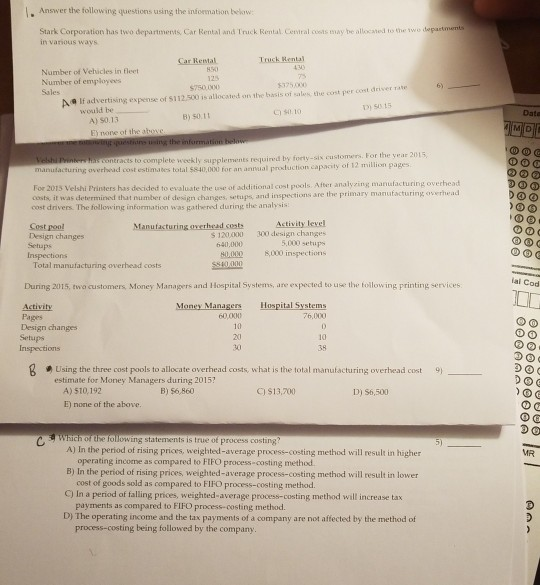

Question: , Answer the following questions using the information bekow Stark Corporation has two departments, Car Rental and Truck Rental Cenitral coots tmay be allocated to

, Answer the following questions using the information bekow Stark Corporation has two departments, Car Rental and Truck Rental Cenitral coots tmay be allocated to the two departmante in various ways Car Rental Number of Vehicles in fleet Number of employees Sales If advertising expense of 5112.500 is allocated os the basis of sales the cost per cost driver Tate 6) would be $750 000 537500 A Date B) s0.11 A) S0.13 to complete weekly y supplements required by forty-six customers. For the year 2015, manufacturing overbead cost estimates total $8-40,00N) for an annual production capacity of 12 million pages For 2015 Velshi Printers has decided to evaluate the use of additional cost pools. After analying manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhe ad cost drivers. The following information was gathered during the analysis Activity level Cost pool Design changes Setups tanufacturing overhead costs s 120,000 300 design changes 5,000 setups 640,000 8008,000 inspections Total manufacturing overhead costs ai Cod During 2015, two customers, Money Managers and Hospital Systems, are expected to use the tollowing printing services 76,000 Pages Design changes 60,000 20 301 10 38 Using the three cost pools to allocate overhead costs, what is the total manufacturing overhead cost 9) estimate for Money Managers during 2015? A) 510.192 E) none of the above B) 56,860 C) $13,70 D) S6,500 cwhich o dhe following statements is true of process costing A) In the period of rising prices, weighted-average process-costing method will result in highesr B) In the period of rising prices weighted-average process-costing method will result in lower C) In a period of falling prices, weighted-average process-costing method will increase tax D) The operating income and the tax payments of a company are not affected by the method of operating income as compared to FIFO process-costing method. cost of goods sold as compared to FIFO process-costing method payments as compared to FIFO process-costing method. process-costing being followed by the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts