Question: answer the question in full and with showing your work for full credit. Chapter 12 Worksheet The Dunn Cherry Orchard always has hired transient workers

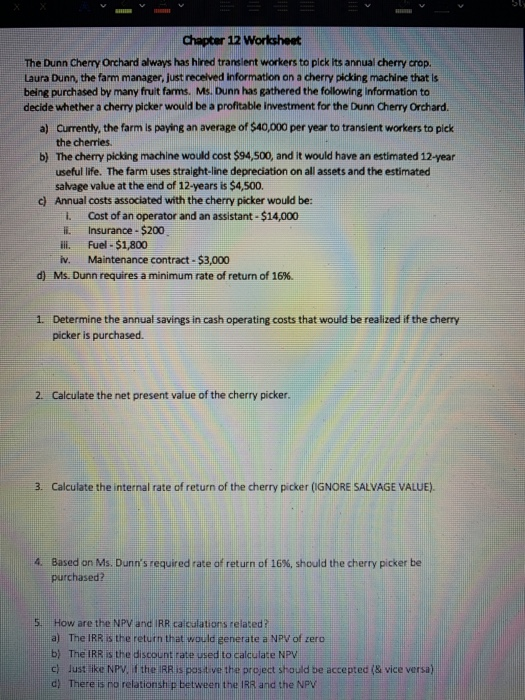

Chapter 12 Worksheet The Dunn Cherry Orchard always has hired transient workers to pick its annual cherry crop Laura Dunn, the farm manager, lust received information on a cherry picking machine that is being purchased by many fruit farms. Ms. Dunn has gathered the following information to decide whether a cherry picker would be a profitable investment for the Dunn Cherry Orchard. a) Currently, the farm is paying an average of $40,000 per year to transient workers to pick the cherries b) The cherry picking machine would cost $94,500, and it would have an estimated 12-year useful life. The farm uses straight-line depreciation on all assets and the estimated salvage value at the end of 12-years is $4,500. c) Annual costs associated with the cherry picker would be: Cost of an operator and an assistant - $14,000 ii Insurance - $200 Ill. Fuel - $1,800 iv. Maintenance contract - $3,000 d) Ms. Dunn requires a minimum rate of return of 16%. 1. Determine the annual savings in cash operating costs that would be realized if the cherry picker is purchased. 2. Calculate the net present value of the cherry picker. 3. Calculate the internal rate of return of the cherry picker (IGNORE SALVAGE VALUE). 4. Based on Ms. Dunn's required rate of return of 16%, should the cherry picker be purchased? 5. How are the NPV and IRR calculations related? a) The IRR is the return that would generate a NPV of zero b) The IRR is the discount rate used to calculate NPV c) Just like NPV the IRR IS positive the project should be accepted (& vice versa) d) There is no relationship between the IRR and the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts