Question: Answer the Question 1,2,3 and 5 no need question 4. many thanks. History and Background Founded in 2011, Dollar Shave Club began as a low-cost,

Answer the Question 1,2,3 and 5 no need question 4. many thanks.

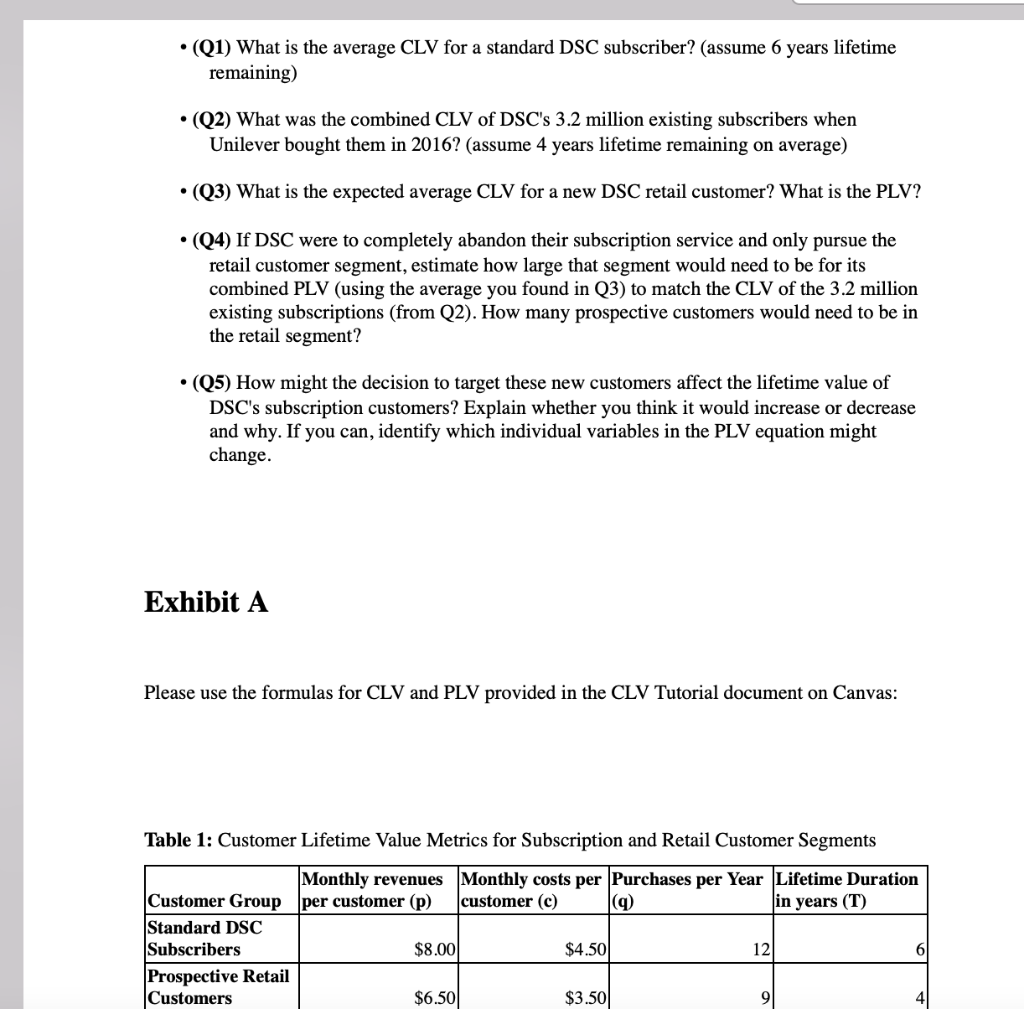

History and Background Founded in 2011, Dollar Shave Club began as a low-cost, direct-to-consumer service providing inexpensive men's razors with home delivery. The company launched its subscription membership service in March 2012 with an iconic video ad that went viral on YouTube and quickly spread awareness about Dollar Shave Club's service and its humorous, sarcastic, underdog brand positioning. See the ad: https://www.youtube.com/watch?v=ZUG9qYTJMSI Through this well-crafted advertisement and its wide exposure, Dollar Shave Club (DSC) not only had a successful launch but also achieved clear horizontal differentiation in a product category that was historically focused on vertical differentiation and price competition. Where market leaders Gillette and Schick had famously been fighting for market share by adding more blades to their products each year, DSC instead competed based on its personality. This proved to be a winning strategy that helped the company grow very rapidly in its first few years. The company had started primarily with the two founders' personal savings, then raised $1 million in Venture Capital (VC) funding just before its 2012 launch. Dollar Shave Club ended up raising an additional $9.8 million in VC funding by the end of that year, and had raised nearly $100 million in total by June 2015. In July 2016, with a total of 3.2 million subscribers, Dollar Shave Club was acquired by consumer goods giant Unilever for $1 billion in cash. This impressive sale price was motivated by DSC's distinctive brand, its strong and stable customer relationships, and the potential for Unilever to scale the brand using its superior resources and marketing capabilities. Customer Relationships at Dollar Shave Club Although Dollar Shave Club entered a mature product category with very little differentiation in features, they have built a strong business model around recurring revenue and sustained customer relationships. By establishing a strong brand personality that customers identify with, paired with a no-hassle subscription sales model, Dollar Shave Club is able to retain each customer's long-term loyalty more effectively than traditional competitors. The company finds that its typical subscription customer stays subscribed for 6 years total. This has let them build a strong base of customer relationships that provide reliable long-term cash flows. Unilever sells most of its other products through major nationwide retailers instead of specialty subscriptions. For example, the company's Axe and Dove brands of personal care products are sold in virtually every grocery, convenience, or drug store in the United States. This approach has been very successful for Unilever across many product categories, so they are strongly considering a similar model for Dollar Shave Club's products. Your job is to address this business problem by helping the brand understand how customer lifetime value might differ if they sold these products in a non-subscription format to a much wider base of customers. Selling Dollar Shave Club products at major retailers like Target, CVS, and large grocery chains would involve some important tradeoffs for the brand (see Table 1). On the positive side, this approach would allow the brand to scale up rapidly and serve a much larger number of customers. The company estimates that the average acquisition cost for a customer in the new retail channel would be around $35.00, compared to a $60.00 acquisition cost in the current subscription model. Relatedly, between economies of scale in their production process and the cost efficiencies of selling in stores instead of home delivery, Unilever's research team estimates that the costs associated with each purchase would be $1.00 lower in these indirect channels. On the negative side, retail customers are likely to be significantly less loyal to the brand than subscription customers. Aside from the general boost to loyalty that comes from a subscription system, the retail channel will also sacrifice some of DSC's strong customer-brand fit by distributing in a less targeted way. These customers are expected to have a slightly lower willingness-to-pay, and because DSC will be competing on price with other brands on the store shelf, they'll have to lower their standard pricing from $8.00 to $6.50. The research team also estimates that retail customer lifetime will be 4 years compared to the subscription program's 6 years due to reduced loyalty. Lastly, rather than purchasing every single month as current subscribers do, these new customers are expected to buy from DSC 9 times per year on average. Should Unilever expand the targeting of DSC to reach this broader base of potential retail customers ? In tackling this business problem, please address the following (see Exhibit A for related notes and assumptions): (Q1) What is the average CLV for a standard DSC subscriber? (assume 6 years lifetime remaining) (Q2) What was the combined CLV of DSC's 3.2 million existing subscribers when Unilever bought them in 2016? (assume 4 years lifetime remaining on average) (Q3) What is the expected average CLV for a new DSC retail customer? What is the PLV? (Q4) If DSC were to completely abandon their subscription service and only pursue the retail customer segment, estimate how large that segment would need to be for its combined PLV (using the average you found in Q3) to match the CLV of the 3.2 million existing subscriptions (from Q2). How many prospective customers would need to be in the retail segment? (25) How might the decision to target these new customers affect the lifetime value of DSC's subscription customers? Explain whether you think it would increase or decrease and why. If you can, identify which individual variables in the PLV equation might change. Exhibit A Please use the formulas for CLV and PLV provided in the CLV Tutorial document on Canvas: Table 1: Customer Lifetime Value Metrics for Subscription and Retail Customer Segments Monthly revenues Monthly costs per Purchases per Year Lifetime Duration Customer Group per customer (p) customer (c) q) in years (T) Standard DSC Subscribers $8.00 $4.50 12 Prospective Retail Customers $6.50 $3.50 91 History and Background Founded in 2011, Dollar Shave Club began as a low-cost, direct-to-consumer service providing inexpensive men's razors with home delivery. The company launched its subscription membership service in March 2012 with an iconic video ad that went viral on YouTube and quickly spread awareness about Dollar Shave Club's service and its humorous, sarcastic, underdog brand positioning. See the ad: https://www.youtube.com/watch?v=ZUG9qYTJMSI Through this well-crafted advertisement and its wide exposure, Dollar Shave Club (DSC) not only had a successful launch but also achieved clear horizontal differentiation in a product category that was historically focused on vertical differentiation and price competition. Where market leaders Gillette and Schick had famously been fighting for market share by adding more blades to their products each year, DSC instead competed based on its personality. This proved to be a winning strategy that helped the company grow very rapidly in its first few years. The company had started primarily with the two founders' personal savings, then raised $1 million in Venture Capital (VC) funding just before its 2012 launch. Dollar Shave Club ended up raising an additional $9.8 million in VC funding by the end of that year, and had raised nearly $100 million in total by June 2015. In July 2016, with a total of 3.2 million subscribers, Dollar Shave Club was acquired by consumer goods giant Unilever for $1 billion in cash. This impressive sale price was motivated by DSC's distinctive brand, its strong and stable customer relationships, and the potential for Unilever to scale the brand using its superior resources and marketing capabilities. Customer Relationships at Dollar Shave Club Although Dollar Shave Club entered a mature product category with very little differentiation in features, they have built a strong business model around recurring revenue and sustained customer relationships. By establishing a strong brand personality that customers identify with, paired with a no-hassle subscription sales model, Dollar Shave Club is able to retain each customer's long-term loyalty more effectively than traditional competitors. The company finds that its typical subscription customer stays subscribed for 6 years total. This has let them build a strong base of customer relationships that provide reliable long-term cash flows. Unilever sells most of its other products through major nationwide retailers instead of specialty subscriptions. For example, the company's Axe and Dove brands of personal care products are sold in virtually every grocery, convenience, or drug store in the United States. This approach has been very successful for Unilever across many product categories, so they are strongly considering a similar model for Dollar Shave Club's products. Your job is to address this business problem by helping the brand understand how customer lifetime value might differ if they sold these products in a non-subscription format to a much wider base of customers. Selling Dollar Shave Club products at major retailers like Target, CVS, and large grocery chains would involve some important tradeoffs for the brand (see Table 1). On the positive side, this approach would allow the brand to scale up rapidly and serve a much larger number of customers. The company estimates that the average acquisition cost for a customer in the new retail channel would be around $35.00, compared to a $60.00 acquisition cost in the current subscription model. Relatedly, between economies of scale in their production process and the cost efficiencies of selling in stores instead of home delivery, Unilever's research team estimates that the costs associated with each purchase would be $1.00 lower in these indirect channels. On the negative side, retail customers are likely to be significantly less loyal to the brand than subscription customers. Aside from the general boost to loyalty that comes from a subscription system, the retail channel will also sacrifice some of DSC's strong customer-brand fit by distributing in a less targeted way. These customers are expected to have a slightly lower willingness-to-pay, and because DSC will be competing on price with other brands on the store shelf, they'll have to lower their standard pricing from $8.00 to $6.50. The research team also estimates that retail customer lifetime will be 4 years compared to the subscription program's 6 years due to reduced loyalty. Lastly, rather than purchasing every single month as current subscribers do, these new customers are expected to buy from DSC 9 times per year on average. Should Unilever expand the targeting of DSC to reach this broader base of potential retail customers ? In tackling this business problem, please address the following (see Exhibit A for related notes and assumptions): (Q1) What is the average CLV for a standard DSC subscriber? (assume 6 years lifetime remaining) (Q2) What was the combined CLV of DSC's 3.2 million existing subscribers when Unilever bought them in 2016? (assume 4 years lifetime remaining on average) (Q3) What is the expected average CLV for a new DSC retail customer? What is the PLV? (Q4) If DSC were to completely abandon their subscription service and only pursue the retail customer segment, estimate how large that segment would need to be for its combined PLV (using the average you found in Q3) to match the CLV of the 3.2 million existing subscriptions (from Q2). How many prospective customers would need to be in the retail segment? (25) How might the decision to target these new customers affect the lifetime value of DSC's subscription customers? Explain whether you think it would increase or decrease and why. If you can, identify which individual variables in the PLV equation might change. Exhibit A Please use the formulas for CLV and PLV provided in the CLV Tutorial document on Canvas: Table 1: Customer Lifetime Value Metrics for Subscription and Retail Customer Segments Monthly revenues Monthly costs per Purchases per Year Lifetime Duration Customer Group per customer (p) customer (c) q) in years (T) Standard DSC Subscribers $8.00 $4.50 12 Prospective Retail Customers $6.50 $3.50 91Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock