Question: Answer the following questions by interpreting the presented data and analysis. Four alternatives are being evaluated: (14 points) Alternative w Y z Initial Investment $100,000

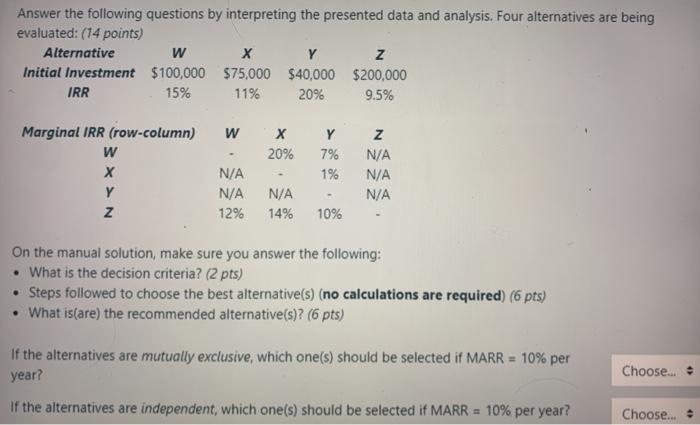

Answer the following questions by interpreting the presented data and analysis. Four alternatives are being evaluated: (14 points) Alternative w Y z Initial Investment $100,000 $75,000 $40,000 $200,000 IRR 15% 11% 20% 9.5% W 20% Marginal IRR (row-column) w Y z Y 7% 1% Z N/A N/A N/A N/A N/A 12% N/A 14% 10% On the manual solution, make sure you answer the following: What is the decision criteria? (2 pts) Steps followed to choose the best alternative(s) (no calculations are required) (6 pts) What is(are) the recommended alternative(s)? (6 pts) Choose... . If the alternatives are mutually exclusive, which one(s) should be selected if MARR = 10% per year? If the alternatives are independent, which one(s) should be selected if MARR = 10% per year? Choose... 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts