Question: answer the following questions based on the corresponding data 1) What is the current ratio in 2020 and 2019? (1 pt) 2) Calculate the acid

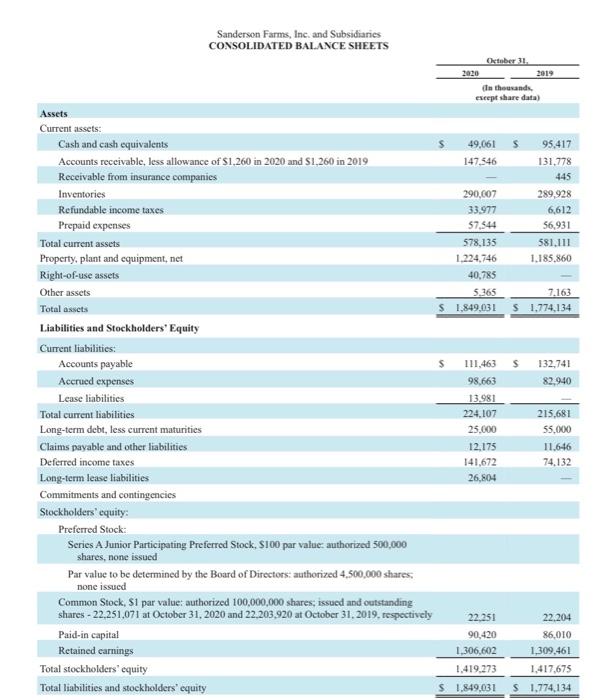

1) What is the current ratio in 2020 and 2019? (1 pt)

2) Calculate the acid test ratios for both years. (1 pt)

3) Has Sanderson Farms become more or less liquid based on your evaluation of the current and acid test ratios? (1 pt)

4) What is the debt to equity ratio in 2020 and 2019? (1 pt)

5) Has Sanderson Farms become more or less solvent based on your evaluation of the debt to equity ratio? (1 pt)

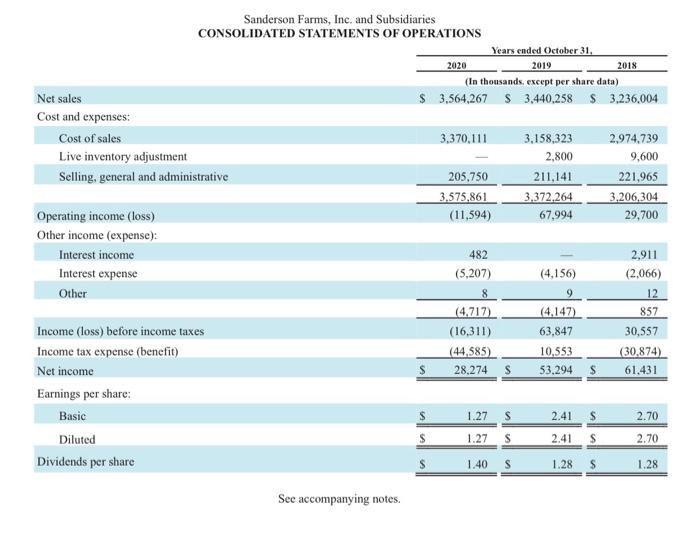

6) What is the return on investment ratio in 2020 and 2019? (1 pt)

7) Based on the return on investment ratio, is Sanderson Farms using their assets more efficiently in 2020 than in 2019? (1 pt)

8) What is the return on owners' equity ratio in 2020 and 2019? (1 pt)

9) Based on the return on owners' equity ratio, are investors seeing a greater return in 2020 than 2019? (1 pt)

10) What is the profit as a percent of sales ratio in 2020 and 2019? (1 pt)

11) Has the profitability of Sanderson Farms improved over these two years? (1 pt)

12) Based on all of your calculations and analyses of the selected financial ratios, what is your opinion of the financial performance of Sanderson Farms in 2020 as compared to 2019?

Sanderson Farms, Inc. and Subsidiaries CONSOLIDATED BAL_ANE SHEEIS Cktnber 31. Assets Current assets: Cash and cash equivalents Accounts receivable, less allowance of $1,260 in 2020 and $1,260 in 2019 5. 49,061 95.417 Receivable from insurance companies 147.546 131,778 Receivable from insurance companies 445 Inventories Refundable income taxes 290,607 289,928 Prepaid expenses Total current assets 33,977 6,612 Prepaid expenses Total current assets Property, plant and equipment, net Right-of-use assets Other assets Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Right-of-use assets Other assets Total assets Liabilities and Stockholders' Equity Par value to be determined by the Board of Directors: authorized 4,500,000 shares: none issued Common Stock, $1 par value: authorized 100,000,000 shares; issued and outstanding shares - 22,251,071 at October 31, 2020 and 22,203,920 at Oetober 31, 2019, respectively Paid-in capital 40,785 \begin{tabular}{|lrr|} \hline CommonStock,$1parvalue:authorized100,000,000shares;issuedandoutstandingshares-22,251,071atOctober31,2020and22,203,920atOctober31,2019,respectively & 22,251 & 22,204 \\ \hline Paid-in capital & 90,420 & 86,010 \\ \hline Retained carnings & 1,306,602 & 1,309,461 \\ \hline Total stockholders' equity & 1,419,273 & 1,417,675 \\ \hline Total liabilities and stockholders' equity & 1,849,031 & 1,774,134 \\ \hline \hline \end{tabular} Sanderson Farms, Inc. and Subsidiaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts