Question: Answer the following report as I have no knowledge about supply chain management. I need a proper answer, previously I put the same question but

Answer the following report as I have no knowledge about supply chain management. I need a proper answer, previously I put the same question but someone just paraphrased it and I can read english but I need proper report on this topic, please research and write this report as I have to submit this by next week. Please and thank you, whoever writes the proper report I will give them thumbs up. It will be really appreciated. Thanks

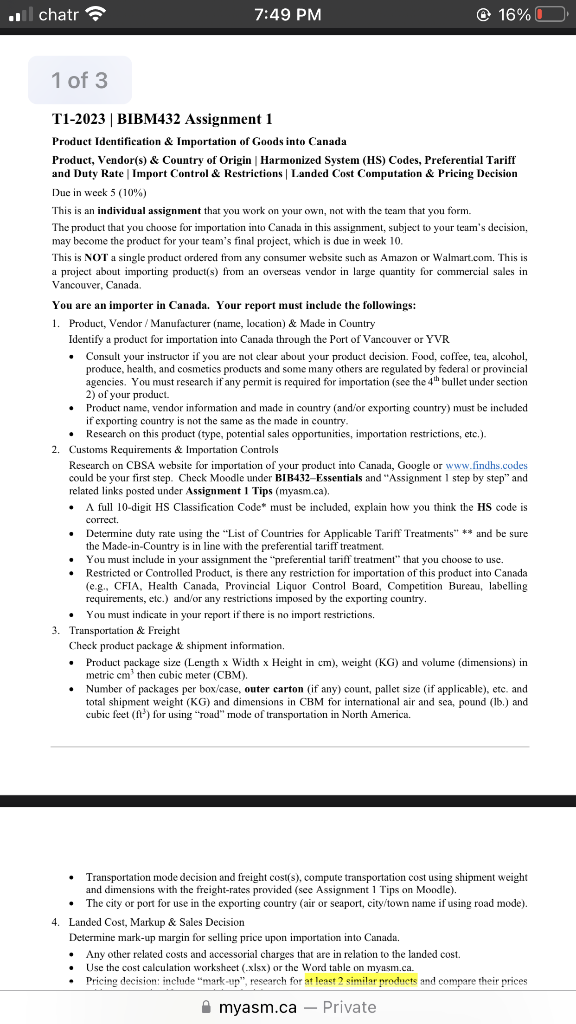

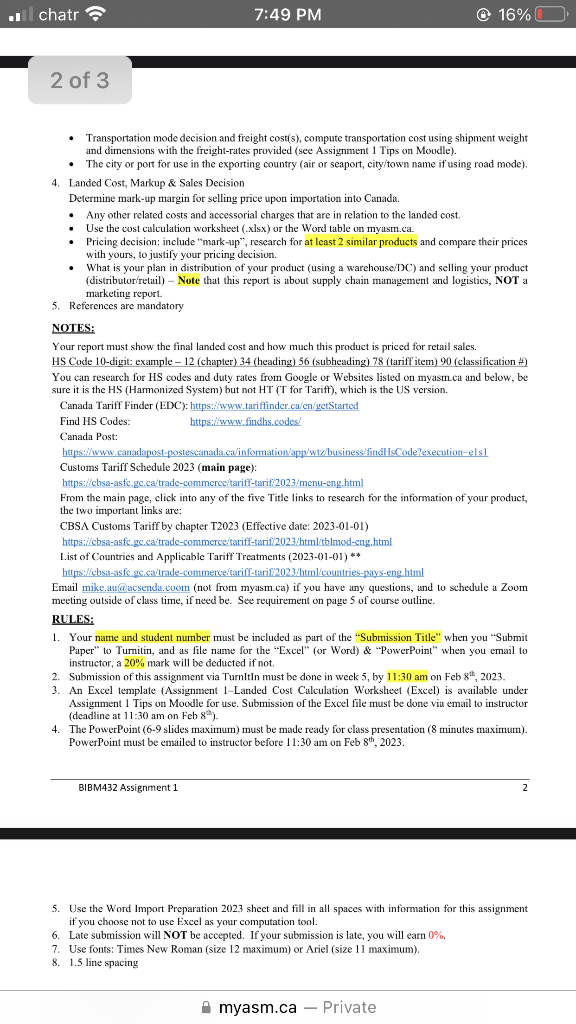

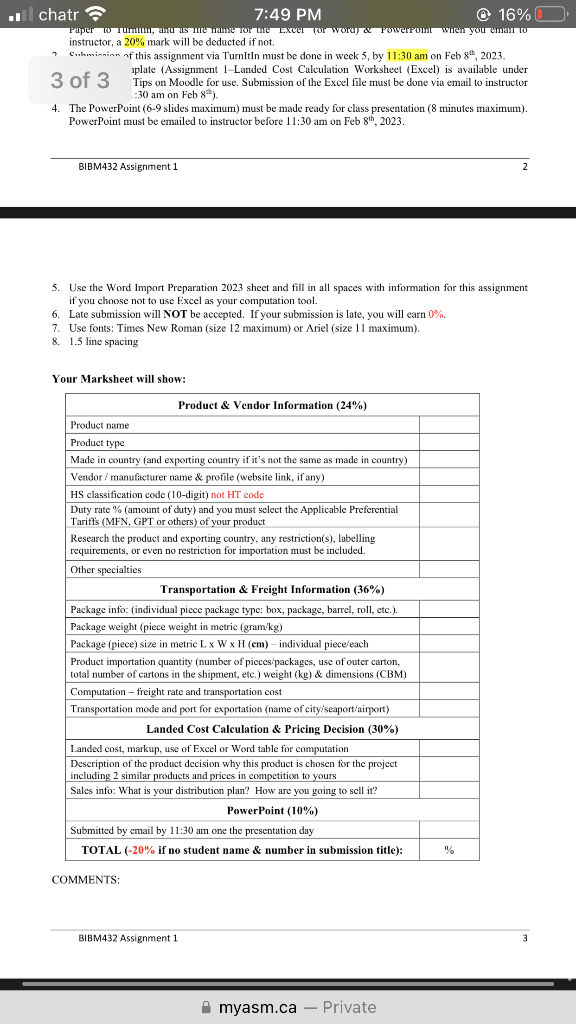

T1-2023 BIBM432 Assignment 1 Product Identification \& Importation of Goods into Canada Product, Vendor(s) \& Country of Origin | Harmonized System (HS) Codes, Preferential Tariff and Duty Rate | Import Control \& Restrictions | Landed Cost Computation \& Pricing Decision Due in week 5(10%) This is an individual assignment that you work on your own, not with the team that you form. The product that you choose for importation into Canada in this assignment, subject to your teum's decision, may become the product for your team's final project, which is due in week 10. This is NOT a single product ordered from any consumer website such as Amazon or Walmart.oom. This is a project about importing product(s) from an overseas vendor in large quantity for commercial sales in Vancouver, Canada. You are an importer in Canada. Your report must include the followings: 1. Product, Vendor / Manufacturer (name, location) \& Made in Country Identify a product for importation into Canada through the Port of Vancouver or YVR - Consult your instructor if you are not clear about your product decision. Food, coffee, tea, alcohol, produce, health, and cosmetics products and some many others are regulated by federal or provincial agencies. You must research if any permit is required for importation (see the 4th bullet under section 2) of your product. - Product name, vendor information and made in country (and/or exporting country) must be included if exporting country is not the same as the made in country. - Research on this product (type, potential sales opportunities, importation restrictions, etc.). 2. Customs Requirements \& Importation Controls Research on CBSA website for importation of your product into Canada, Google or www.findhs.codes could be your first step. Check Moodle under BIB432-Essentials and "Assignment 1 step by step" and related links posted under Assignment 1 Tips (myasm.ca). - A full 10-digit HS Classification Code* must be included, explain how you think the HS code is correct. - Determine duty rate using the "List of Countries for Applicable Tariff Treatments" ** and be sure the Made-in-Country is in line with the preferential tariff treatment. - You must include in your assignment the "preferential tariff treatment" that you choose to use. - Restricted or Controlled Product, is there any restriction for importation of this product into Canada (e.g., CFIA, Health Canada, Provincial Liquor Control Board, Competition Bureau, labelling requirements, etc.) and/or any restrictions imposed by the exporting country. - You must indicate in your report if there is no import restrictions. 3. Transportation \& Freight Check product package \& shipment information. - Product package size (Length x Width x Height in cm), weight (KG) and volume (dimensions) in metric cm3 then cubic meter (CBM). - Number of packages per box/case, outer carton (if any) count, pallet size (if applicable), etc, and total shipment weight (KG) and dimensions in CBM for international air and sea, pound ( lb.) and cubic feet (f3) for using "road" mode of transportation in North America. - Transportation mode decision and freight cost(s), compute transportation cost using shipment weight and dimensions with the freight-rates provided (see Assignment 1 Tips on Moodle). - The city or port for use in the exporting country (air or seaport, city/town name if using road mode). 4. Landed Cost, Markup \& Sales Decision Determine mark-up margin for selling price upon importation into Canada. - Any other related costs and accessorial charges that are in relation to the landed cost. - Use the cost calculation worksheet ( xlsx) or the Word table on myasm.ca. - Pricing decision: include "mark-up", research for at least 2 similar products and compare their prices - Transportation mode decision and freight cost(s), compute transportation cost using shipment weight and dimensions with the freight-rates provided (see Assignment 1 Tips on Moodle). - The city or port for use in the exporting country (air or seaport, city/town name if using road mode). 4. Landed Cost, Markup \& Sales Decision Determine mark-up margin for selling price upon importation into Canada. - Any other related costs and accessorial charges that are in relation to the landed cost. - Use the cost calculation worksheet (.lsx) or the Word table on myasm.ca. - Pricing decision: include "mark-up", research for at least 2 similar products and compare their prices with yours, to justify your pricing decision. - What is your plan in distribution of your product (using a warehouse/DC) and selling your product (distributoriretail) - Note that this report is about supply chain management and logistics, NOT a marketing report. 5. References are mandatory NOTES: Your report must show the final landed cost and how much this product is priced for retail sales. HS Code 10-digit: example - 12 (chapter) 34 (heading) 56 (subheading) 78 (tariff item) 90 (classification 4 ) You can research for HS codes and duty rates from Google or Websites listed on myasm.a and below, be sure it is the HS (Harmonized System) but not HT (T for Tarift), which is the US version. Canada Tariff Finder (EDC): https://www.tariffinder.ca/cn/getStarted Find HS Codes: https://www. findhs.codes! Canada Post: htps://www.canadapost-postescanadaca/information'app'wtz/husiness/findHsCode?execution-els 1 Customs Tariff Schedule 2023 (main page): https://cbsa-asfc.gc.ca/trade-commerce/tariff-tarif/2023/menu-cng.html From the main page, click into any of the five Title links to research for the information of your product, the two important links are: CBSA Customs Tariff by chapter T2023 (Effective date: 2023-01-01) https://cbsa-asfc. gc.caitrade-conmerce/tariff-tarif/2023/html/tblmod-eng.html List of Countries and Applicable Tariff Treatments (2023-01-01) ** https://cbsa-asfc.gccaitrade-commerceitariff-tarifi2023/html/countries-pays-eng html Email mike.au@acsenda.coom (not from myasm.ca) if you have any questions, and to schedule a Zoom meeting outside of class time, if need be. See requirement on page 5 of course outline. RULES: 1. Your name and student number must be included as part of the "Submission Title" when you "Submit Paper" to Turnitin, and as file name for the "Excel" (or Word) \& "PowerPoint" when you email to instructor, a 20% mark will be deducted if not. 2. Submission of this assignment via Turnitln must be done in week 5, by 11:30 am on Feb 8th,2023. 3. An Excel template (Assignment 1-Landed Cost Calculation Worksheet (Excel) is available under Assignment 1 Tips on Moodle for use. Submission of the Excel file must be done via email to instructor (deadline at 11:30 am on Feb 82 ). 4. The PowerPoint (6-9 slides maximum) must be made ready for class presentation ( 8 minutes maximum). PowerPoint must be emailed to instructor before 11:30 am on Feb 8th,2023. BIBM432 Assignment 1 5. Use the Word Import Preparation 2023 sheet and fill in all spaces with information for this assignment if you choose not to use Excel as your computation tool. 6. Late submission will NOT be accepted. If your submission is late, you will earn 0%. 7. Use fonts: Times New Roman (size 12 maximum) or Ariel (size 11 maximum). 8. 1.5 line spacing instructor, a 20% mark will be deducted if not. 7 Sohminnion of this assignment via Turnitin must be done in week 5 , by 11:30 am on Feb 8th,2023. 3 of 3 plate (Assignment 1-Landed Cost Calculation Worksheet (Excel) is available under Tips on Moodle for use. Submission of the Excel file must be done via email to instructor :30 am on Feb 82 ). 4. The PowerPoint (6-9 slides maximum) must be made ready for class presentation (8 minutes maximum). PowerPoint must be emailed to instructor before 11:30am on Feb 8th,2023. BIBM432 Assignment 1 5. Use the Word Import Preparation 2023 sheet and fill in all spaces with information for this assignment if you choose not to use Excel as your computation tool. 6. Late submission will NOT be accepted. If your submission is late, you will earn 0%. 7. Use fonts: Times New Roman (size 12 maximum) or Ariel (size 11 maximum). 8. 1.5 line spacing Yane Marlehant will show

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts