Question: Answer the following problems : Problem 26-2 (IAA) On January 1, 2017, Magna Company offered the chief executive officer share appreciation rights, The terms are

Answer the following problems :

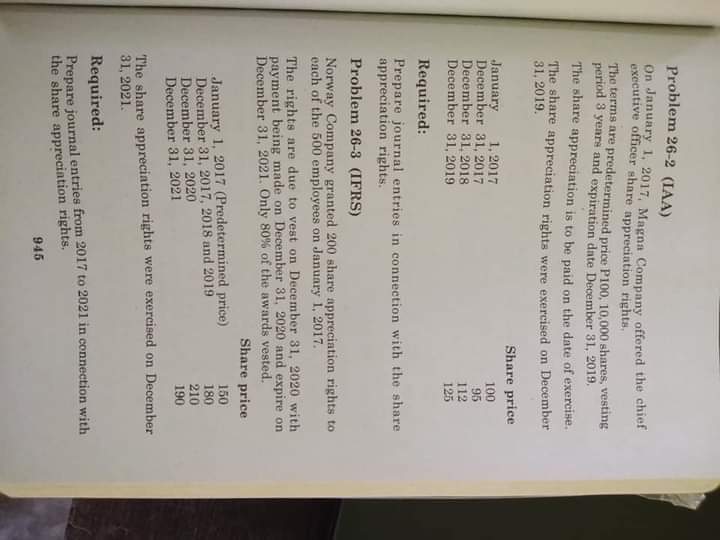

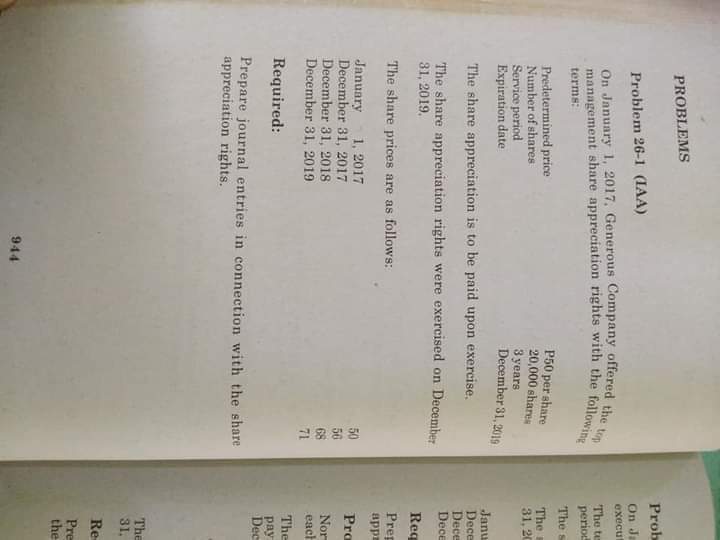

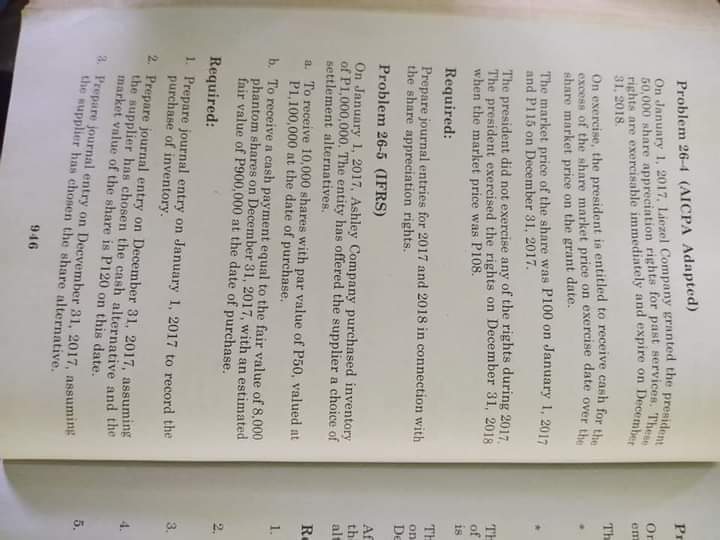

Problem 26-2 (IAA) On January 1, 2017, Magna Company offered the chief executive officer share appreciation rights, The terms are predetermined price P100, 10,000 shares, vesting period 3 years and expiration date December 31, 2019, The share appreciation is to be paid on the date of exercise. 31, 2019. The share appreciation rights were exercised on December Share price January 1, 2017 December 31, 2017 100 95 December 31, 2018 112 December 31, 2019 125 Required: Prepare journal entries in connection with the share appreciation rights. Problem 26-3 (IFRS) Norway Company granted 200 share appreciation rights to each of the 500 employees on January 1. 2017. The rights are due to vest on December 31, 2020 with payment being made on December 31, 2020 and expire on December 31, 2021. Only 80% of the awards vested. Share price January 1, 2017 (Predetermined price) 150 December 31, 2017, 2018 and 2019 180 December 31, 2020 210 December 31, 2021 190 The share appreciation rights were exercised on December 31, 2021. Required: Prepare journal entries from 2017 to 2021 in connection with the share appreciation rights, 945PROBLEMS Prob Problem 26-1 (IAA) On J execu On January 1, 2017. Generous Company of y offered the top management share appreciation rights with the following The te perio terms: The Predetermined price P50 per share The Number of shares 20,000 shares 31. 2 Service period 3 years Expiration date December 31, 2019 Janu The share appreciation is to be paid upon exercise. Dece Dece The share appreciation rights were exercised on December Dec 31, 2019. Req The share prices are as follows: Pre app January 1, 2017 50 Pro December 31, 2017 December 31, 2018 Nor December 31, 2019 each The Required: pay Dec Prepare journal entries in connection with the share appreciation rights. The 31. Re Pre the 944Problem 26-1 (AICPA Adapted) P On January 1. 2017, Liczel Company granted the president 60,000 share appreciation rights for past services. They Or rights are exercisable immediately and expire on December 31, 2018. Th On exercise, the president is entitled to receive cash for the excess of the share market price on exercise date over the share market price on the grant date. The market price of the share was P100 on January 1, 2017 and Pl15 on December 31, 2017. The president did not exercise any of the rights during 2017 The president exercised the rights on December 31, 2018 TH when the market price was P108. of is Required: TH Prepare journal entries for 2017 and 2018 in connection with on the share appreciation rights. De Problem 26-5 (IFRS) Af On January 1, 2017, Ashley Company purchased inventory th of P1,000,000. The entity has offered the supplier a choice of al settlement alternatives. R a. To receive 10,000 shares with par value of P50, valued at P1, 100,000 at the date of purchase. 1. b. To receive a cash payment equal to the fair value of 8.000 phantom shares on December 31, 2017, with an estimated fair value of P900,000 at the date of purchase. 2. Required: 1: Prepare journal entry on January 1, 2017 to record the 3. purchase of inventory. 2. Prepare journal entry on December 31, 2017, assuming the supplier has chosen the cash alternative and the market value of the share is P120 on this date. a. Prepare journal entry on December 31, 2017, assuming 5. the supplier has chosen the share alternative. 946