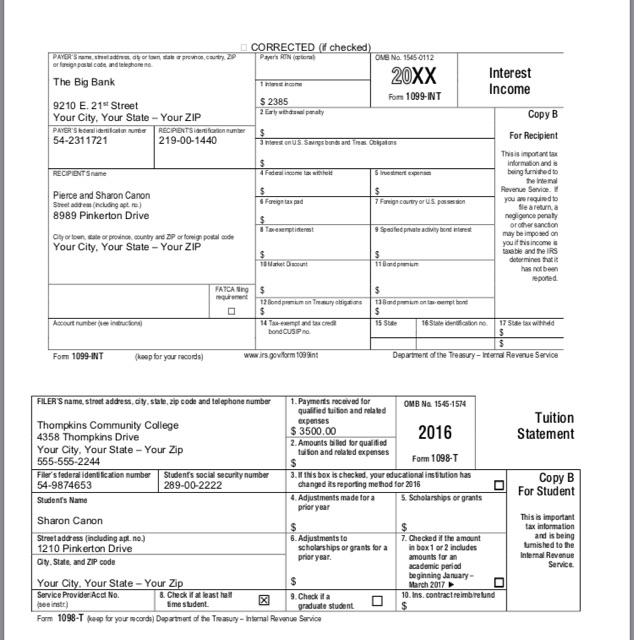

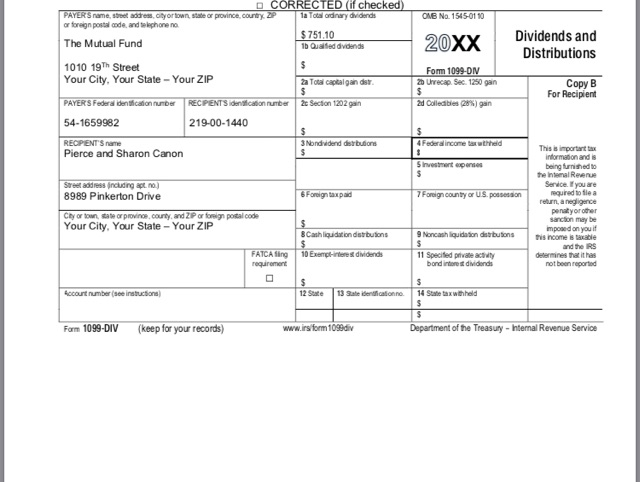

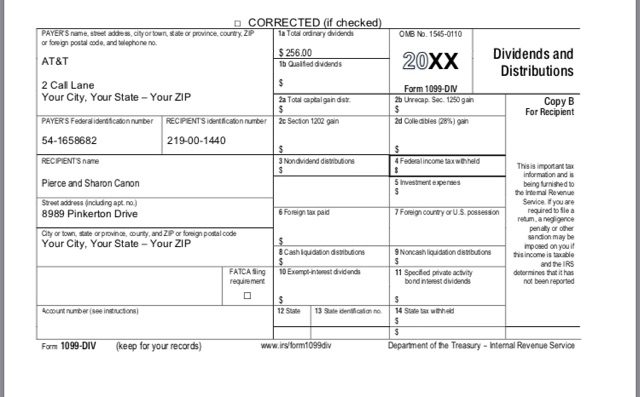

Question: Answer the following question based on the tax return you prepared for Pierce and Sharon Canon Which form should be used to file the Canon

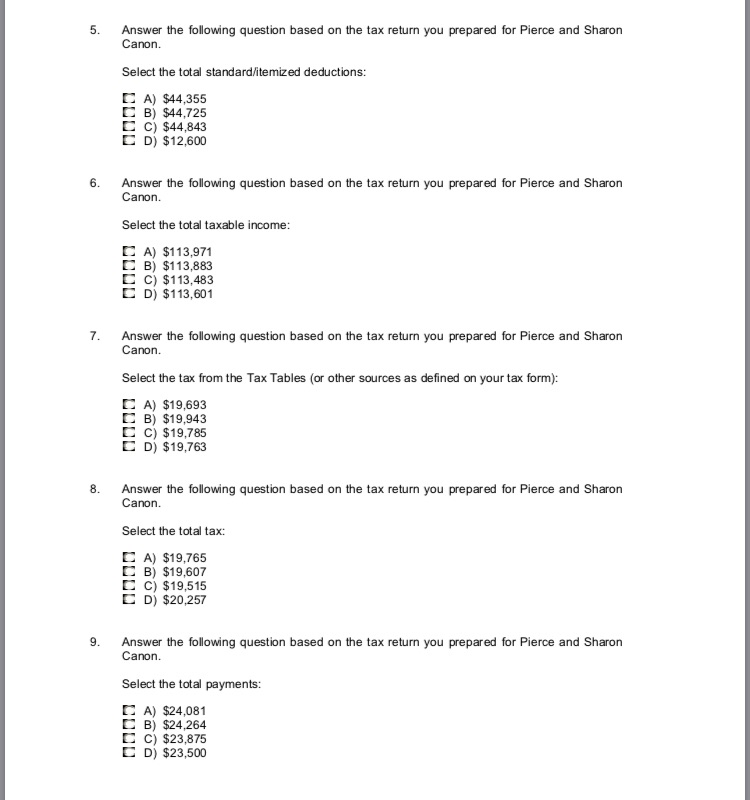

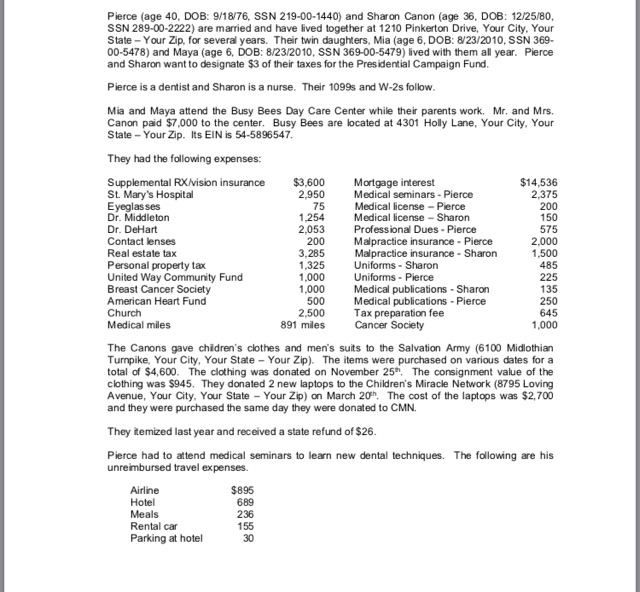

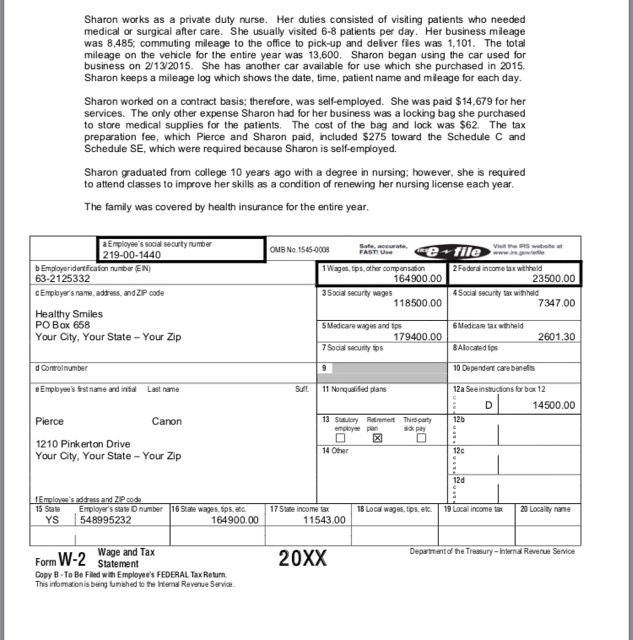

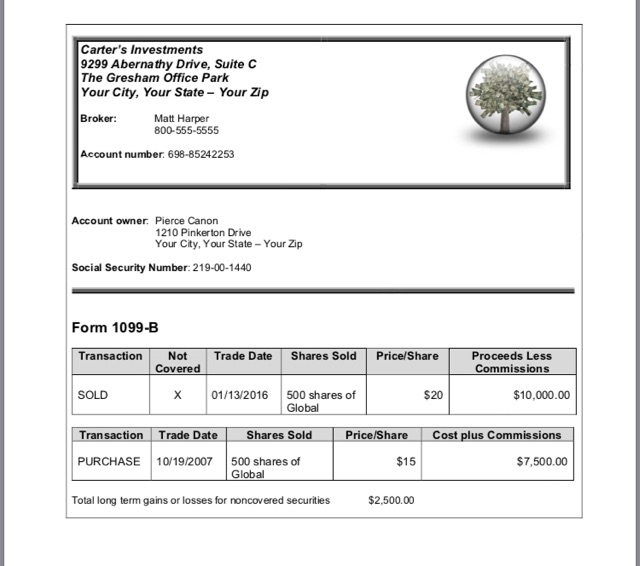

Answer the following question based on the tax return you prepared for Pierce and Sharon Canon Which form should be used to file the Canon return? C A) 1040 C B) 1040A C C) 1040EZ D) 1040X 2 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the total wages: C A) $164,900 C B) $168,890 C C) $171,390 D) $174,808 3 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the total income C A) $174,782 C B) $169,010 C C) $171,510 D) $174,808 4 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the Adjusted Gross Income (AGI): C A) $172,526 C B) $171,026 E C) $174,526 D) $174,808 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon Which form should be used to file the Canon return? C A) 1040 C B) 1040A C C) 1040EZ D) 1040X 2 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the total wages: C A) $164,900 C B) $168,890 C C) $171,390 D) $174,808 3 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the total income C A) $174,782 C B) $169,010 C C) $171,510 D) $174,808 4 Answer the following question based on the tax return you prepared for Pierce and Sharon Canon. Select the Adjusted Gross Income (AGI): C A) $172,526 C B) $171,026 E C) $174,526 D) $174,808

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts