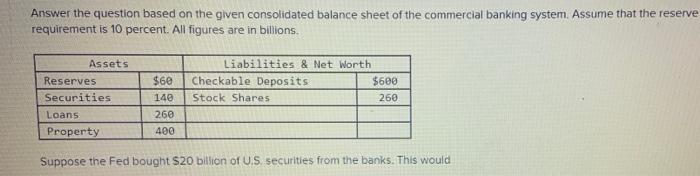

Question: Answer the question based on the given consolidated balance sheet of the commercial banking system. Assume that the reserve requirement is 10 percent. All figures

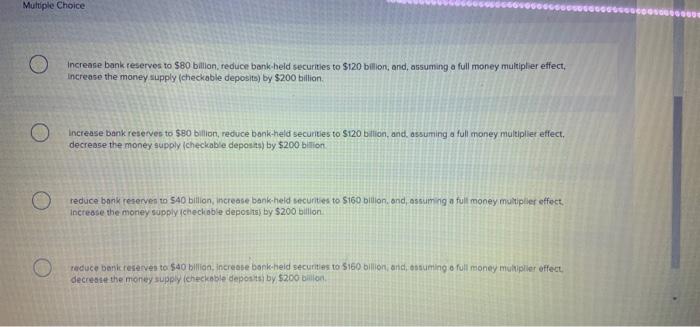

Answer the question based on the given consolidated balance sheet of the commercial banking system. Assume that the reserve requirement is 10 percent. All figures are in billions. Assets Reserves Securities Loans Property Liabilities & Net Worth Checkable Deposits $600 Stock Shares 268 $6e 140 260 400 Suppose the Fed bought $20 billion of U.S. securities from the banks. This would Multiple Choice Increase bank reserves to $80 billion, reduce bank held securities to $120 billion, and, assuming a full money multiplier effect, Increase the money supply(checkable deposits) by $200 billion Increase bank reserves to $80 billion, reduce bank-held securities to $120 billion, and, assuming a full money multiplier effect, decrease the money supply checkable deposits) by $200 billion. reduce bank reserve to 540 billion, increase bank-held securities to S160 bilion, and, assuming a full money multiple effect Increase the money supply checkoble deposits by $200 billion o reduce bank reserves to $40 billion, increase bork held securities to $160 billion and assuming a full money multiplier offect decrease the money supply checkable deposit by $200 bilion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts