Question: Answer the part (a) correctly with proper diagram. I will give Upvote if done correctly. Problem 4-8 (Algo) Expando, Inc. is considering the possibility of

Answer the part (a) correctly with proper diagram. I will give Upvote if done correctly.

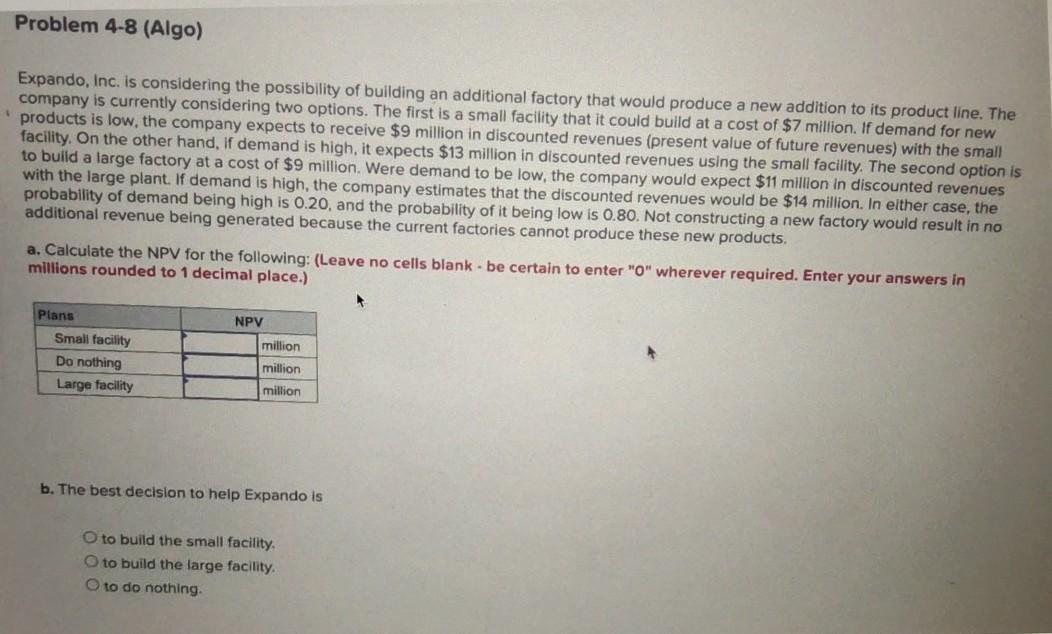

Problem 4-8 (Algo) Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $9 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, If demand is high, it expects $13 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $9 million. Were demand to be low, the company would expect $11 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $14 million. In either case, the probability of demand being high is 0.20, and the probability of it being low is 0.80. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products, a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in millions rounded to 1 decimal place.) NPV Plans Small facility Do nothing Large facility million million million b. The best decision to help Expando is O to build the small facility. O to build the large facility. O to do nothing Problem 4-8 (Algo) Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $9 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, If demand is high, it expects $13 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $9 million. Were demand to be low, the company would expect $11 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $14 million. In either case, the probability of demand being high is 0.20, and the probability of it being low is 0.80. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products, a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in millions rounded to 1 decimal place.) NPV Plans Small facility Do nothing Large facility million million million b. The best decision to help Expando is O to build the small facility. O to build the large facility. O to do nothingStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts