Question: Answer the given problem. PROBLEM SET NUMBER 1: MANAGERIAL ECONOMICS AND ACCOUNTING 1. You are the Chief Executive Officer (CEO) of a five - star

Answer the given problem.

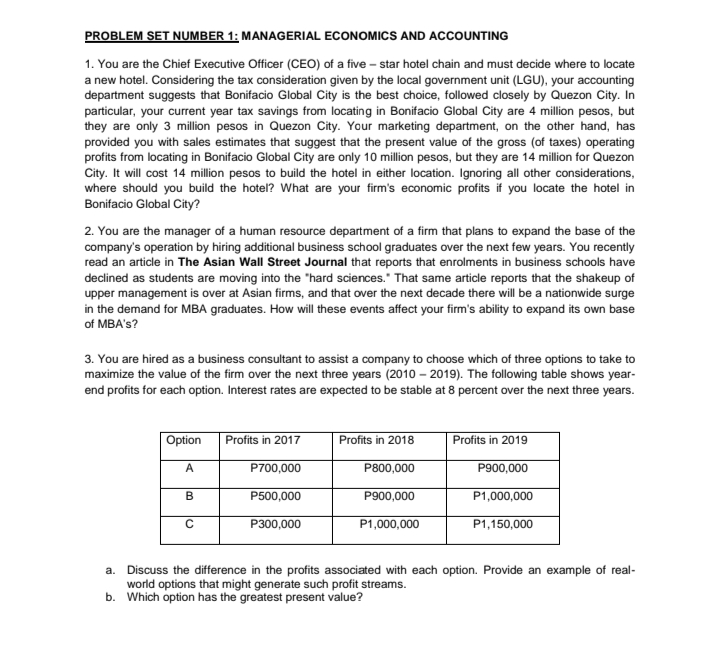

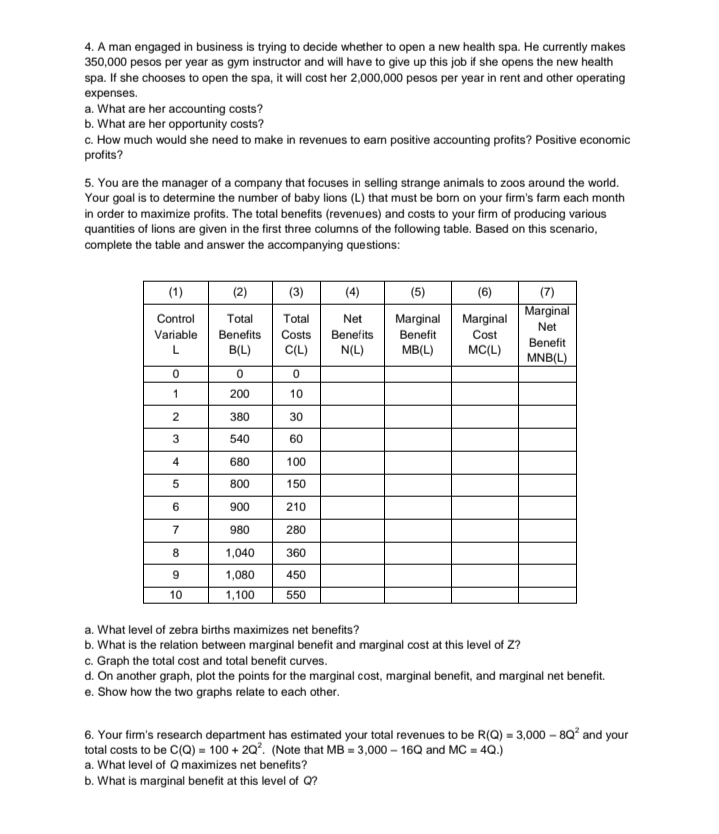

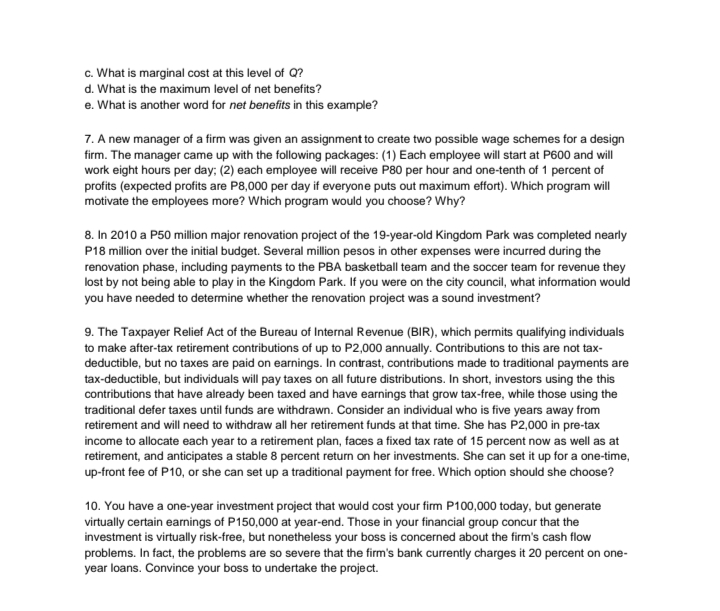

PROBLEM SET NUMBER 1: MANAGERIAL ECONOMICS AND ACCOUNTING 1. You are the Chief Executive Officer (CEO) of a five - star hotel chain and must decide where to locate a new hotel. Considering the tax consideration given by the local government unit (LGU), your accounting department suggests that Bonifacio Global City is the best choice, followed closely by Quezon City. In particular, your current year tax savings from locating in Bonifacio Global City are 4 million pesos, but they are only 3 million pesos in Quezon City. Your marketing department, on the other hand, has provided you with sales estimates that suggest that the present value of the gross (of taxes) operating profits from locating in Bonifacio Global City are only 10 million pesos, but they are 14 million for Quezon City. It will cost 14 million pesos to build the hotel in either location. Ignoring all other considerations, where should you build the hotel? What are your firm's economic profits if you locate the hotel in Bonifacio Global City? 2. You are the manager of a human resource department of a firm that plans to expand the base of the company's operation by hiring additional business school graduates over the next few years. You recently read an article in The Asian Wall Street Journal that reports that enrolments in business schools have declined as students are moving into the "hard sciences." That same article reports that the shakeup of upper management is over at Asian firms, and that over the next decade there will be a nationwide surge in the demand for MBA graduates. How will these events affect your firm's ability to expand its own base of MBA's? 3. You are hired as a business consultant to assist a company to choose which of three options to take to maximize the value of the firm over the next three years (2010 - 2019). The following table shows year- end profits for each option. Interest rates are expected to be stable at 8 percent over the next three years. Option Profits in 2017 Profits in 2018 Profits in 2019 P700,000 P800,000 P900,000 B P500,000 P900,000 1,000,000 C P300,000 P1,000,000 P1,150,000 a. Discuss the difference in the profits associated with each option. Provide an example of real- world options that might generate such profit streams. b. Which option has the greatest present value?4. A man engaged in business is trying to decide whether to open a new health spa. He currently makes 350,000 pesos per year as gym instructor and will have to give up this job if she opens the new health spa. If she chooses to open the spa, it will cost her 2,000,000 pesos per year in rent and other operating expenses. a. What are her accounting costs? b. What are her opportunity costs? C. How much would she need to make in revenues to earn positive accounting profits? Positive economic profits? 5. You are the manager of a company that focuses in selling strange animals to zoos around the world. Your goal is to determine the number of baby lions (L) that must be born on your firm's farm each month in order to maximize profits. The total benefits (revenues) and costs to your firm of producing various quantities of lions are given in the first three columns of the following table. Based on this scenario, complete the table and answer the accompanying questions: (1) (2) (3) (4) (5) (6) (7) Control Marginal Total Total Net Marginal Marginal Net Variable Benefits Costs Benefits Benefit Cost B(L) C(L) N(L) MB(L) MC(L) Benefit MNB(L) 0 0 1 200 10 2 380 30 3 540 BO 4 680 100 5 300 50 6 300 210 7 980 280 8 1,040 360 9 1,080 450 10 1,100 550 a. What level of zebra births maximizes net benefits? b. What is the relation between marginal benefit and marginal cost at this level of Z? c. Graph the total cost and total benefit curves. d. On another graph, plot the points for the marginal cost, marginal benefit, and marginal net benefit. e. Show how the two graphs relate to each other. 6. Your firm's research department has estimated your total revenues to be R(Q) = 3,000 - 807 and your total costs to be C(Q) = 100 + 20". (Note that MB = 3,000 - 16Q and MC = 4Q.) a. What level of Q maximizes net benefits? b. What is marginal benefit at this level of Q?c. What is marginal cost at this level of Q? d. What is the maximum level of net benefits? e. What is another word for net benefits in this example? 7. A new manager of a firm was given an assignment to create two possible wage schemes for a design firm. The manager came up with the following packages: (1) Each employee will start at P600 and will work eight hours per day; (2) each employee will receive P80 per hour and one-tenth of 1 percent of profits (expected profits are P8,000 per day if everyone puts out maximum effort). Which program will motivate the employees more? Which program would you choose? Why? 8. In 2010 a P50 million major renovation project of the 19-year-old Kingdom Park was completed nearly P18 million over the initial budget. Several million pesos in other expenses were incurred during the renovation phase, including payments to the PBA basketball team and the soccer team for revenue they lost by not being able to play in the Kingdom Park. If you were on the city council, what information would you have needed to determine whether the renovation project was a sound investment? 9. The Taxpayer Relief Act of the Bureau of Internal Revenue (BIR), which permits qualifying individuals to make after-tax retirement contributions of up to P2,000 annually. Contributions to this are not tax- deductible, but no taxes are paid on earnings. In contrast, contributions made to traditional payments are tax-deductible, but individuals will pay taxes on all future distributions. In short, investors using the this contributions that have already been taxed and have earnings that grow tax-free, while those using the traditional defer taxes until funds are withdrawn. Consider an individual who is five years away from retirement and will need to withdraw all her retirement funds at that time. She has P2,000 in pre-tax income to allocate each year to a retirement plan, faces a fixed tax rate of 15 percent now as well as at retirement, and anticipates a stable 8 percent return on her investments. She can set it up for a one-time, up-front fee of P10, or she can set up a traditional payment for free. Which option should she choose? 10. You have a one-year investment project that would cost your firm P100,000 today, but generate virtually certain earnings of P150,000 at year-end. Those in your financial group concur that the investment is virtually risk-free, but nonetheless your boss is concerned about the firm's cash flow problems. In fact, the problems are so severe that the firm's bank currently charges it 20 percent on one- year loans. Convince your boss to undertake the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts