Question: Answer the following questions. please note- this answer has come back wrong a few times. i will attatch 2 pictures of some formulas from the

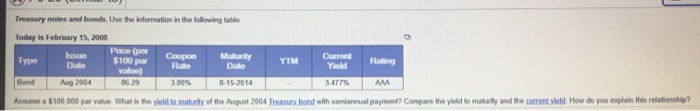

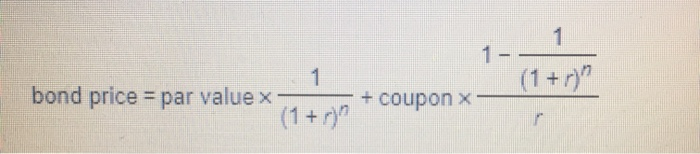

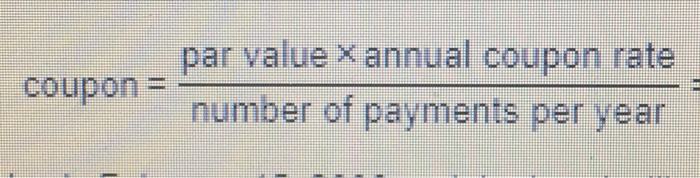

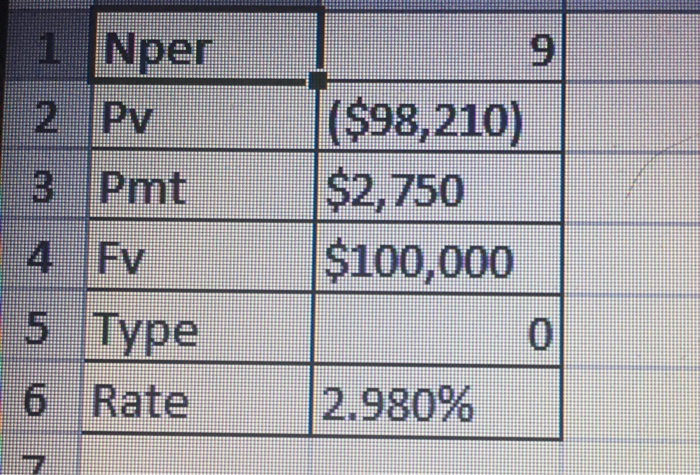

Treasury notes and bonds. Use the information in the following table Today is February 15, 2008 Price (per $100 par value) Issue Date Coupon Rate Maurity Current Type YIM Rating Yiokd Date 300% 8-15-2014 AA 3477% Bond Aug 2004 86 29 Ansume a $100 000 par value What is the yield to maturity of the August 2004 Treasury bond with semiannual payment? Compare the yield to mahurty and the current yield How do you explain this relationship? 1 1-- (1+r) 1 bond price = par value x +coupon x (1+r) par value x annual coupon rate Coupon number of payments per year 1 Nper 9 2 Pv ($98,210) $2,750 $100,000 3 Pmt 4 Fv 5 Type 6 Rate 2.980%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts