Question: ANSWER THE FOLLOWING QUESTION AND PROVIDE SOLUTIONS : Problem 9.1 COMPREHENSIVE Valkyrie reported the following income during the year. Service Fees Interest Income from bank

ANSWER THE FOLLOWING QUESTION AND PROVIDE SOLUTIONS:

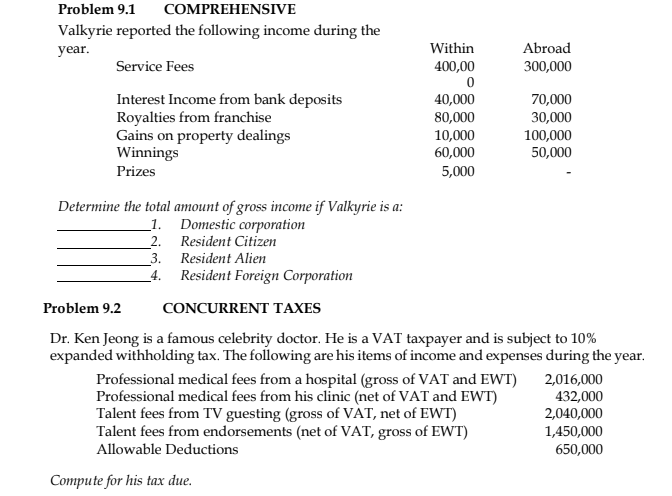

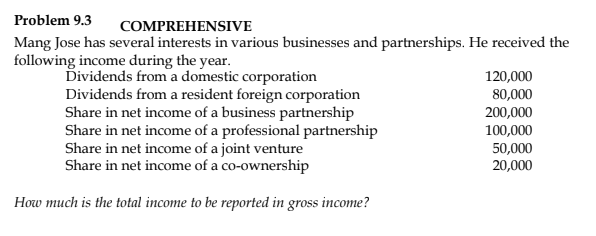

Problem 9.1 COMPREHENSIVE Valkyrie reported the following income during the year. Service Fees Interest Income from bank deposits Royalties from franchise Gains on property dealings Winnings Prizes Determine the total amount of gross income if Valkyrie is a: 1. Domestic corporation 2. Resident Citizen 3. Resident Alien 4. Resident Foreign Corporation Within 400,00 0 40,000 80,000 10,000 60,000 5,000 Compute for his tax due. Professional medical fees from a hospital (gross of VAT and EWT) Professional medical fees from his clinic (net of VAT and EWT) Talent fees from TV guesting (gross of VAT, net of EWT) Talent fees from endorsements (net of VAT, gross of EWT) Allowable Deductions Abroad 300,000 Problem 9.2 CONCURRENT TAXES Dr. Ken Jeong is a famous celebrity doctor. He is a VAT taxpayer and is subject to 10% expanded withholding tax. The following are his items of income and expenses during the year. 70,000 30,000 100,000 50,000 2,016,000 432,000 2,040,000 1,450,000 650,000

Step by Step Solution

There are 3 Steps involved in it

Answer To solve these problems we need to understand the different types of taxpayers and the applicable tax rules for each Problem 91 Determining Gro... View full answer

Get step-by-step solutions from verified subject matter experts