Question: answer the following. only the answer is needed no explainations thank you. 2) A partnership has two partners, Ms. Lee and Mr. Wan, and profit

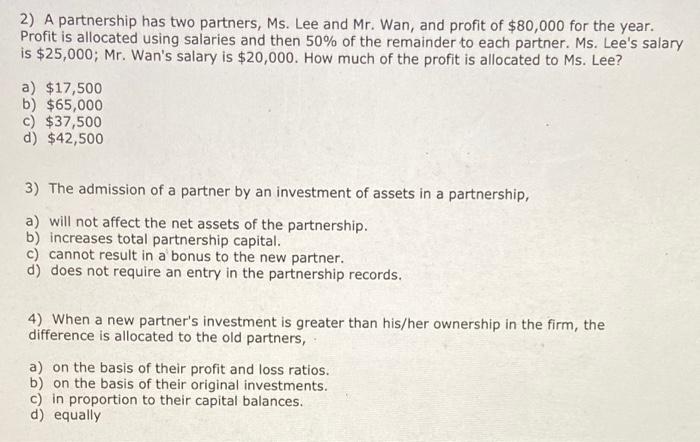

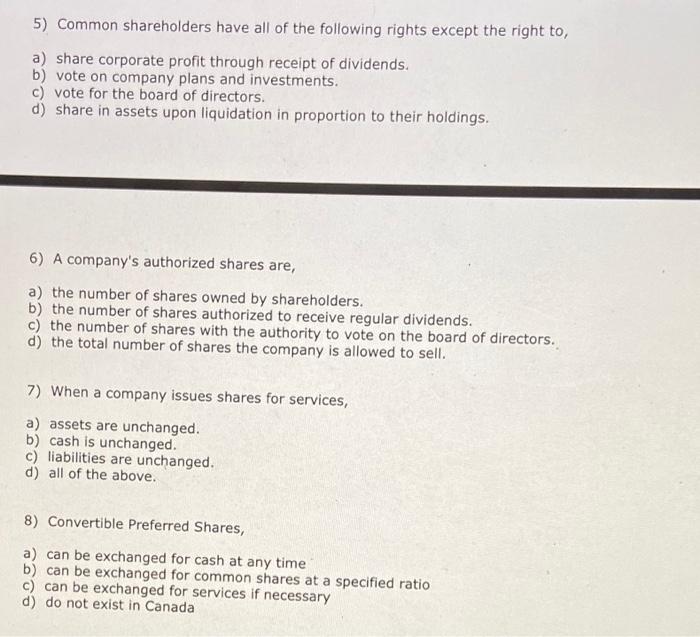

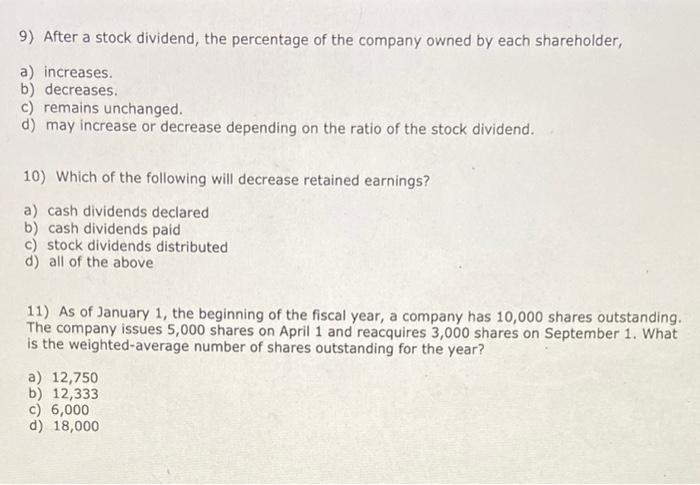

2) A partnership has two partners, Ms. Lee and Mr. Wan, and profit of $80,000 for the year. Profit is allocated using salaries and then 50% of the remainder to each partner. Ms. Lee's salary is $25,000; Mr. Wan's salary is $20,000. How much of the profit is allocated to Ms. Lee? a) $17,500 b) $65,000 c) $37,500 d) $42,500 3) The admission of a partner by an investment of assets in a partnership, a) will not affect the net assets of the partnership. b) increases total partnership capital. c) cannot result in a bonus to the new partner. d) does not require an entry in the partnership records. 4) When a new partner's investment is greater than his/her ownership in the firm, the difference is allocated to the old partners, a) on the basis of their profit and loss ratios. b) on the basis of their original investments. c) in proportion to their capital balances. d) equally 5) Common shareholders have all of the following rights except the right to, a) share corporate profit through receipt of dividends. b) vote on company plans and investments. c) vote for the board of directors. d) share in assets upon liquidation in proportion to their holdings. 6) A company's authorized shares are, a) the number of shares owned by shareholders. b) the number of shares authorized to receive regular dividends. c) the number of shares with the authority to vote on the board of directors. d) the total number of shares the company is allowed to sell. 7) When a company issues shares for services, a) assets are unchanged. b) cash is unchanged. c) liabilities are unchanged. d) all of the above. 8) Convertible Preferred Shares, a) can be exchanged for cash at any time b) can be exchanged for common shares at a specified ratio c) can be exchanged for services if necessary d) do not exist in Canada 9) After a stock dividend, the percentage of the company owned by each shareholder, a) increases. b) decreases. c) remains unchanged. d) may increase or decrease depending on the ratio of the stock dividend. 10) Which of the following will decrease retained earnings? a) cash dividends declared b) cash dividends paid c) stock dividends distributed d) all of the above 11) As of January 1, the beginning of the fiscal year, a company has 10,000 shares outstanding. The company issues 5,000 shares on April 1 and reacquires 3,000 shares on September 1 . What is the weighted-average number of shares outstanding for the year? a) 12,750 b) 12,333 c) 6,000 d) 18,000 12) Which of the following statements is true? a) All privately-held corporations produce annual reports for their shareholders. b) A healthy company should demonstrate growth in revenues over time. c) Corporations are not allowed to post their annual reports online. d) Shareholders of a corporation should be happy if the top executives are earning exorbitant amounts of money because that tells them that they have quality people running the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts