Question: Answer the following problem, imperative to explain your assumptions to complete the forecast for 2002,2003 and 2004. Take also into consideration the instructions on how

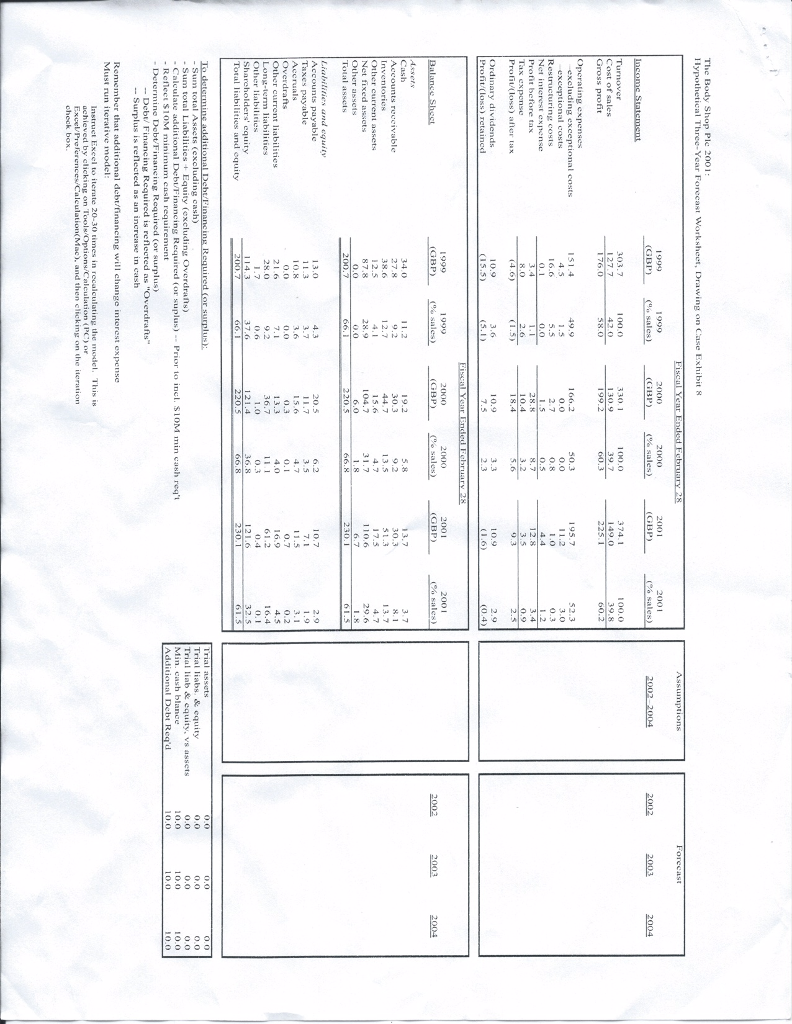

Answer the following problem, imperative to explain your assumptions to complete the forecast for 2002,2003 and 2004. Take also into consideration the instructions on how to determined additional debt/financing required or surplus on bottom of page with spreadsheet plus formula to calculate interest on the first page. (for example increase or decrease sales by 10% each year, increase inventories etc for your assumptions) When it comes to the Debt/Financing surplus depending on you assumptions you will have a surplus in cash or a deficit, compute that in the spreadsheet.

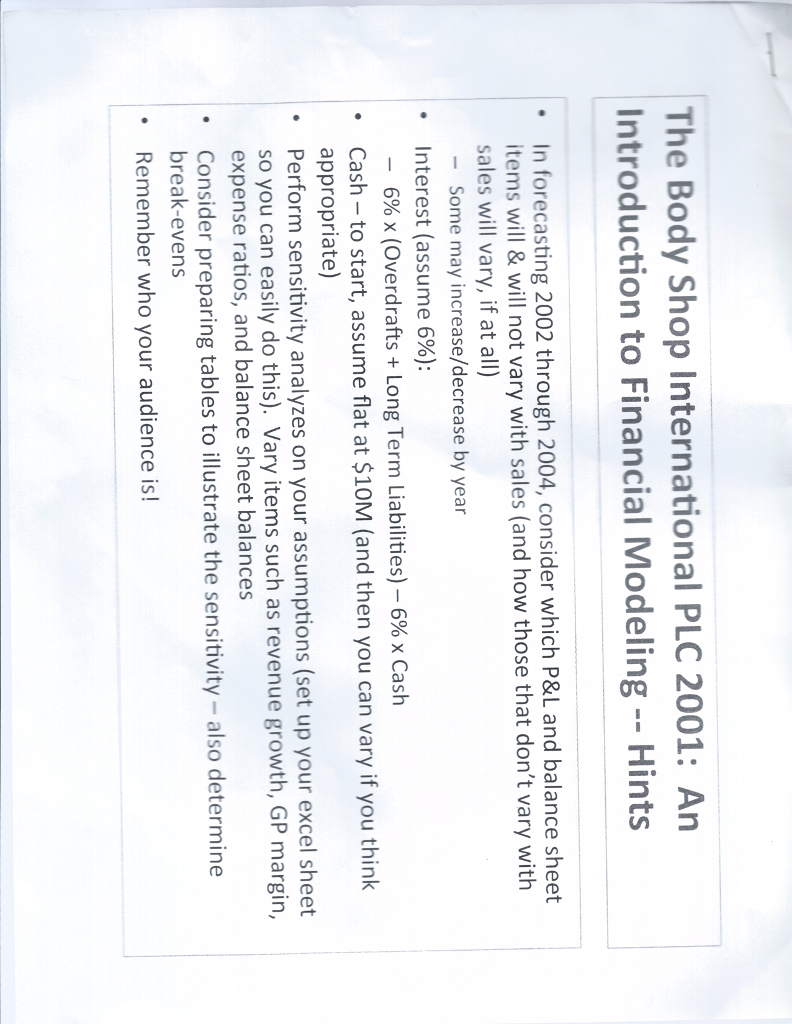

The Body Shop International PLC 2001: An Introduction to Financial Modeling Hints In forecasting 2002 through 2004, consider which P&L and balance sheet items will & will not vary with sales (and how those that don't vary with sales will vary, if at all) Some may increase/decrease by year Interest (assume 6%) 6% x (overdrafts Long Term Liabilities) 6% x Cash Cash to start, assume flat at $10M (and then you can vary if you think appropriate) Perform sensitivity analyzes on your assumptions (set up your excel sheet so you can easily do this). Vary items such as revenue growth, GP margin, expense ratios, and balance sheet balances Consider preparing tables to illustrate the sensitivity also determine break-evens Remember who your audience is! The Body Shop International PLC 2001: An Introduction to Financial Modeling Hints In forecasting 2002 through 2004, consider which P&L and balance sheet items will & will not vary with sales (and how those that don't vary with sales will vary, if at all) Some may increase/decrease by year Interest (assume 6%) 6% x (overdrafts Long Term Liabilities) 6% x Cash Cash to start, assume flat at $10M (and then you can vary if you think appropriate) Perform sensitivity analyzes on your assumptions (set up your excel sheet so you can easily do this). Vary items such as revenue growth, GP margin, expense ratios, and balance sheet balances Consider preparing tables to illustrate the sensitivity also determine break-evens Remember who your audience is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts