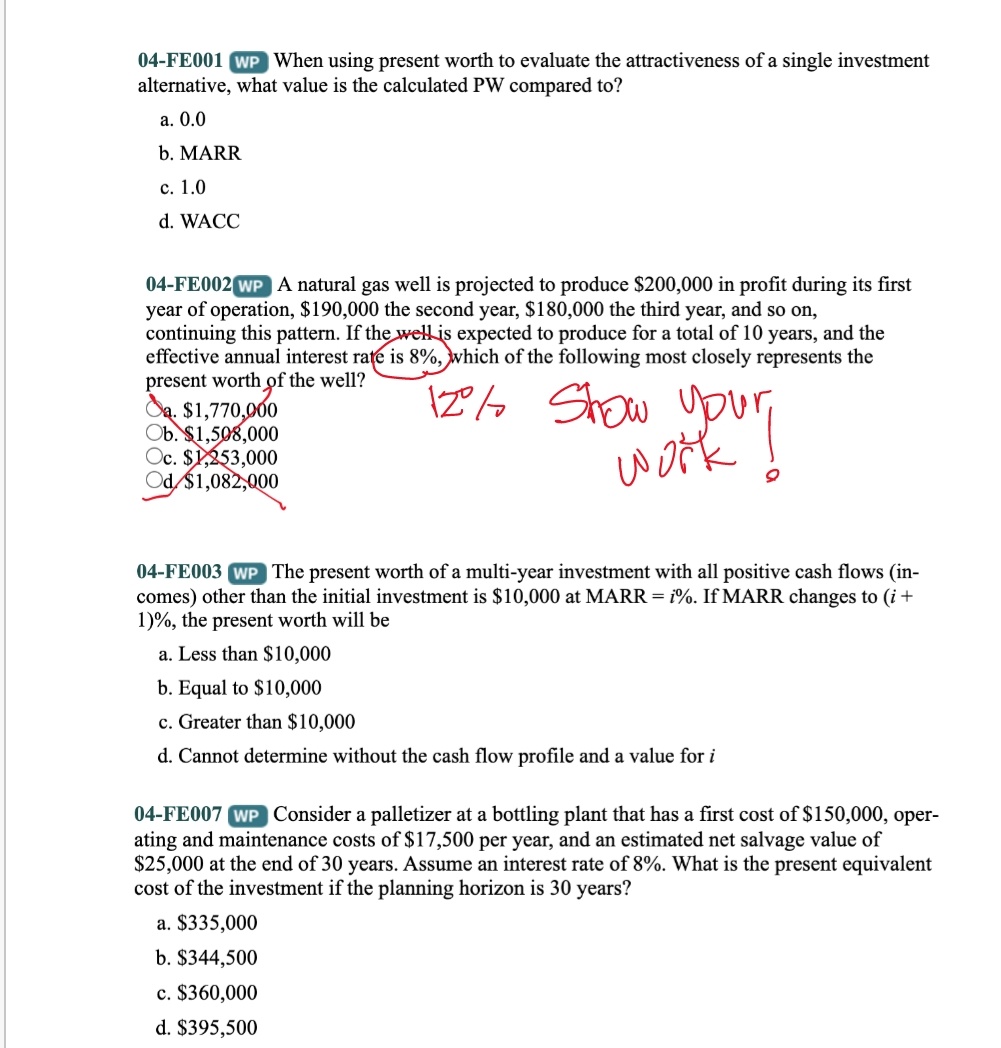

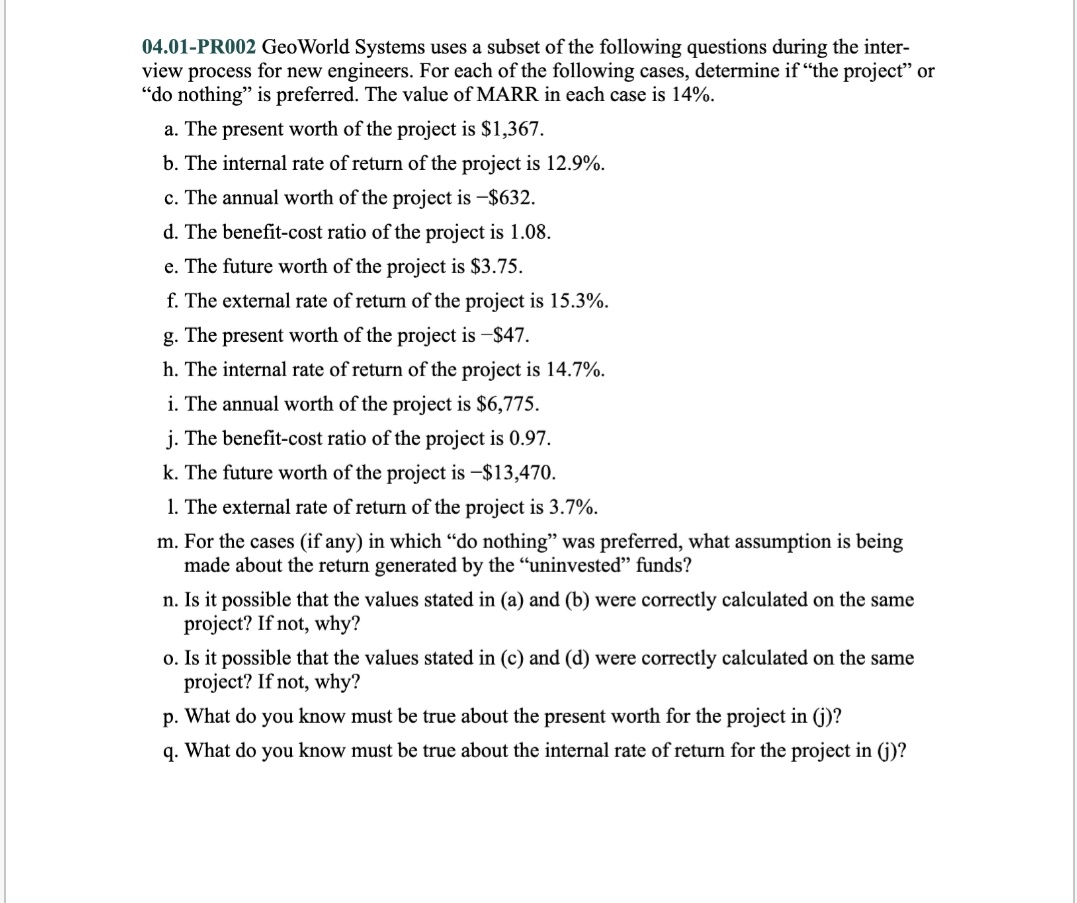

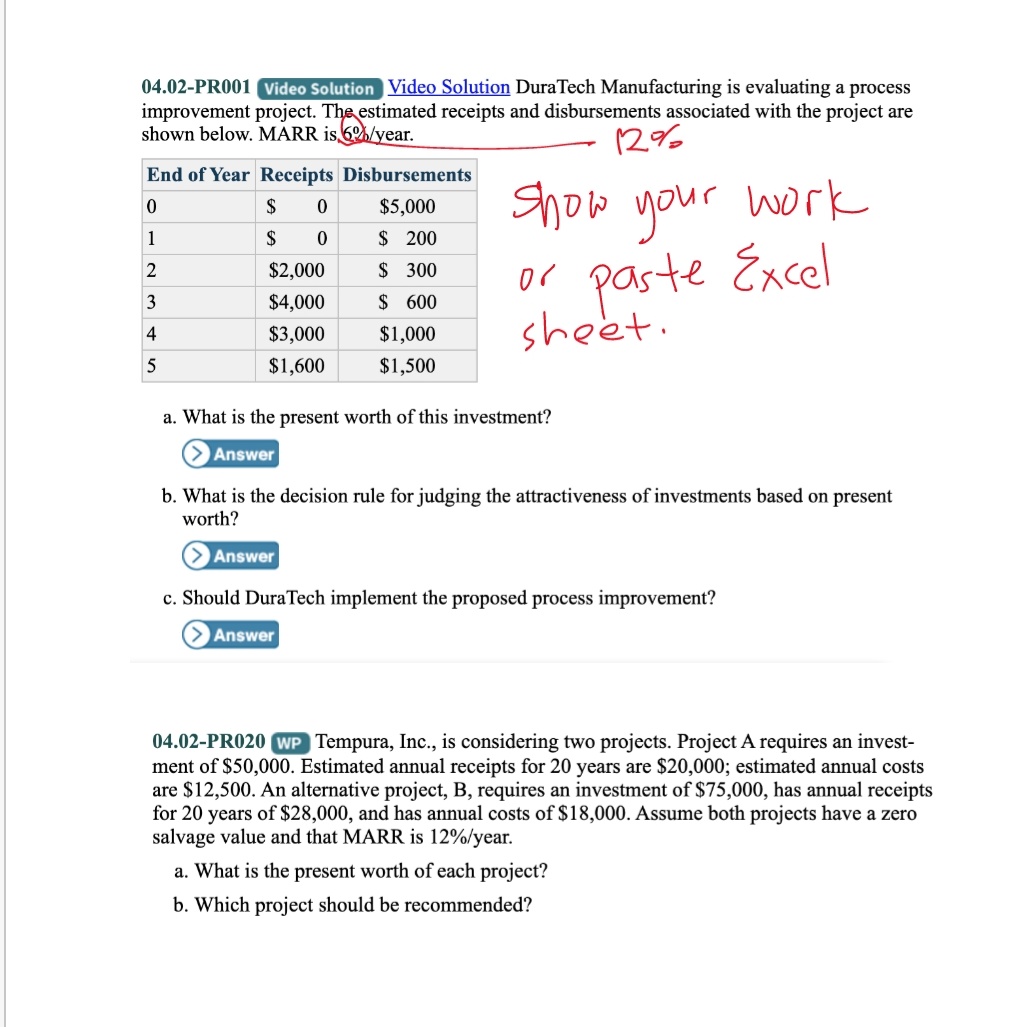

04-FE001 wp When using present worth to evaluate the attractiveness of a single investment alternative, what value is the calculated PW compared to? a. 0.0 b. MARR c. 1.0 d. WACC 04-FE002 WP A natural gas well is projected to produce $200,000 in profit during its first year of operation, $190,000 the second year, $180,000 the third year, and so on, continuing this pattern. If the well is expected to produce for a total of 10 years, and the effective annual interest rate is 8%, which of the following most closely represents the present worth of the well? Sa. $1,770,900 Ob. $1,508,000 12 / Show your Oc. $1,253,000 Od/$1,082,000 work ! 04-FE003 WP The present worth of a multi-year investment with all positive cash flows (in- comes) other than the initial investment is $10,000 at MARR = 1%. If MARR changes to (i + 1)%, the present worth will be a. Less than $10,000 b. Equal to $10,000 c. Greater than $10,000 d. Cannot determine without the cash flow profile and a value for i 04-FE007 WP Consider a palletizer at a bottling plant that has a first cost of $150,000, oper- ating and maintenance costs of $17,500 per year, and an estimated net salvage value of $25,000 at the end of 30 years. Assume an interest rate of 8%. What is the present equivalent cost of the investment if the planning horizon is 30 years? a. $335,000 b. $344,500 c. $360,000 d. $395,50004.01-PR002 GeoWorld Systems uses a subset of the following questions during the inter- view process for new engineers. For each of the following cases, determine if \"the project" or \"do nothing\" is preferred. The value of MARR in each case is 14%. a. The present worth of the project is $1,367. b. The internal rate of return of the project is 12.9%. c. The annual worth of the project is -$632. :1. The benet-cost ratio of the project is 1.08. c. The future worth of the project is $335. f. The external rate of return of the project is 15.3%. g. The present worth of the project is $4?. h. The internal rate of return of the project is 14.7%. i. The annual worth of the project is $6,775. j. The benet-cost ratio of the project is 0.97. k. The future worth of the project is -$13,470. 1. The external rate of return of the project is 3.7%. m. For the cases (if any) in which \"do nothing" was preferred, what assumption is being made about the return generated by the 'minvested\" mds? n. Is it possible that the values stated in (a) and (b) were correctly calculated on the same project? If not, why? 0. Is it possible that the values stated in (c) and (d) were correctly calculated on the same project? If not, why? p. What do you know must be true about the present worth for the project in (j)? q. What do you know must be true about the internal rate of return for the project in (j)? 04.02-PR001 Video Solution Video Solution Dura Tech Manufacturing is evaluating a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 621/year. 12% End of Year Receipts Disbursements $ 0 $5,000 Show your work $ 0 $ 200 $2,000 $ 300 $4,000 $ 600 or paste Excel $3,000 $1,000 sheet . $1,600 $1,500 a. What is the present worth of this investment? Answer b. What is the decision rule for judging the attractiveness of investments based on present worth? Answer c. Should Dura Tech implement the proposed process improvement? Answer 04.02-PR020 WP Tempura, Inc., is considering two projects. Project A requires an invest- ment of $50,000. Estimated annual receipts for 20 years are $20,000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $75,000, has annual receipts for 20 years of $28,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 12%/year. a. What is the present worth of each project? b. Which project should be recommended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts