Question: Answer the following questions using your table from question (2). If the stock price increases to 52, by approximately how much will the Long and

Answer the following questions using your table from question (2).

If the stock price increases to 52, by approximately how much will the Long and Short Risk Reversal change?

Compare the net prices, deltas and gammas of the Short Butterfly, Long Straddle and Long Strangle. Do you see any relationship between strategy price and delta? Strategy price and gamma? What is that relationship?

Which strategy has the largest vega? By how much will this strategy change in value if the volatility increases from 50% up to 65%?

Which strategy has the largest tau? Holding everything else constant, by how much will the value of the strategy change after 20 days?

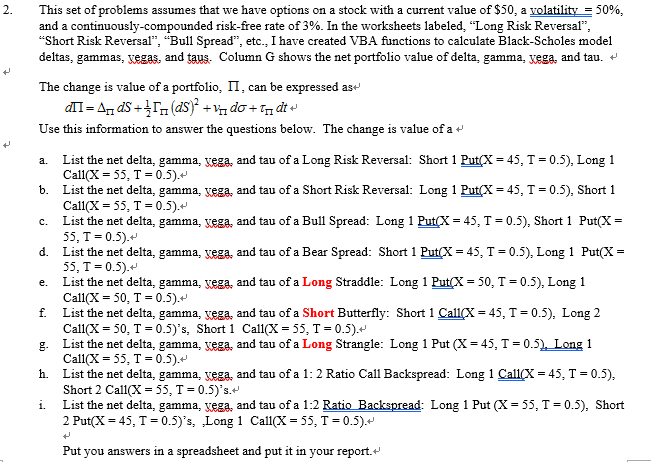

2. This set of problems assumes that we have options on a stock with a current value of $50, a volatility E 50%, and a continuously-compounded risk-free rate of 3%. In the worksheets labeled, "Long Risk Reversal" Short Risk Reversal", Bull Spread", etc., I have created VBA functions to calculate Black-Scholes model deltas, gammas, vegas, and taus. Column G shows the net portfolio value of delta, gamma, vega, and tau. The change is value of a portfolio, II, can be expressed as Use this information to answer the questions below. The change is value of a a. List the net delta, gamma, vega: and tau of a Long Risk Reversal: Short 1 PutX 45, T 0.50, Long 1 Call (X 55, T 0.5). b. List the net delta, gamma, vega. and tau of a Short Risk Reversal: Long 1Putx 45, T 0.50, Short 1 Call 55 0.5). c. List the net delta, gamma, vega, and tau of a B Spread: Long 1 Putx-45, T 0.5), Short 1 Put(X- 55, T 0.5) d. List the net delta, gamma, yega, and tau of a Bear Spread: Short 1 Putx-45, T-0.5), Long 1 Put(X 55, T 0.5). e. t the net delta, gamma, vega and tau of a Long Straddle: Long 1 Putx- 50, T-0.5), Long 1 Call 50 0.5). f List the net delta, gamma, vega and tau of a Short Butterfly: Short 1 CallCX-45, T 0.5), Long 2 Call 50 0.5)'s, Short 1 Call (X 55, T 0.5). g. List the net delta, gamma, vega and tau of a Long Strangle: Long 1 Put OK 45, T 0.5 Long 1 Call 55, 0.5). h. t the net delta, gamma, vega and tau of a 1: 2 Ratio Call Backspread: Long 1 Callx- 45, 0.5) Short 2 CallOK 55 T 0.50 s. i. List the net delta, gamma, vega and tau of a 1:2 Ratio Backspread: Long 1 Put CK 35, T-0.5), Short 2 Put(X 45, T 0.5)'s, Long 1 Call 55, T 0.5). Put you answers in a spreadsheet and put it in your report. 2. This set of problems assumes that we have options on a stock with a current value of $50, a volatility E 50%, and a continuously-compounded risk-free rate of 3%. In the worksheets labeled, "Long Risk Reversal" Short Risk Reversal", Bull Spread", etc., I have created VBA functions to calculate Black-Scholes model deltas, gammas, vegas, and taus. Column G shows the net portfolio value of delta, gamma, vega, and tau. The change is value of a portfolio, II, can be expressed as Use this information to answer the questions below. The change is value of a a. List the net delta, gamma, vega: and tau of a Long Risk Reversal: Short 1 PutX 45, T 0.50, Long 1 Call (X 55, T 0.5). b. List the net delta, gamma, vega. and tau of a Short Risk Reversal: Long 1Putx 45, T 0.50, Short 1 Call 55 0.5). c. List the net delta, gamma, vega, and tau of a B Spread: Long 1 Putx-45, T 0.5), Short 1 Put(X- 55, T 0.5) d. List the net delta, gamma, yega, and tau of a Bear Spread: Short 1 Putx-45, T-0.5), Long 1 Put(X 55, T 0.5). e. t the net delta, gamma, vega and tau of a Long Straddle: Long 1 Putx- 50, T-0.5), Long 1 Call 50 0.5). f List the net delta, gamma, vega and tau of a Short Butterfly: Short 1 CallCX-45, T 0.5), Long 2 Call 50 0.5)'s, Short 1 Call (X 55, T 0.5). g. List the net delta, gamma, vega and tau of a Long Strangle: Long 1 Put OK 45, T 0.5 Long 1 Call 55, 0.5). h. t the net delta, gamma, vega and tau of a 1: 2 Ratio Call Backspread: Long 1 Callx- 45, 0.5) Short 2 CallOK 55 T 0.50 s. i. List the net delta, gamma, vega and tau of a 1:2 Ratio Backspread: Long 1 Put CK 35, T-0.5), Short 2 Put(X 45, T 0.5)'s, Long 1 Call 55, T 0.5). Put you answers in a spreadsheet and put it in your report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts