Question: Answer the problem 1-10 and give the correct answer. Financial Management 202 Name: Date: 1. The company is considering a project that has the following

Answer the problem 1-10 and give the correct answer.

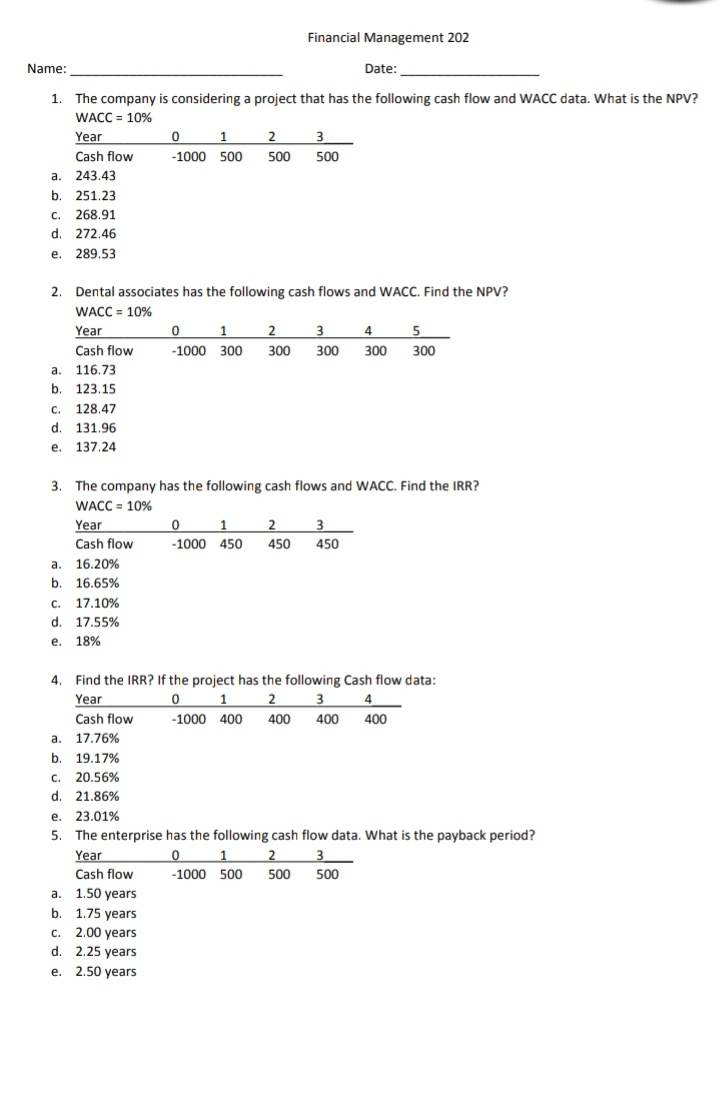

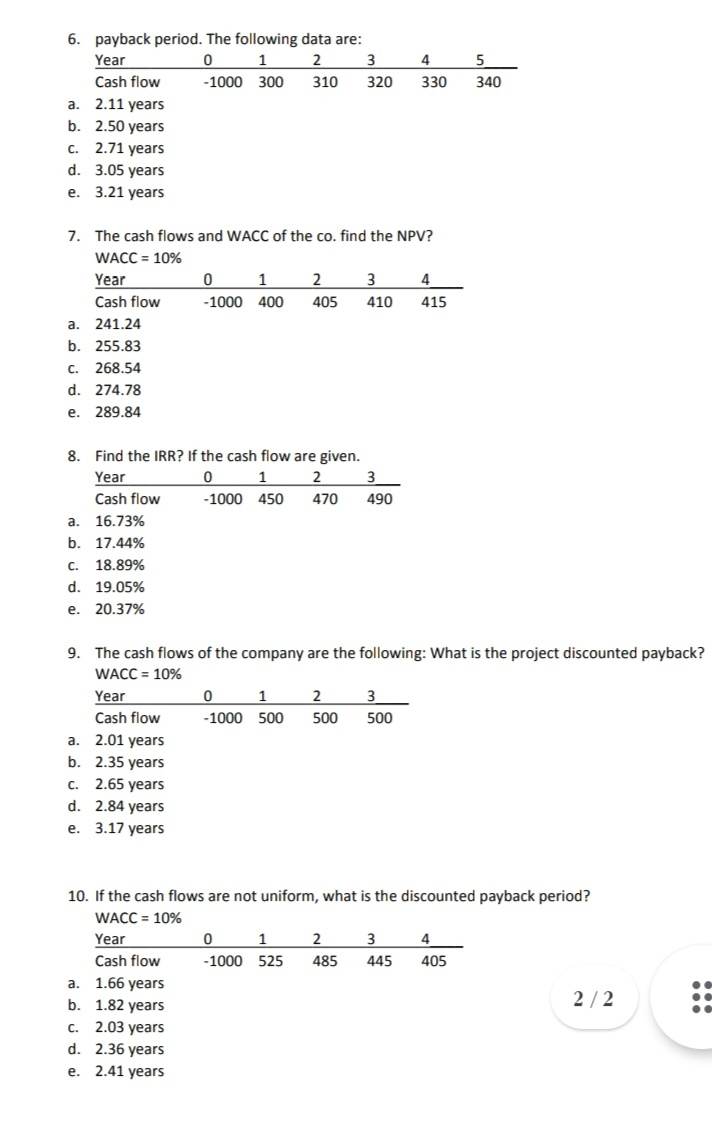

Financial Management 202 Name: Date: 1. The company is considering a project that has the following cash flow and WACC data. What is the NPV? WACC = 10% Year Cash flow -1000 500 500 500 a. 243.43 b. 251.23 268.91 d. 272.46 289.53 2. Dental associates has the following cash flows and WACC. Find the NPV? WACC = 10% Year 3 4 5 Cash flow 1000 300 300 300 300 300 a. 116.73 b. 123.15 . 128.47 d. 131.96 e. 137.24 3. The company has the following cash flows and WACC. Find the IRR? WACC = 10% Year 0 3 Cash flow -1000 450 450 450 a. 16.20% b. 16.65% C. 17.10% d. 17.55% 18% 4. Find the IRR? If the project has the following Cash flow data: Year 0 2 3 4 Cash flow -1000 400 400 400 400 a. 17.76% b. 19.17% . 20.56% d. 21.86% e. 23.01% 5. The enterprise has the following cash flow data. What is the payback period? Year 0 2 3 Cash flow -1000 500 500 500 a. 1.50 years b. 1.75 years c. 2.00 years d. 2.25 years e. 2.50 years6. payback period. The following data are: Year 0 2 3 5 Cash flow -1000 300 310 320 330 340 a. 2.11 years b. 2.50 years c. 2.71 years d. 3.05 years e. 3.21 years 7. The cash flows and WACC of the co. find the NPV? WACC = 10% Year 0 1 2 3 4 Cash flow -1000 400 405 410 415 241.24 b. 255.83 C. 268.54 d. 274.78 e. 289.84 8. Find the IRR? If the cash flow are given. Year 0 2 3 Cash flow -1000 450 470 490 a. 16.73% b. 17.44% C. 18.89% d. 19.05% e. 20.37% 9. The cash flows of the company are the following: What is the project discounted payback? WACC = 10% Year 0 1 2 3 Cash flow -1000 500 500 500 a. 2.01 years b. 2.35 years c. 2.65 years d. 2.84 years e. 3.17 years 10. If the cash flows are not uniform, what is the discounted payback period? WACC = 10% Year 0 1 2 3 4 Cash flow 1000 525 485 445 405 a. 1.66 years b. 1.82 years 2/2 c. 2.03 years d. 2.36 years e. 2.41 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts