Question: Answer the following questions: Question 1: Current liabilities - Assignment 2 1- Castle Bank agrees to lend 200,000 on March 1, 2019, to Landscape Co.

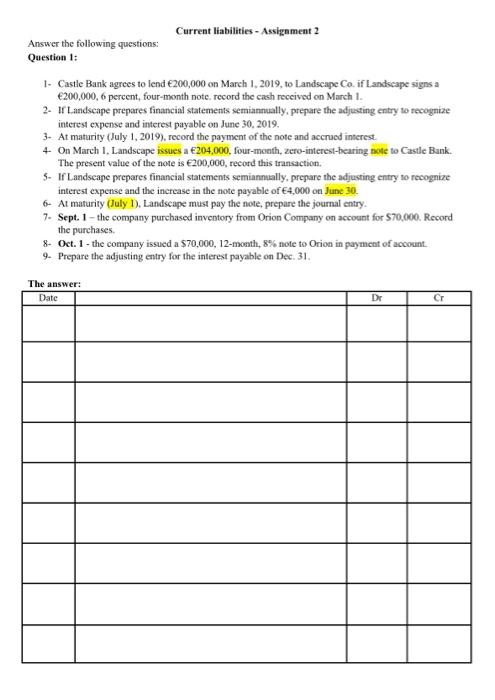

Current liabilities - Assignment 2 Answer the following questions: Question 1: 1. Castle Bank agrees to lend 200,000 on March 1, 2019, to Landscape Co. if Landscape signs a 200,000,6 perent, four-month note. record the cash received on March 1. 2. If Landscape prepares financial statements semiannually, prepare the adjusting entry wo recognize interest expense and interest payable on June 30, 2019. 3- At maturity (July 1, 2019), record the payment of the note and accrued interest. 4. On March 1, Landscape issues a 204,000, four-month, zero-interest-bearing note to Castle Bank. The present value of the note is 200,000, record this transaction. 5. If Landseape prepares financial statements semiannually, prepare the adjusting entry to recognize interest expense and the increase in the note payable of 4,000 on June 30. 6- At maturity (July 1), Landscape must pay the note, prepare the journal entry. 7. Sept. 1 - the company purchased inventory from Orion Company on account for $70,000. Record the purchases. 8. Oct. 1 - the company issued a $70,000,12-month, 8% note to Orion in payment of account. 9. Prepare the adjusting entry for the interest payable on Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts