Question: Answer the following multiple - choice questions. Indicate your choice by selecting only one option from the four options given for each question answered. Use

Answer the following multiplechoice questions. Indicate your

choice by selecting only one option from the four options given

for each question answered.

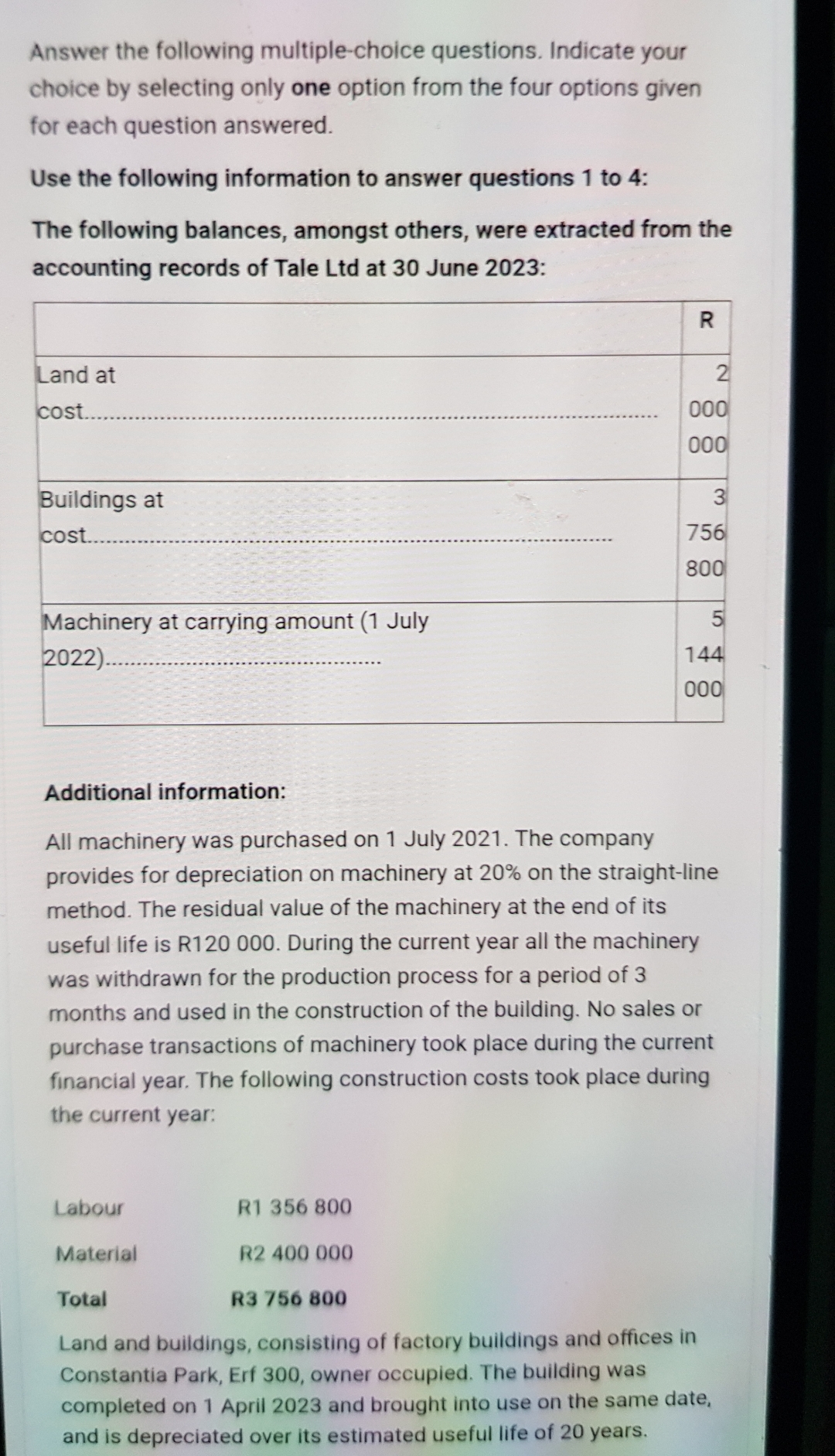

Use the following information to answer questions to :

The following balances, amongst others, were extracted from the

accounting records of Tale Ltd at June :

Additional information:

All machinery was purchased on July The company

provides for depreciation on machinery at on the straightline

method. The residual value of the machinery at the end of its

useful life is R During the current year all the machinery

was withdrawn for the production process for a period of

months and used in the construction of the building. No sales or

purchase transactions of machinery took place during the current

financial year. The following construction costs took place during

the current year:

Labour

R

Material

R

Total

R

Land and buildings, consisting of factory buildings and offices in

Constantia Park, Erf owner occupied. The building was

completed on April and brought into use on the same date,

and is depreciated over its estimated useful life of years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock