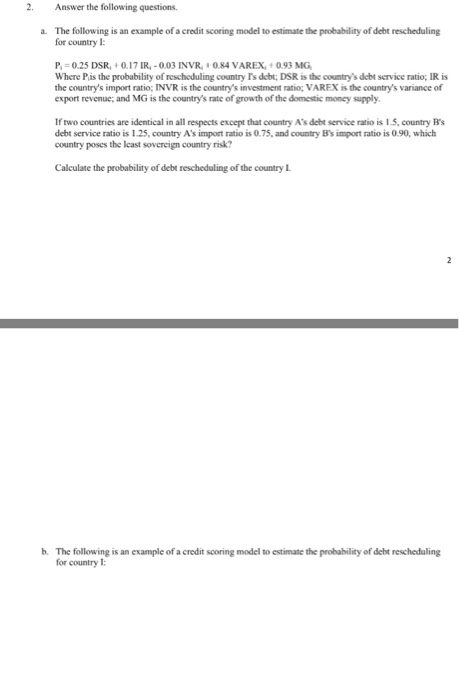

Question: Answer the following questions, a. The following it an example of a credit scoring model to estimate the probability of debt rescheduling for country I:

Answer the following questions, a. The following it an example of a credit scoring model to estimate the probability of debt rescheduling for country I: P_i = 0.25 DSR_i + 0.17 IR_i - 0. 03 INVR_i + 0.84 VAREX_i + 0.93 MG_i Where P_i the probability of rescheduling country I's debt: DSR is the country's debt service ratio: IR is the country's import ratio: INVR is the country's investment ratio; VARFX is the country's variance of export revenue; and MG is the country's rate of growth of the domestic money supply. If two countries are identical in all respects except that country A's debt service ratio is 1.5, country B's debt service ratio is 1.25, country A's import ratio is 0.75, and country B's import ratio is 0.90, which country poses the least sovereign country risk? Calculate the probability of debt rescheduling of the country I. b. The following is an example of a credit scoring model to estimate the probability of debt rescheduling for country

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts