Question: Answer the following: with solution Activig 16: Instructions: (A) Answer the provided problems. Write your solutions on any clean piece(s) of paper. For numerical requirements,

Answer the following: with solution

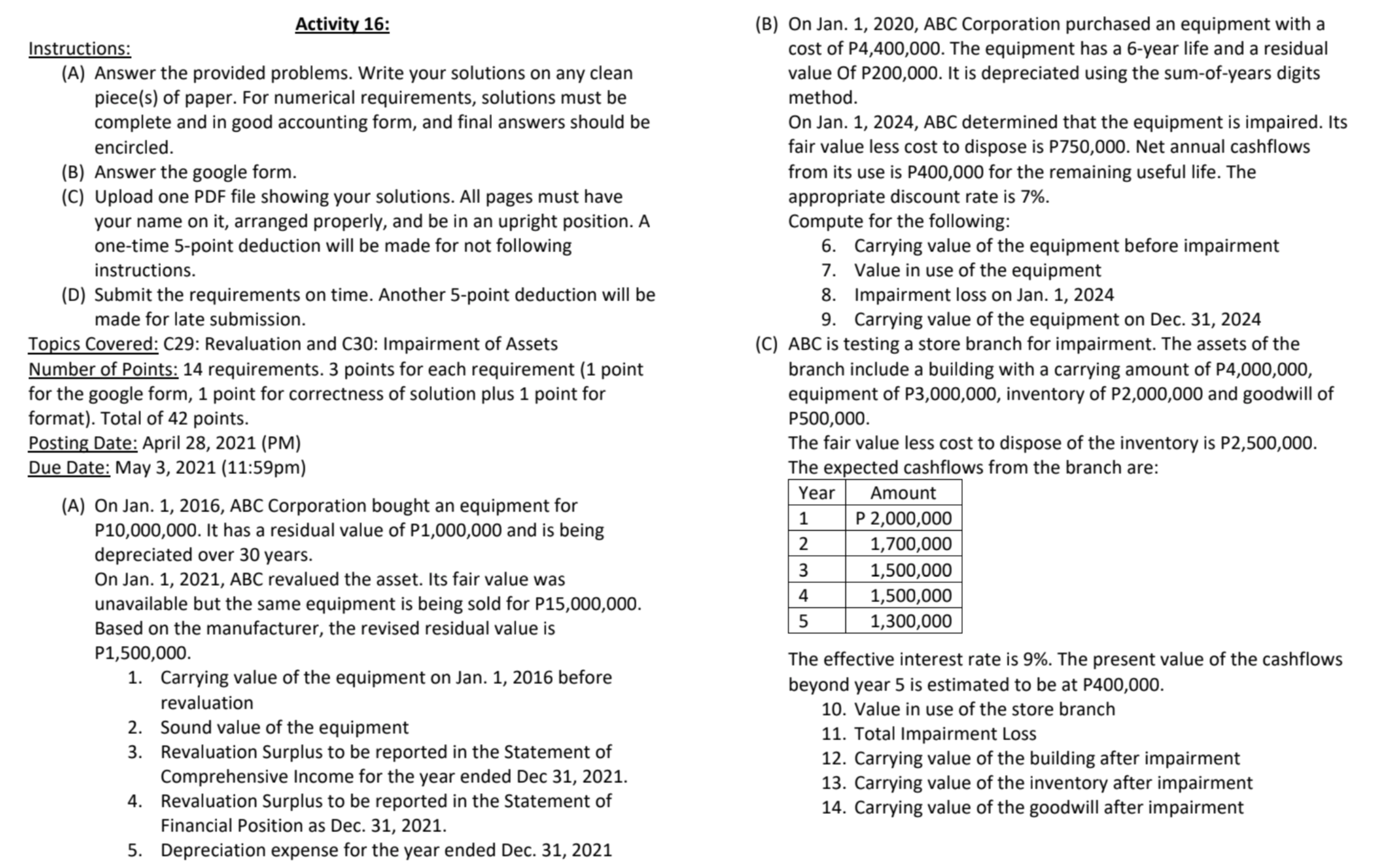

Activig 16: Instructions: (A) Answer the provided problems. Write your solutions on any clean piece(s) of paper. For numerical requirements, solutions must be complete and in good accounting form, and nal answers should be encircled. (B) Answer the google form. (C) Upload one PDF file showing your solutions. All pages must have your name on it, arranged properly, and be in an upright position. A one-time 5-point deduction will be made for not following instructions. (D) Submit the requirements on time. Another 5-point deduction will be made for late submission. Topics Covered: C29: Revaluation and C30: Impairment of Assets Number of Points: 14 requirements. 3 points for each requirement (1 point for the google form, 1 point for correctness of solution plus 1 point for format). Total of 42 points. Posting Date: April 28, 2021 (PM) Due Date: May 3, 2021 (11:59pm) (A) On Jan. 1, 2016, ABC Corporation bought an equipment for P10,000,000. It has a residual value of P1,000,000 and is being depreciated over 30 years. On Jan. 1, 2021, ABC revalued the asset. Its fair value was unavailable but the same equipment is being sold for P15,000,000. Based on the manufacturer, the revised residual value is P1,500,000. 1. Carrying value of the equipment on Jan. 1, 2016 before revaluation 2. Sound value of the equipment 3. Revaluation Surplus to be reported in the Statement of Comprehensive Income for the year ended Dec 31, 2021. 4. Revaluation Surplus to be reported in the Statement of Financial Position as Dec. 31, 2021. 5. Depreciation expense for the year ended Dec. 31, 2021 (B) On Jan. 1, 2020, ABC Corporation purchased an equipment with a cost of P4,400,000. The equipment has a 6-year life and a residual value Of P200,000. It is depreciated using the sum-of-years digits method. On Jan. 1, 2024, ABC determined that the equipment is impaired. Its fair value less cost to dispose is P750,000. Net annual cashows from its use is P400,000 for the remaining useful life. The appropriate discount rate is 7%. Compute for the following: 6. Carrying value of the equipment before impairment 7. Value in use of the equipment 8. Impairment loss on Jan. 1, 2024 9. Carrying value of the equipment on Dec. 31, 2024 (C) ABC is testing a store branch for impairment. The assets of the branch include a building with a carrying amount of P4,000,000, equipment of P3,000,000, inventory of P2,000,000 and goodwill of P500,000. The fair value less cost to dispose of the inventory is P2,500,000. The expected cashows from the branch are: The effective interest rate is 9%. The present value of the cashflows beyond year 5 is estimated to be at P400300. 10. Value in use of the store branch 11. Total Impairment Loss 12. Carrying value of the building after impairment 13. Carrying value of the inventory after impairment 14. Carrying value of the goodwill after impairment