Question: Answer the following questions true or false and EXPLAIN why (regardless of true or false). Without explanation, you will only receive 2 points each even

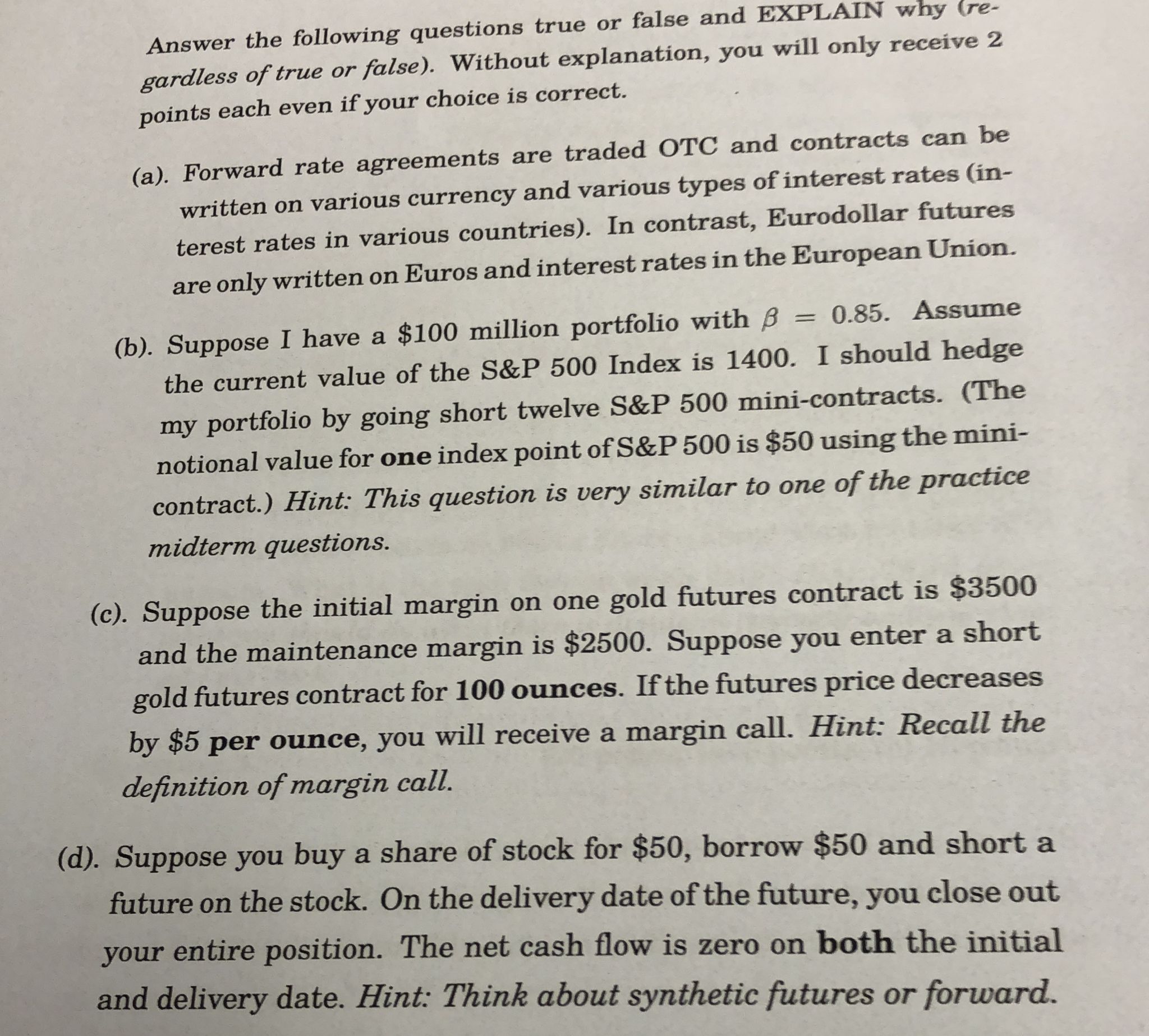

Answer the following questions true or false and EXPLAIN why (regardless of true or false). Without explanation, you will only receive 2 points each even if your choice is correct. (a). Forward rate agreements are traded OTC and contracts can be written on various currency and various types of interest rates (interest rates in various countries). In contrast, Eurodollar futures are only written on Euros and interest rates in the European Union. (b). Suppose I have a $100 million portfolio with =0.85. Assume the current value of the S\&P 500 Index is 1400. I should hedge my portfolio by going short twelve S\&P 500 mini-contracts. (The notional value for one index point of S\&P 500 is $50 using the minicontract.) Hint: This question is very similar to one of the practice midterm questions. (c). Suppose the initial margin on one gold futures contract is $3500 and the maintenance margin is $2500. Suppose you enter a short gold futures contract for 100 ounces. If the futures price decreases by $5 per ounce, you will receive a margin call. Hint: Recall the definition of margin call. (d). Suppose you buy a share of stock for $50, borrow $50 and short a future on the stock. On the delivery date of the future, you close out your entire position. The net cash flow is zero on both the initial and delivery date. Hint: Think about synthetic futures or forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts