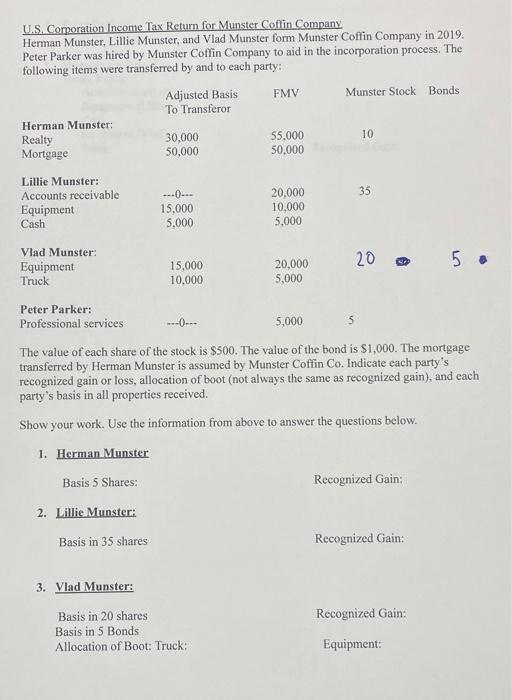

Question: Answer the following questions from the information provided U.S. Comoration Income Tax Return for Munster Coffin Company Herman Munster, Lillie Munster, and Vlad Munster form

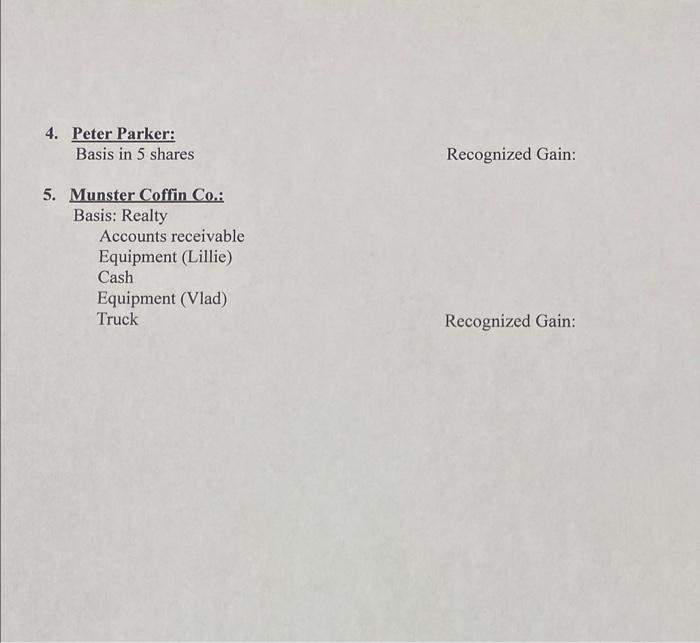

U.S. Comoration Income Tax Return for Munster Coffin Company Herman Munster, Lillie Munster, and Vlad Munster form Munster Coffin Company in 2019. Peter Parker was hired by Munster Coffin Company to aid in the incorporation process. The following items were transferred by and to each party: FMV Munster Stock Bonds Adjusted Basis To Transferor 10 Herman Munster: Realty Mortgage 30,000 50,000 55,000 50.000 35 Lillie Munster: Accounts receivable Equipment Cash -0. 15,000 5.000 20.000 10,000 5,000 Vlad Munster: Equipment Truck 20 @ 5. 15,000 10,000 20,000 5,000 Peter Parker: Professional services 5,000 5 The value of each share of the stock is $500. The value of the bond is $1,000. The mortgage transferred by Herman Munster is assumed by Munster Coffin Co. Indicate each party's recognized gain or loss, allocation of boot (not always the same as recognized gain), and each party's basis in all properties received. Show your work. Use the information from above to answer the questions below. 1. Herman Munster Basis 5 Shares: Recognized Gain: 2. Lillie Munster: Basis in 35 shares Recognized Gain: 3. Vlad Munster: Recognized Gain: Basis in 20 shares Basis in 5 Bonds Allocation of Boot: Truck: Equipment: 4. Peter Parker: Basis in 5 shares Recognized Gain: 5. Munster Coffin Co.: Basis: Realty Accounts receivable Equipment (Lillie) Cash Equipment (Vlad) Truck Recognized Gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts