Question: answer the last question for two problems 1 2 Stark Industries expects an earnings per share of $2.03 and reinvests 40% of its earnings. Management

answer the last question for two problems

1

2

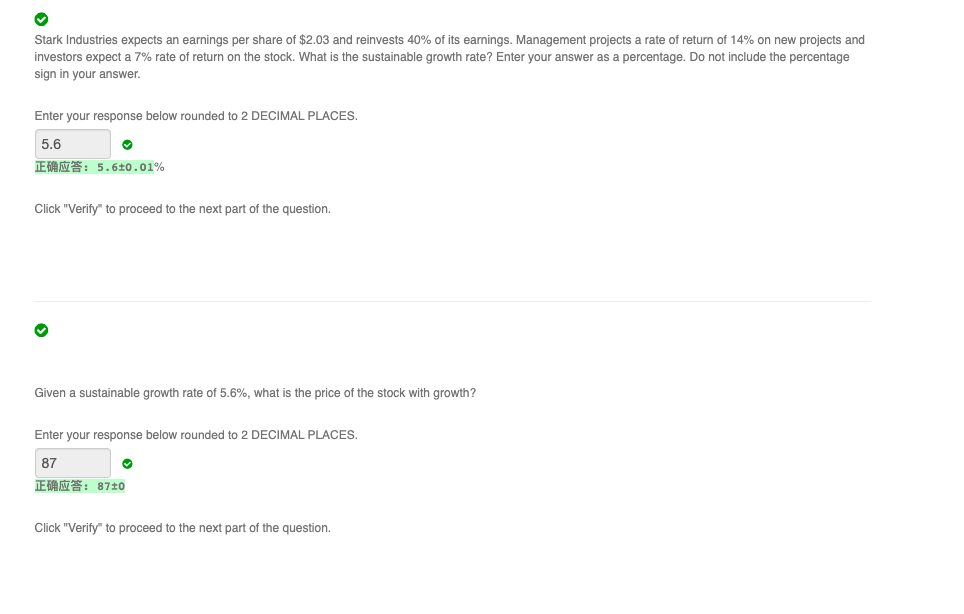

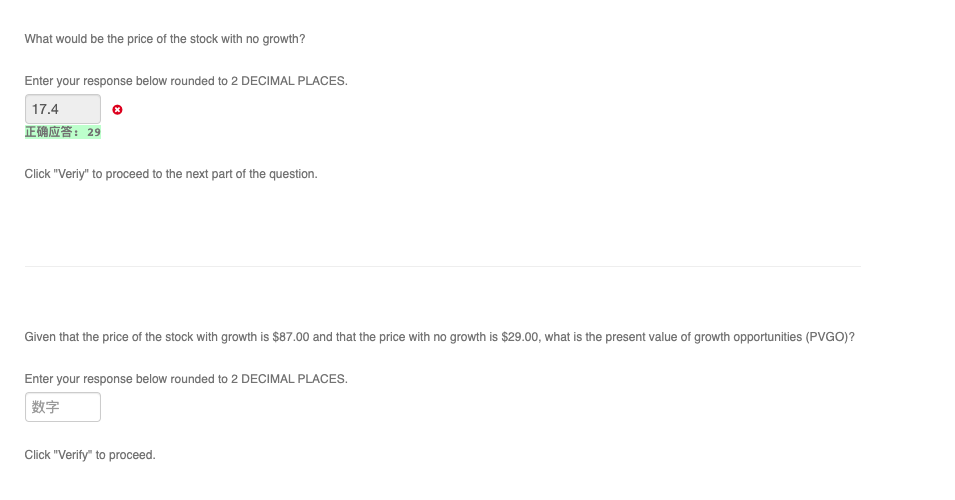

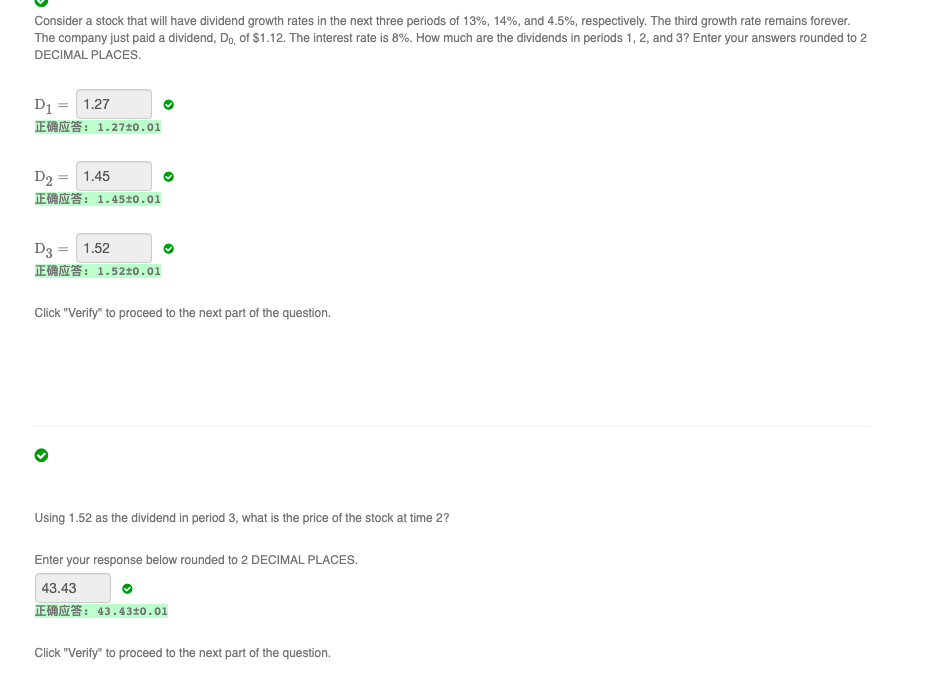

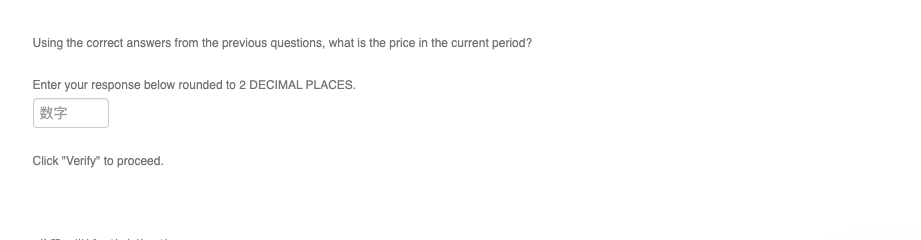

Stark Industries expects an earnings per share of $2.03 and reinvests 40% of its earnings. Management projects a rate of return of 14% on new projects and investors expect a 7% rate of return on the stock. What is the sustainable growth rate? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES, 5.6 IEWS: 5.630.01% Click "Verify" to proceed to the next part of the question. Given a sustainable growth rate of 5.6%, what is the price of the stock with growth? Enter your response below rounded to 2 DECIMAL PLACES. 87 : 8740 Click "Verify" to proceed to the next part of the question. What would be the price of the stock with no growth? Enter your response below rounded to 2 DECIMAL PLACES. 17.4 :29 Click "Veriy" to proceed to the next part of the question. Given that the price of the stock with growth is $87.00 and that the price with no growth is $29.00, what is the present value of growth opportunities (PVGO)? Enter your response below rounded to 2 DECIMAL PLACES. Click "Verify" to proceed. Consider a stock that will have dividend growth rates in the next three periods of 13%, 14%, and 4.5%, respectively. The third growth rate remains forever. The company just paid a dividend, Do, of $1.12. The interest rate is 8%. How much are the dividends in periods 1, 2, and 3? Enter your answers rounded to 2 DECIMAL PLACES D1 = 1.27 TE: 1.270.01 D2 = 1.45 :1.4540.01 D3 = 1.52 :1.520.01 : Click "Verify" to proceed to the next part of the question. > Using 1.52 as the dividend in period 3, what is the price of the stock at time 2? Enter your response below rounded to 2 DECIMAL PLACES. 43.43 :43.430.01 Click "Verify" to proceed to the next part of the question. Using the correct answers from the previous questions, what is the price in the current period? Enter your response below rounded to 2 DECIMAL PLACES. * Click "Verify" to proceed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts