Question: ANSWER THE FOLLOWING QUESTIONS BASED ON EXHIBIT 1 4. AT THE END OF 2010 A BUYER PURCHASES WIDGET COMPANY FOR 7X EBITDA. WHAT IS THE

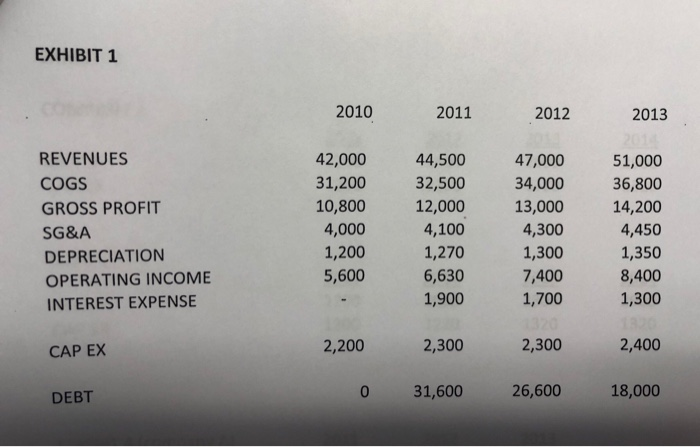

ANSWER THE FOLLOWING QUESTIONS BASED ON EXHIBIT 1

4. AT THE END OF 2010 A BUYER PURCHASES WIDGET COMPANY FOR 7X EBITDA. WHAT IS THE PURCHASE PRICE?

5. HOW MUCH WAS THE VALUE OF THE EQUITY IN WIDGET COMPANY WORTH AT THE TIME OF THE PURCHASE?

6. THE BUYER FINANCED THE PURCHASE PRICE IN PART WITH $34,000 OF DEBT. HOW WAS THE REST OF THE PURCHASE FINANCED?

EXHIBIT 1 2010 2011 2012 2013 REVENUES COGS GROSS PROFIT SG&A DEPRECIATION OPERATING INCOM INTEREST EXPENSE 42,000 44,500 47,000 51,000 31,200 32,500 34,000 36,800 10,800 12,000 13,000 14,200 4,450 1,350 8,400 1,300 4,000 1,200 5,600 4,100 1,270 6,630 1,900 4,300 1,300 7,400 1,700 CAP EX 2,200 2,300 2,300 2,400 DEBT 0 31,600 26,600 18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts