Question: Answer the following questions for 2 points each about a cattle feedlot who expects cattle to be ready for slaughter in March using the April

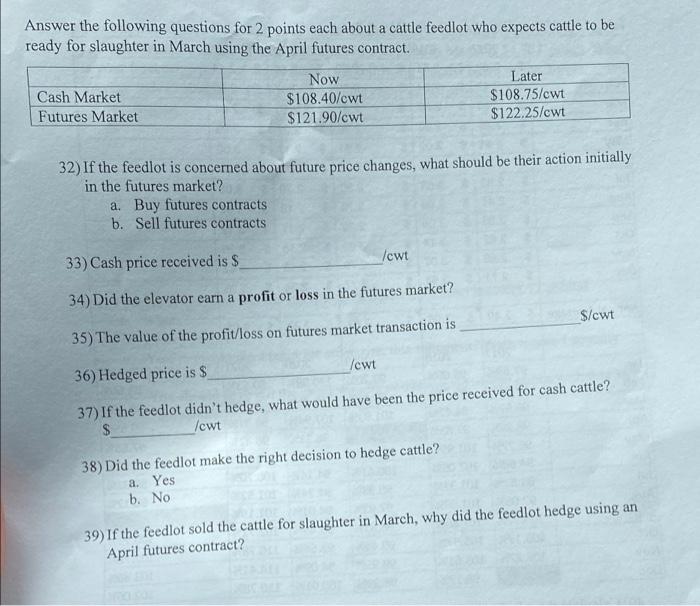

Answer the following questions for 2 points each about a cattle feedlot who expects cattle to be ready for slaughter in March using the April futures contract. Now Later Cash Market $108.40/cwt $108.75/cwt Futures Market $121.90/cwt $122.25/cwt 32) If the feedlot is concerned about future price changes, what should be their action initially in the futures market? a. Buy futures contracts b. Sell futures contracts Icwt 33) Cash price received is $ 34) Did the elevator earn a profit or loss in the futures market? $/cwt 35) The value of the profit/loss on futures market transaction is Icwt 36) Hedged price is $ 37) If the feedlot didn't hedge, what would have been the price received for cash cattle? $ lowt 38) Did the feedlot make the right decision to hedge cattle? a. Yes b. No 39) If the feedlot sold the cattle for slaughter in March, why did the feedlot hedge using an April futures contract? Answer the following questions for 2 points each about a cattle feedlot who expects cattle to be ready for slaughter in March using the April futures contract. Now Later Cash Market $108.40/cwt $108.75/cwt Futures Market $121.90/cwt $122.25/cwt 32) If the feedlot is concerned about future price changes, what should be their action initially in the futures market? a. Buy futures contracts b. Sell futures contracts Icwt 33) Cash price received is $ 34) Did the elevator earn a profit or loss in the futures market? $/cwt 35) The value of the profit/loss on futures market transaction is Icwt 36) Hedged price is $ 37) If the feedlot didn't hedge, what would have been the price received for cash cattle? $ lowt 38) Did the feedlot make the right decision to hedge cattle? a. Yes b. No 39) If the feedlot sold the cattle for slaughter in March, why did the feedlot hedge using an April futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts