Question: Answer the following questions: Question 7 You work for Tango Ltd.: you estimated that the company will produce the following state- dependent cash flows in

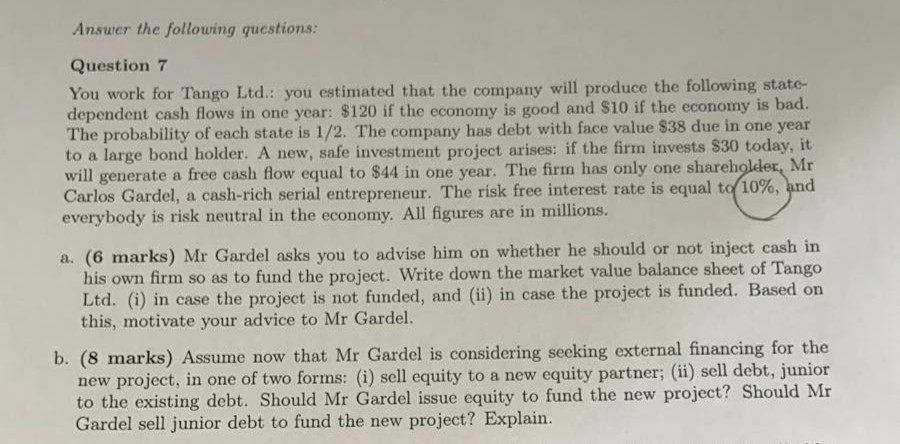

Answer the following questions: Question 7 You work for Tango Ltd.: you estimated that the company will produce the following state- dependent cash flows in one year: $120 if the economy is good and $10 if the economy is bad. The probability of each state is 1/2. The company has debt with face value $38 due in one year to a large bond holder. A new, safe investment project arises: if the firm invests $30 today, it will generate a free cash flow equal to $44 in one year. The firm has only one shareholder, Mr Carlos Gardel, a cash-rich serial entrepreneur. The risk free interest rate is equal to 10%, and everybody is risk neutral in the economy. All figures are in millions. a. (6 marks) Mr Gardel asks you to advise him on whether he should or not inject cash in his own firm so as to fund the project. Write down the market value balance sheet of Tango Ltd. (i) in case the project is not funded, and (ii) in case the project is funded. Based on this, motivate your advice to Mr Gardel. b. (8 marks) Assume now that Mr Gardel is considering seeking external financing for the new project, in one of two forms: (i) sell equity to a new equity partner; (ii) sell debt, junior to the existing debt. Should Mr Gardel issue equity to fund the new project? Should Mr Gardel sell junior debt to fund the new project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts