Question: answer the following question step by step final answers are: a) OH rate = RM50/hr b) A= RM180, B=RM104 c)OH: A=RM123, B=39.50 d) A=RM213, B=98.50

answer the following question step by step final answers are: a) OH rate = RM50/hr b) A= RM180, B=RM104 c)OH: A=RM123, B=39.50 d) A=RM213, B=98.50

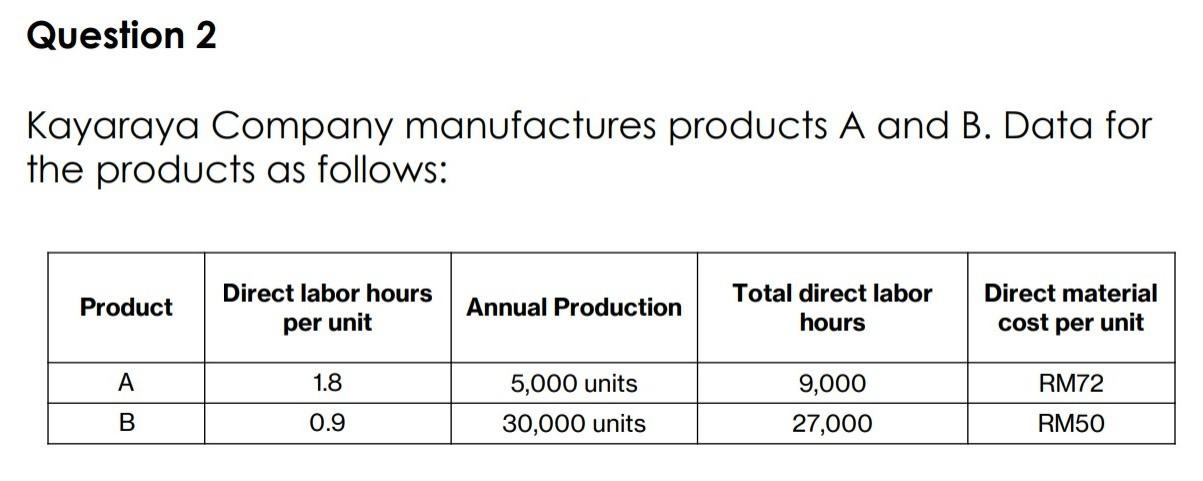

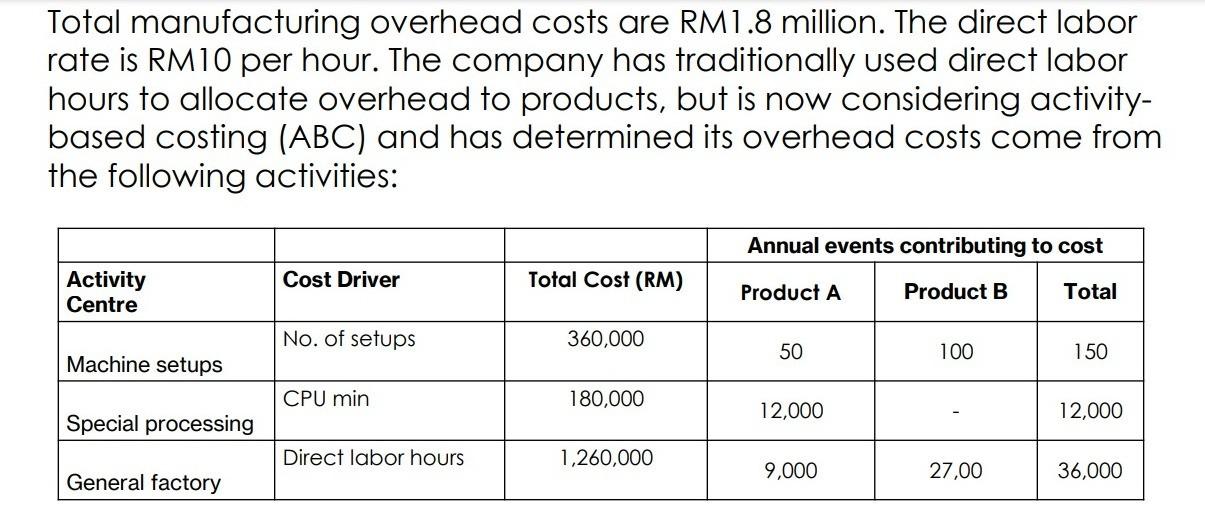

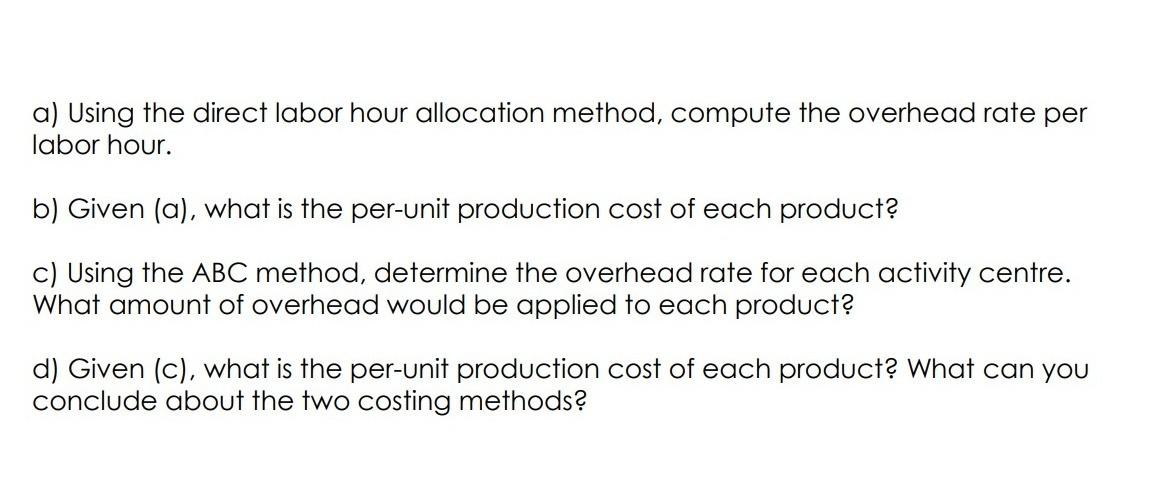

Kayaraya Company manufactures products A and B. Data for the products as follows: Total manufacturing overhead costs are RM1.8 million. The direct labor rate is RM10 per hour. The company has traditionally used direct labor hours to allocate overhead to products, but is now considering activitybased costing (ABC) and has determined its overhead costs come from the following activities: a) Using the direct labor hour allocation method, compute the overhead rate per labor hour. b) Given (a), what is the per-unit production cost of each product? C) Using the ABC method, determine the overhead rate for each activity centre. What amount of overhead would be applied to each product? d) Given (c), what is the per-unit production cost of each product? What can you conclude about the two costing methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts