Question: Answer the following questions either true or false. If any part of a statement is false, your answer should be false. Only if the entire

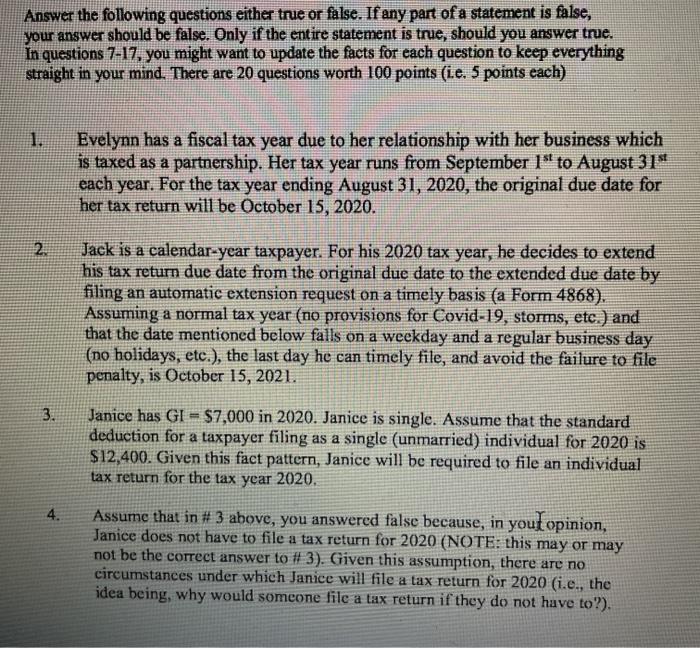

Answer the following questions either true or false. If any part of a statement is false, your answer should be false. Only if the entire statement is true, should you answer true. In questions 7-17, you might want to update the facts for each question to keep everything straight in your mind. There are 20 questions worth 100 points (i.e. 5 points each) 1. Evelynn has a fiscal tax year due to her relationship with her business which is taxed as a partnership. Her tax year runs from September 1" to August 31" each year. For the tax year ending August 31, 2020, the original due date for her tax return will be October 15, 2020. 2 Jack is a calendar-year taxpayer. For his 2020 tax year, he decides to extend his tax return due date from the original due date to the extended due date by filing an automatic extension request on a timely basis (a Form 4868). Assuming a normal tax year (no provisions for Covid-19, storms, etc.) and that the date mentioned below falls on a weekday and a regular business day (no holidays, etc.), the last day he can timely file, and avoid the failure to file penalty, is October 15, 2021. 3. Janice has GI - $7,000 in 2020. Janice is single. Assume that the standard deduction for a taxpayer filing as a single (unmarried) individual for 2020 is $12,400. Given this fact pattern, Janice will be required to file an individual tax return for the tax year 2020. 4. Assume that in # 3 above, you answered false because, in yout opinion, Janice does not have to file a tax return for 2020 (NOTE: this may or may not be the correct answer to #3). Given this assumption, there are no circumstances under which Janice will file a tax return for 2020 (i.e., the idea being, why would someone file a tax return if they do not have to?). Answer the following questions either true or false. If any part of a statement is false, your answer should be false. Only if the entire statement is true, should you answer true. In questions 7-17, you might want to update the facts for each question to keep everything straight in your mind. There are 20 questions worth 100 points (i.e. 5 points each) 1. Evelynn has a fiscal tax year due to her relationship with her business which is taxed as a partnership. Her tax year runs from September 1" to August 31" each year. For the tax year ending August 31, 2020, the original due date for her tax return will be October 15, 2020. 2 Jack is a calendar-year taxpayer. For his 2020 tax year, he decides to extend his tax return due date from the original due date to the extended due date by filing an automatic extension request on a timely basis (a Form 4868). Assuming a normal tax year (no provisions for Covid-19, storms, etc.) and that the date mentioned below falls on a weekday and a regular business day (no holidays, etc.), the last day he can timely file, and avoid the failure to file penalty, is October 15, 2021. 3. Janice has GI - $7,000 in 2020. Janice is single. Assume that the standard deduction for a taxpayer filing as a single (unmarried) individual for 2020 is $12,400. Given this fact pattern, Janice will be required to file an individual tax return for the tax year 2020. 4. Assume that in # 3 above, you answered false because, in yout opinion, Janice does not have to file a tax return for 2020 (NOTE: this may or may not be the correct answer to #3). Given this assumption, there are no circumstances under which Janice will file a tax return for 2020 (i.e., the idea being, why would someone file a tax return if they do not have to?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts