Question: ANSWER THE FOLLOWING DIRECT CASH FLOW STATEMENT, ANSWER ALL EMPTY GRAY SQAURES Instructions: Prepare the Direct Cash Flow Statement for Ace Company in the format

ANSWER THE FOLLOWING DIRECT CASH FLOW STATEMENT, ANSWER ALL EMPTY GRAY SQAURES

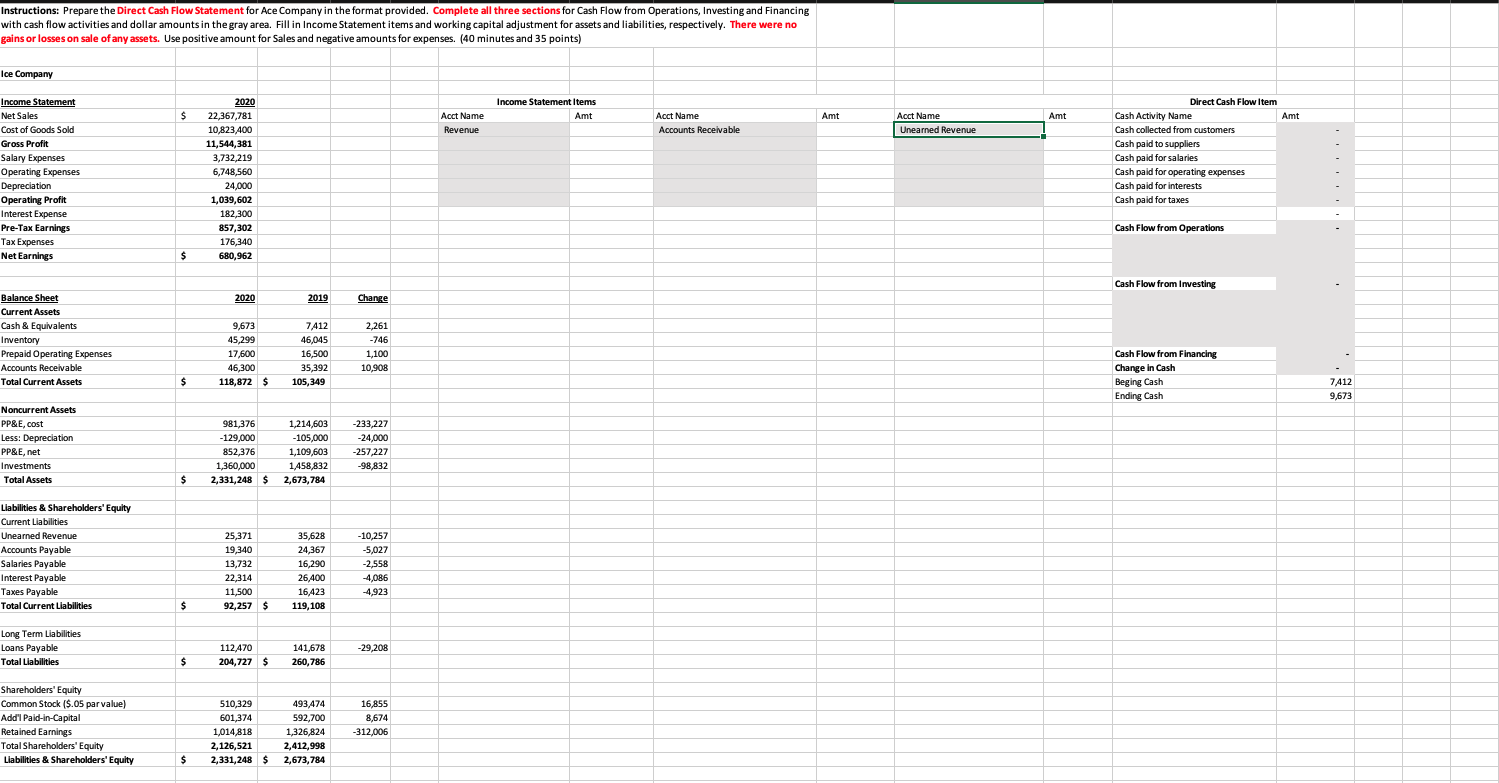

Instructions: Prepare the Direct Cash Flow Statement for Ace Company in the format provided. Complete all three sections for Cash Flow from Operations, Investing and Financing with cash flow activities and dollar amounts in the gray area. Fill in Income Statement items and working capital adjustment for assets and liabilities, respectively. There were no gains or losses on sale of any assets. Use positive amount for Sales and negative amounts for expenses. (40 minutes and 35 points) Ice Company Income Statement items Amt $ Amt Amt Acct Name Revenue Acct Name Accounts Receivable Acct Name Unearned Revenue Income Statement Net Sales Cost of Goods Sold Gross Profit Salary Expenses Operating Expenses Depreciation Operating Profit Interest Expense Pre-Tax Earnings Tax Expenses Net Earnings 2020 22,367,781 10,823,400 11,544,381 3,732,219 6,748,560 24,000 1,039,602 182,300 857,302 176,340 680,962 Direct Cash Flow Item Cash Activity Name Amt Cash collected from customers Cash paid to suppliers Cash paid for salaries Cash paid for operating expenses Cash paid for interests Cash paid for taxes Cash Flow from Operations $ Cash Flow from Investing 2020 2019 Change Balance Sheet Current Assets Cash & Equivalents Inventory Prepaid Operating Expenses Accounts Receivable Total Current Assets 9,673 45,299 17,600 46,300 118,872 $ 7,412 46,045 16,500 35,392 105,349 2,261 -746 1,100 10,908 Cash Flow from Financing Change in Cash Beging Cash Ending Cash $ 7412 9,673 Noncurrent Assets PP&E, cost Less: Depreciation PP&E.net Investments Total Assets 981,376 -129,000 852,376 1,360,000 2,331,248 $ 1,214,603 -105,000 1,109,603 1,458,832 2,673,784 -233,227 -24,000 -257,227 -98,832 $ Liabilities & Shareholders' Equity Current Liabilities Unearned Revenue Accounts Payable Salaries Payable Interest Payable Taxes Payable Total Current Liabilities 25,371 19,340 13,732 22,314 11,500 92,257 $ 35,628 24,367 16,290 26,400 16,423 119, 108 -10,257 -5,027 -2,558 -4,086 4,923 $ Long Term Liabilities Loans Payable Total Liabilities -29,208 112470 204,727 s 141,678 260,786 $ Shareholders' Equity Common Stock ($.05 par value) Add'l Paid-in-Capital Retained Earnings Total Shareholders' Equity Liabilities & Shareholders' Equity 510,329 601,374 1,014,818 2,126,521 2,331,248 $ 493 474 592,700 1,326,824 2,412,998 2,673,784 16,855 8,674 -312,006 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts