Question: Answer the following question with calculation and explanation (d) Suppose that the equilibrium real fed funds rate is 2%, the inflation rate target is 2%,

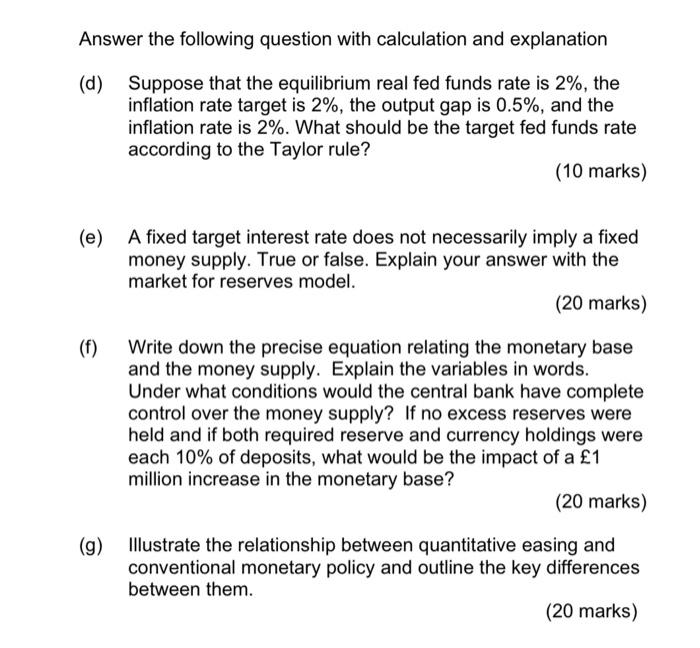

Answer the following question with calculation and explanation (d) Suppose that the equilibrium real fed funds rate is 2%, the inflation rate target is 2%, the output gap is 0.5%, and the inflation rate is 2%. What should be the target fed funds rate according to the Taylor rule? (10 marks) (e) A fixed target interest rate does not necessarily imply a fixed money supply. True or false. Explain your answer with the market for reserves model. (20 marks) (1) Write down the precise equation relating the monetary base and the money supply. Explain the variables in words. Under what conditions would the central bank have complete control over the money supply? If no excess reserves were held and if both required reserve and currency holdings were each 10% of deposits, what would be the impact of a 1 million increase in the monetary base? (20 marks) (9) Illustrate the relationship between quantitative easing and conventional monetary policy and outline the key differences between them. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts