Question: Answer the following question using the income statement and partial balance sheet of Toogle company for the year 2019. Toogle company also provides the following

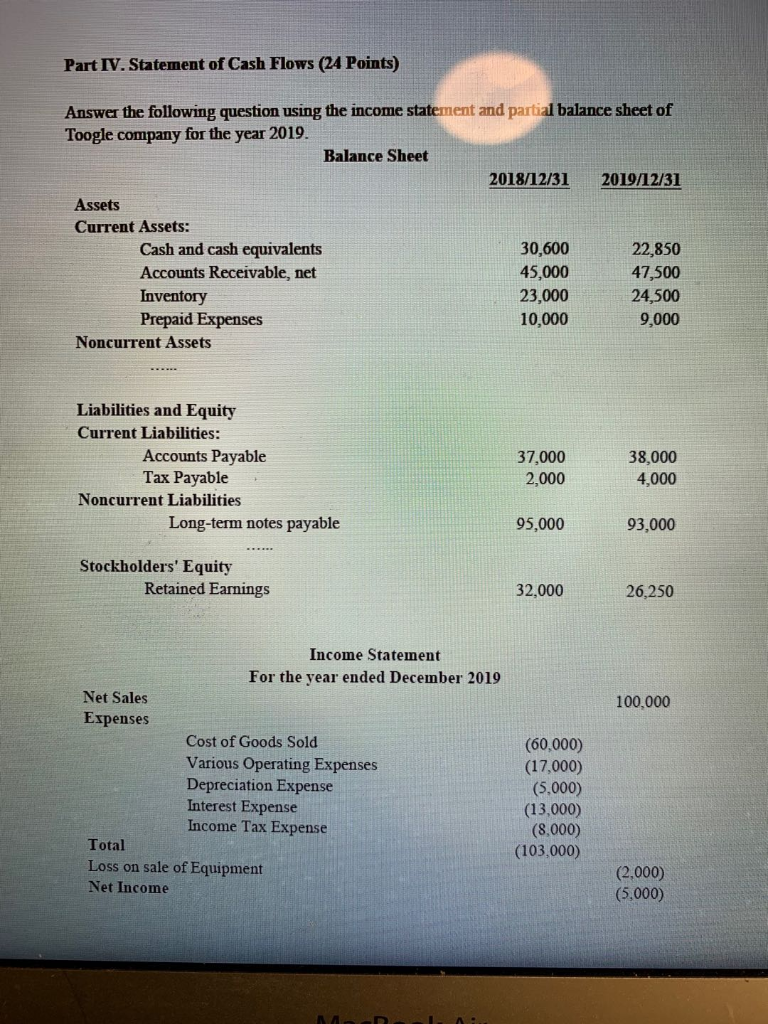

Answer the following question using the income statement and partial balance sheet of

Toogle company for the year 2019.

Toogle company also provides the following information:

1. During the year, the company bought equipment for $9,000 cash. In the meantime,

the company sold an old equipment with net book value of $4,000. The cash was

received.

2. The company paid back principal on the long-term note payable with cash. No new

debt was issued during 2019.

3. Cash dividends were paid to stockholders. No shares were repurchased.

Question 1. Prepare the section for cash flows from operations using the indirect

method. Show your work for full credits. Answers with no work (i.e. with only final

numbers) will not be given full credits (16 points).

Question 2. Prepare the section for cash flows from investing activities. Show your

work for full credit. Answers with no work (i.e. with only final numbers) will not be

given full credits (4 points).

Question 3. Prepare the section for cash flows from financing activities. Show your

work for full credit. Answers with no work (i.e. with only final numbers) will not be

given full credits (4 points).

Part IV. Statement of Cash Flows (24 Points) Answer the following question using the income statement and partial balance sheet of Toogle company for the year 2019. Balance Sheet 2018/12/31 2019/12/31 Assets Current Assets: Cash and cash equivalents 30,600 22,850 Accounts Receivable, net 45,000 47,500 Inventory 23,000 24,500 Prepaid Expenses 10,000 9,000 Noncurrent Assets Liabilities and Equity Current Liabilities: Accounts Payable Tax Payable Noncurrent Liabilities Long-term notes payable 37,000 38,000 4,000 2,000 95,000 93,000 Stockholders' Equity Retained Earnings 32,000 26,250 100,000 Income Statement For the year ended December 2019 Net Sales Expenses Cost of Goods Sold Various Operating Expenses Depreciation Expense Interest Expense Income Tax Expense Total Loss on sale of Equipment Net Income (60,000) (17,000) (5.000) (13,000) (8,000) (103,000) (2.000) (5,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts