Question: answer the following questions based on the article attached below 1. As described in the article, investors were nervous about flattening an inverted yield curve

answer the following questions based on the article attached below

1. As described in the article, investors were nervous about flattening an inverted yield curve in 2019. What exactly was the evidence flattening yield curve?

2. According to the author, why should investors use economic fundamentals instead of blindly believing in inverted yield curve phenomena?

3. What are other likely explanations of inverted yield curve phenomena?

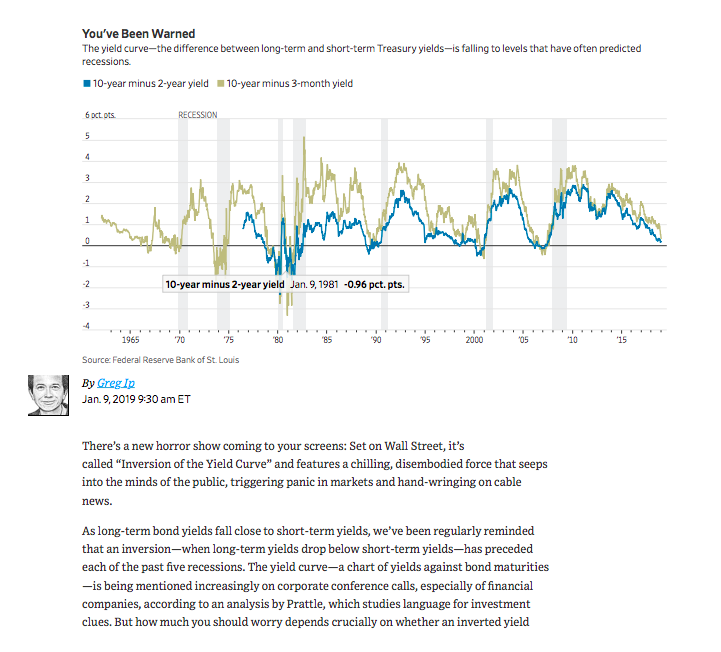

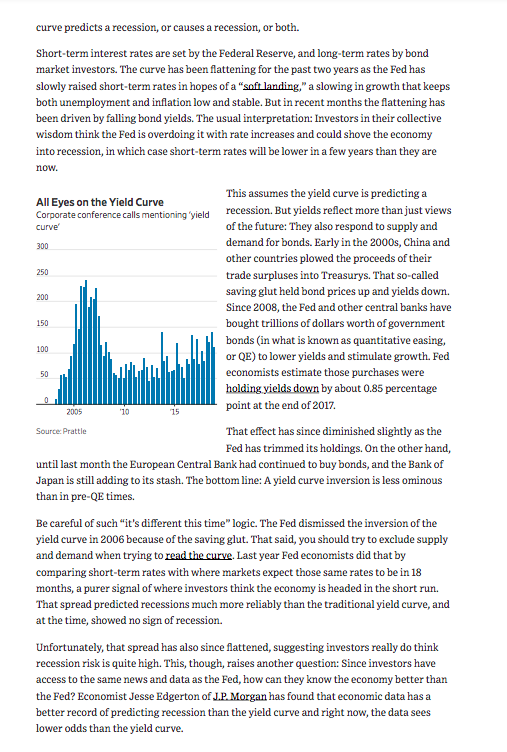

You've Been Warned The yield curve-the difference between long-term and short-term Treasury yields-is falling to levels that have often predicted recessions 10-year minus 2-year yield 10-year minus 3-month yield 6 oct.ots RECESSION 5 4 3 2 1 0 -1 -2 10-year minus 2-year yield Jan. 9.1981 -0.96 pct. pts. -4 1965 70 25 '80 '90 95 2000 05 10 '15 Source: Federal Reserve Bank of St. Louis By Greg Ip Jan 9, 2019 9:30 am ET There's a new horror show coming to your screens: Set on Wall Street, it's called "Inversion of the Yield Curve" and features a chilling, disembodied force that seeps into the minds of the public, triggering panic in markets and hand-wringing on cable news. As long-term bond yields fall close to short-term yields, we've been regularly reminded that an inversion-when long-term yields drop below short-term yields-has preceded each of the past five recessions. The yield curve-achart of yields against bond maturities -is being mentioned increasingly on corporate conference calls, especially of financial companies, according to an analysis by Prattle, which studies language for investment clues. But how much you should worry depends crucially on whether an inverted yield curve 300 250 200 150 100 curve predicts a recession, or causes a recession, or both. Short-term interest rates are set by the Federal Reserve, and long-term rates by bond market investors. The curve has been flattening for the past two years as the Fed has slowly raised short-term rates in hopes of a "soft landing," a slowing in growth that keeps both unemployment and inflation low and stable. But in recent months the flattening has been driven by falling bond yields. The usual interpretation: Investors in their collective wisdom think the Fed is overdoing it with rate increases and could shove the economy into recession, in which case short-term rates will be lower in a few years than they are now. This assumes the yield curve is predicting a All Eyes on the Yield Curve Corporate conference calls mentioning yield recession. But yields reflect more than just views of the future: They also respond to supply and demand for bonds. Early in the 2000s, China and other countries plowed the proceeds of their trade surpluses into Treasurys. That so-called saving glut held bond prices up and yields down. Since 2008, the Fed and other central banks have bought trillions of dollars worth of government bonds (in what is known as quantitative easing, or QE) to lower yields and stimulate growth. Fed economists estimate those purchases were holding yields down by about 0.85 percentage point at the end of 2017. That effect has since diminished slightly as the Fed has trimmed its holdings. On the other hand, until last month the European Central Bank had continued to buy bonds, and the Bank of Japan is still adding to its stash. The bottom line: Ayield curve inversion is less ominous than in pre-QE times. Be careful of such it's different this time" logic. The Fed dismissed the inversion of the yield curve in 2006 because of the saving glut. That said, you should try to exclude supply and demand when trying to read the curve. Last year Fed economists did that by comparing short-term rates with where markets expect those same rates to be in 18 months, a purer signal of where investors think the economy is headed in the short run. That spread predicted recessions much more reliably than the traditional yield curve, and at the time, showed no sign of recession. Unfortunately, that spread has also since flattened, suggesting investors really do think recession risk is quite high. This, though, raises another question: Since investors have access to the same news and data as the Fed, how can they know the economy better than the Fed? Economist Jesse Edgerton of J.P. Morgan has found that economic data has a better record of predicting recession than the yield curve and right now, the data sees lower odds than the yield curve. 50 2005 '10 15 Source: Prattle NEWSLETTER SIGN UP This leads to another possibility: that bond investors and the yield curve don't just predict a recession, they can cause a recession. For Real Time Economics example, by narrowing the spread between loan rates (which are tied to bond yields) and The latest economic news, analysis and data deposits (which are tied to short-term rates), it curated weekdays by WSJ's Jeffrey Sparshott. makes lending less profitable. Or the yield curve could help bring on a PREVIEW SUBSCRIBE recession via psychology, which plays a big and unpredictable role in every business cycle. This is especially true during a panic. Investors rush to bonds because of their safety, driving their yields down, and dump riskier stocks and corporate bonds. This directly hits growth by tightening the supply of credit and shrinking household wealth, and indirectly by fomenting fear. If investors, companies and consumers think a recession is coming, they'll invest, spend or hire less, thus making recession more likely. In a recent survey by the Fed, a large share of lending officers said an inverted yield curve would lead them to tighten standards, not just by making lending less profitable but because it signals a worsening economy and deteriorating loan quality. If all that mattered were the economic fundamentals, the Fed could ignore the yield curve movie now playing on Wall Street. But as long as recessions can be self-fulfilling prophesies, it needs to stay to the end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts