Question: Answer the following questions: Question 1: (5 points): Will Islamic banking transactions be treated on a par with conventional financial transactions for VAT,- eg.

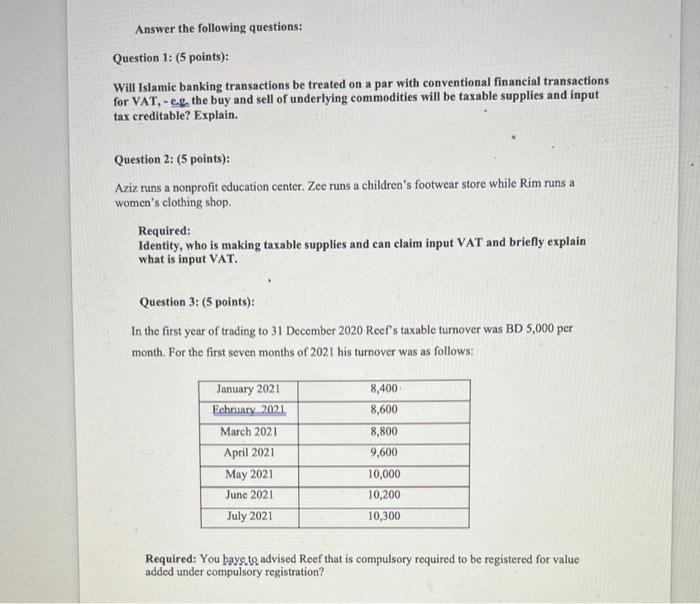

Answer the following questions: Question 1: (5 points): Will Islamic banking transactions be treated on a par with conventional financial transactions for VAT,- eg. the buy and sell of underlying commodities will be taxable supplies and input tax creditable? Explain. Question 2: (5 points): Aziz runs a nonprofit education center. Zee runs a children's footwear store while Rim runs a women's clothing shop. Required: Identity, who is making taxable supplies and can claim input VAT and briefly explain what is input VAT. Question 3: (5 points): In the first year of trading to 31 December 2020 Reef's taxable turnover was BD 5,000 per month. For the first seven months of 2021 his turnover was as follows: January 2021 8,400 February 2021 8,600 March 2021 8,800 April 2021 9,600 May 2021 10,000 June 2021 10,200 July 2021 10,300 Required: You bays.to advised Reef that is compulsory required to be registered for value added under compulsory registration?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts