Question: Answer the previous 4 questions with true or false. (explain why its true or false) Internal Controls for Bank Lending Pacific Bank provides loans to

Answer the previous 4 questions with true or false. (explain why its true or false)

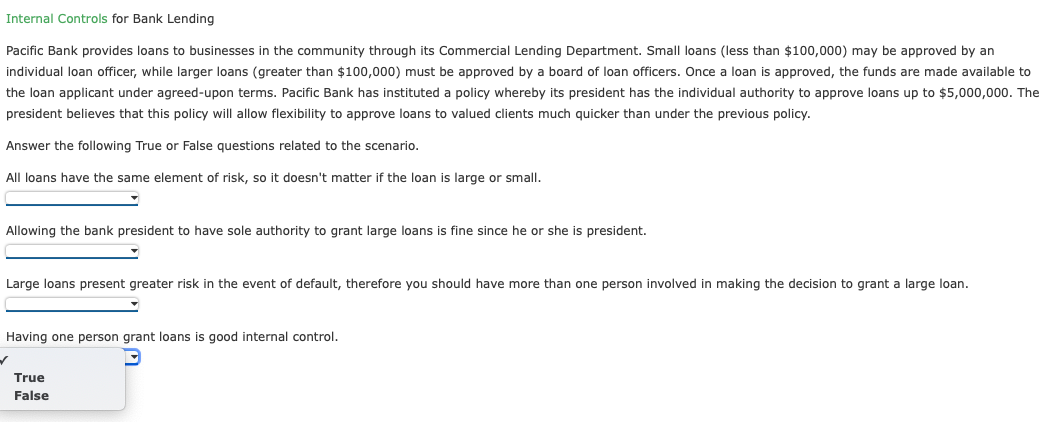

Internal Controls for Bank Lending Pacific Bank provides loans to businesses in the community through its Commercial Lending Department. Small loans (less than $100,000) may be approved by an individual loan officer, while larger loans (greater than $100,000) must be approved by a board of loan officers. Once a loan is approved, the funds are made available to the loan applicant under agreed-upon terms. Pacific Bank has instituted a policy whereby its president has the individual authority to approve loans up to $5,000,000. The president believes that this policy will allow flexibility to approve loans to valued clients much quicker than under the previous policy. Answer the following True or False questions related to the scenario. All loans have the same element of risk, so it doesn't matter if the loan is large or small. Allowing the bank president to have sole authority to grant large loans is fine since he or she is president. Large loans present greater risk in the event of default, therefore you should have more than one person involved in making the decision to grant a large loan. Having one person grant loans is good internal control. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts