Question: Answer the following questions. Table 6-4 or Table 6-5. Note: Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals. Required:

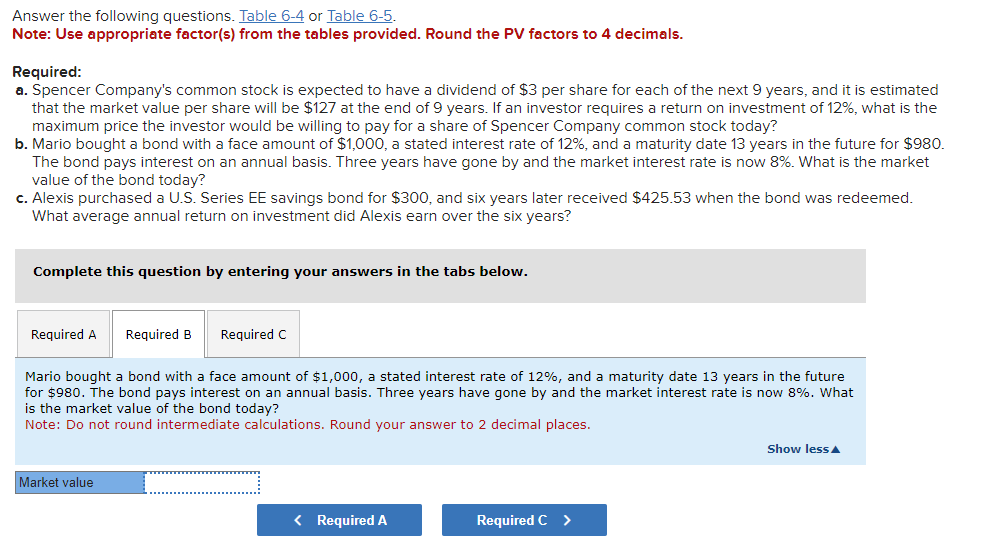

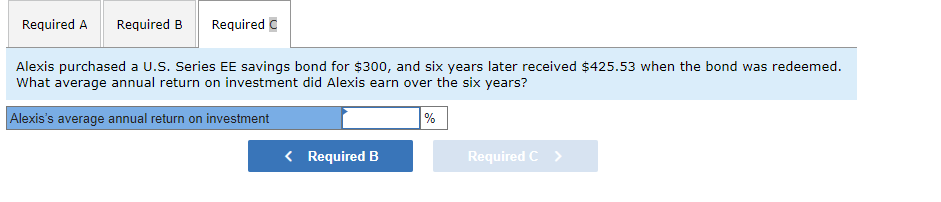

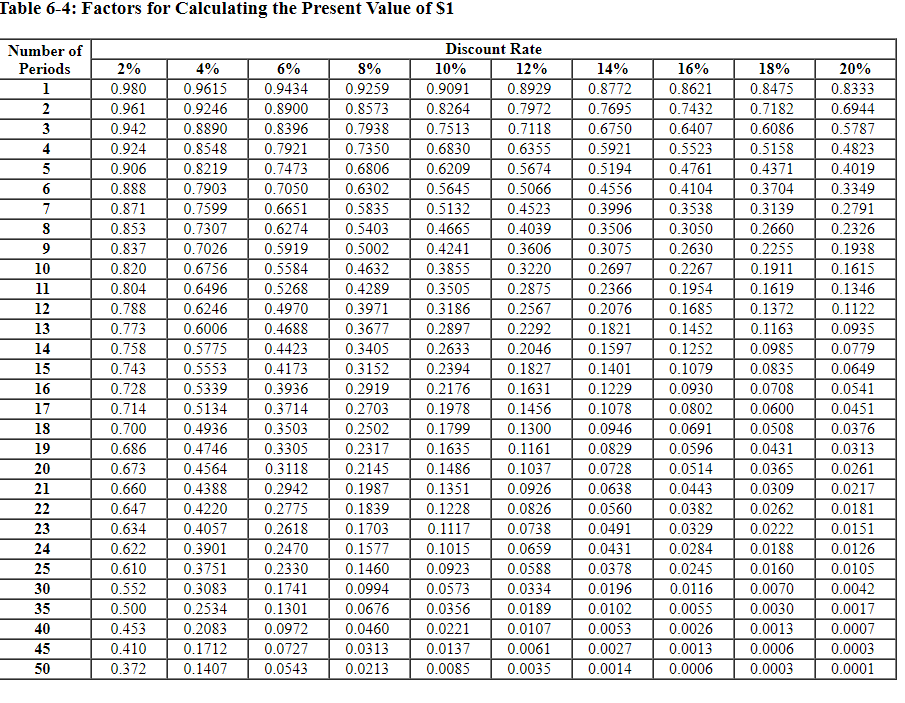

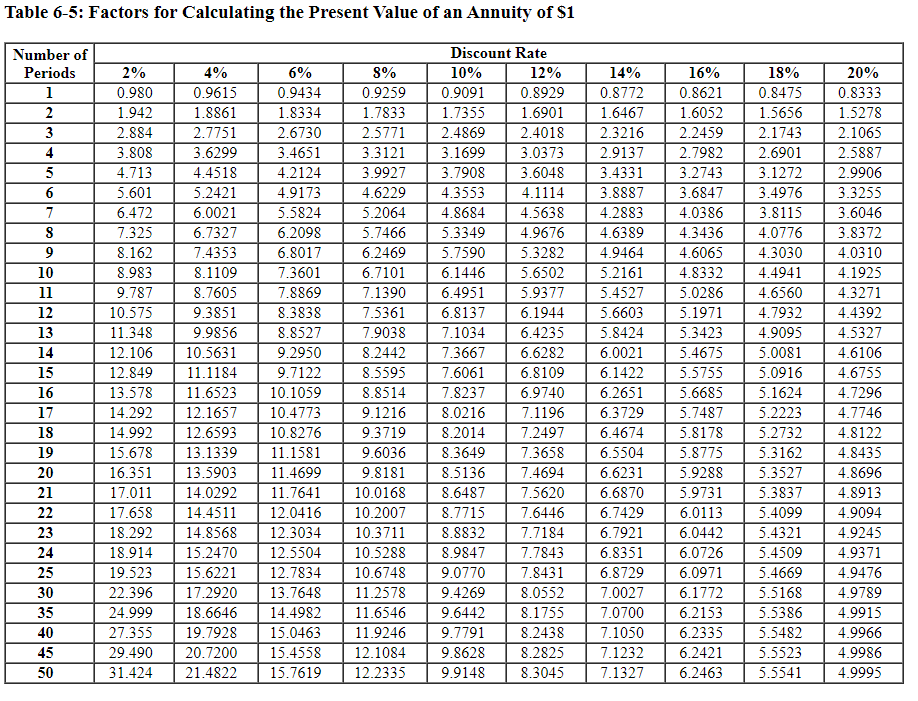

Answer the following questions. Table 6-4 or Table 6-5. Note: Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals. Required: a. Spencer Company's common stock is expected to have a dividend of $3 per share for each of the next 9 years, and it is estimated that the market value per share will be $127 at the end of 9 years. If an investor requires a return on investment of 12%, what is the maximum price the investor would be willing to pay for a share of Spencer Company common stock today? b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 12%, and a maturity date 13 years in the future for $980. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 8%. What is the market value of the bond today? c. Alexis purchased a U.S. Series EE savings bond for $300, and six years later received $425.53 when the bond was redeemed. What average annual return on investment did Alexis earn over the six years? Complete this question by entering your answers in the tabs below. Mario bought a bond with a face amount of $1,000, a stated interest rate of 12%, and a maturity date 13 years in the future for $980. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 8%. What is the market value of the bond today? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Table 6-4: Factors for Calculating the Present Value of \$1 Table 6-5: Factors for Calculating the Present Value of an Annuity of $1 Alexis purchased a U.S. Series EE savings bond for $300, and six years later received $425.53 when the bond was redeemed. What average annual return on investment did Alexis earn over the six years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts