Question: Answer the following question lart a, b, c and d 1-23 Net Income from Operations. A and B are MDs in the AB partnership. Because

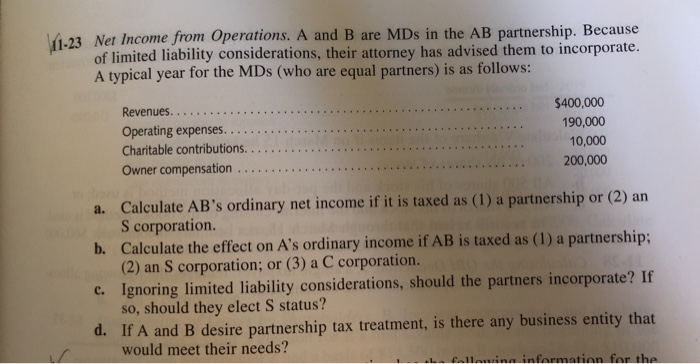

1-23 Net Income from Operations. A and B are MDs in the AB partnership. Because of limited liability considerations, their attorney has advised them to incorporate. A typical year for the MDs (who are equal partners) is as follows: Revenues............ Operating expenses......... Charitable contributions...... Owner compensation ....... $400,000 190,000 10,000 200,000 a. Calculate AB's ordinary net income if it is taxed as (1) a partnership or (2) an S corporation. b. Calculate the effect on A's ordinary income if AB is taxed as (1) a partnership; (2) an S corporation; or (3) a C corporation. c. Ignoring limited liability considerations, should the partners incorporate? If so, should they elect S status? d. If A and B desire partnership tax treatment, is there any business entity that would meet their needs? Callowing information for the 1-23 Net Income from Operations. A and B are MDs in the AB partnership. Because of limited liability considerations, their attorney has advised them to incorporate. A typical year for the MDs (who are equal partners) is as follows: Revenues............ Operating expenses......... Charitable contributions...... Owner compensation ....... $400,000 190,000 10,000 200,000 a. Calculate AB's ordinary net income if it is taxed as (1) a partnership or (2) an S corporation. b. Calculate the effect on A's ordinary income if AB is taxed as (1) a partnership; (2) an S corporation; or (3) a C corporation. c. Ignoring limited liability considerations, should the partners incorporate? If so, should they elect S status? d. If A and B desire partnership tax treatment, is there any business entity that would meet their needs? Callowing information for the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts