Question: Answer the question below; Write up the following transactions in the books of S Pink: 2003 March 1 Started business with cash Sh.1,000. 2

Answer the question below;

Write up the following transactions in the books of S Pink:

2003

March 1 Started business with cash Sh.1,000.

" 2 Bought goods on credit from A Cliks Sh.296.

" 3 Paid rent by cash Sh.28.

" 4 Paid Sh.1,000 of the cash of the firm into a bank account.

" 5 Sold goods on credit to J Simpson Sh.54.

" 7 Bought stationery Sh.15 paying by cheque.

" 11 Cash sales Sh.49.

" 14 Goods returned by us to A Cliks Sh.17.

" 17 Sold goods on credit to P Lutz Sh.29.

" 20 Paid for repairs to the building by cash Sh.18.

37

" 22 J Simpson returned goods to us Sh.14.

" 27 Paid A Cliks by cheque Sh.279.

" 28 Cash purchases Sh.125.

" 29 Bought a motor vehicle paying by cheque Sh.395.

" 30 Paid motor expenses in cash Sh.15.

" 31 Bought fixtures Sh.120 on credit from R west.

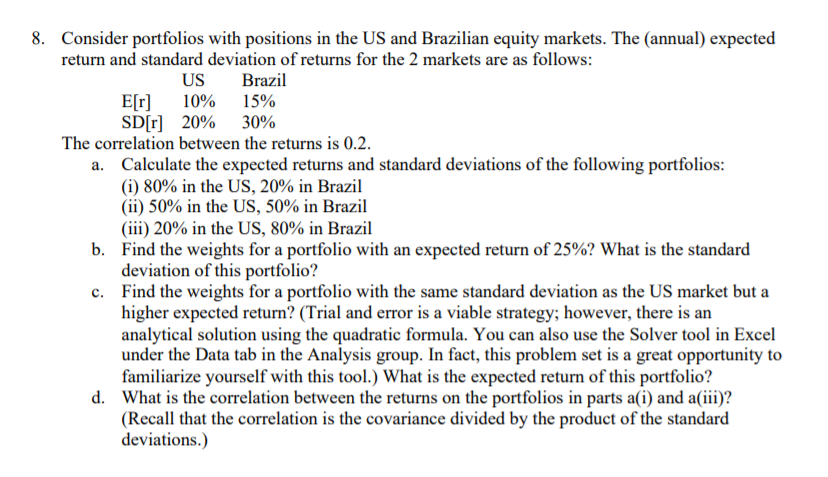

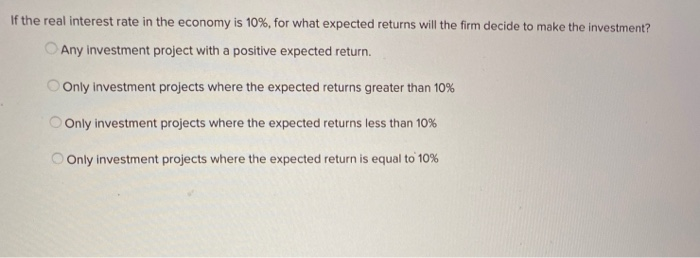

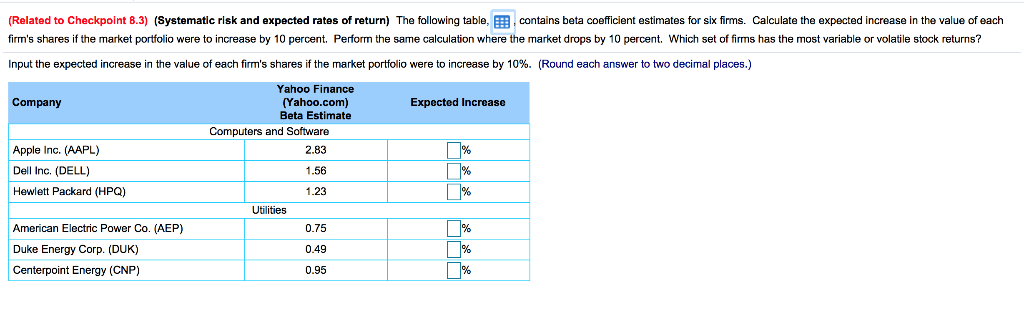

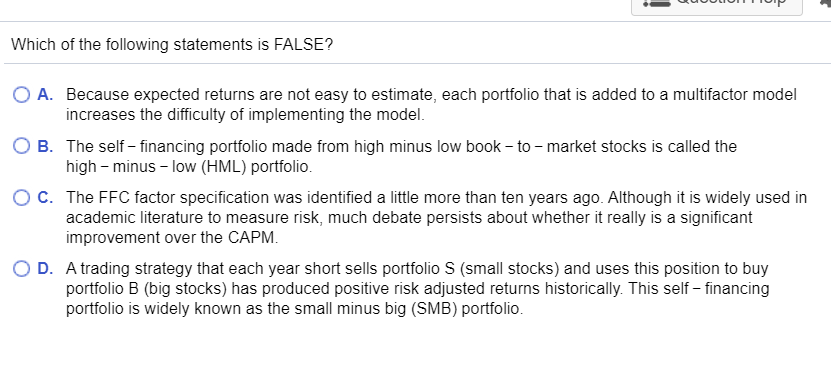

3. Consider portfolios with positions in the US and Brazilian equity markets. The {annual} expected return and standard deviation of returns for the 2 markets are as follows: US Brazil E[r] 10% 15% SD[r] 20% 30% The correlation between the returns is 0.2. a. |Calculate the expected returns and standard deviations of the following portfolios: (i) 30% in the US, 2D% in Brazil (ii) 50% in the US, 50% in Brazil {iii} 20% in the US, 8% in Brazil b. Find the weights for a portfolio with an expected return of 25%? What is the standard deviation of this portfolio? c. Find the weights for a portfolio with the same standard deviation as the US market but a higher expected return? {Trial and error is a viable strategy; however. there is an analytical solution using the quadratic formula. You can also use the Solver tool in Excel under the Data tab in the Analysis group. In fact, this problem set is a great opportunity to familiarize yourself with this tool.) What is the expected return of this portfolio? d. What is the correlation between the returns on the portfolios in parts a(i) and a(iii}? {Recall that the correlation is the covariance divided by the product of the standard deviations.) If the real interest rate in the economy is 10%, for what expected returns will the firm decide to make the investment? O Any investment project with a positive expected return. Only investment projects where the expected returns greater than 10% O Only investment projects where the expected returns less than 10% O Only investment projects where the expected return is equal to 10%(Related to Checkpoint 8.3) (Systematic risk and expected rates of return) The following table, , contains beta coefficient estimates for six firms. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by 10 percent. Perform the same calculation where the market drops by 10 percent. Which set of firms has the most variable or volatile stock returns? Input the expected increase in the value of each firm's shares if the market portfolio were to increase by 10%. (Round each answer to two decimal places.) Yahoo Finance Company (Yahoo.com) Expected Increase Beta Estimate Computers and Software Apple Inc. (AAPL) 2.83 7% Dell Inc. (DELL) 1.56 % Hewlett Packard (HPQ) 1.23 % Utilities American Electric Power Co. (AEP) 0.75 Duke Energy Corp. (DUK) 0.49 1% Centerpoint Energy (CNP) 0.95 %Which of the following statements is FALSE? O A. Because expected returns are not easy to estimate, each portfolio that is added to a multifactor model increases the difficulty of implementing the model. O B. The self - financing portfolio made from high minus low book - to - market stocks is called the high - minus - low (HML) portfolio. O C. The FFC factor specification was identified a little more than ten years ago. Although it is widely used in academic literature to measure risk, much debate persists about whether it really is a significant improvement over the CAPM. O D. A trading strategy that each year short sells portfolio S (small stocks) and uses this position to buy portfolio B (big stocks) has produced positive risk adjusted returns historically. This self - financing portfolio is widely known as the small minus big (SMB) portfolio