Question: Answer the full question plz and the steps below preciscly A firm is considering three mutually exclusive alternatives as part of an upgrade to an

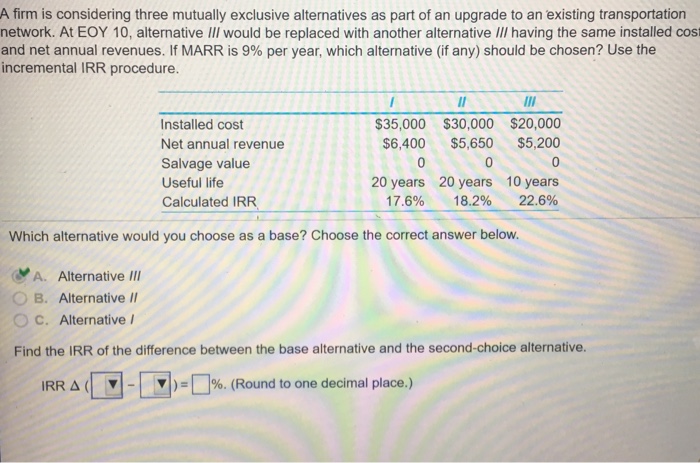

A firm is considering three mutually exclusive alternatives as part of an upgrade to an existing transportation network. At EOY 10, alternative IlI would be replaced with another alternative II/ having the same installed cost and net annual revenues. If MARR is 9% per year, which alternative (if any) should be chosen? Use the incremental IRR procedure. Installed cost Net annual revenue Salvage value Useful life Calculated IRR $35,000 $30,000 $20,000 $6,400 $5,650 $5,200 0 20 years 20 years 10 years 17.6% 18.2% 22.6% Which alternative would you choose as a base? Choose the correct answer below. A. Alternative Il O B. AlternativeII O C. Alternative I Find the IRR of the difference between the base alternative and the second-choice alternative. ?RR ? (I-T?-l "I | %. (Round to one decimal place.) )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts