Question: answer the question in typed format. The financial year for Drip Dry Cleaning Services ends on 30 June. Using the following information make the necessary

answer the question in typed format.

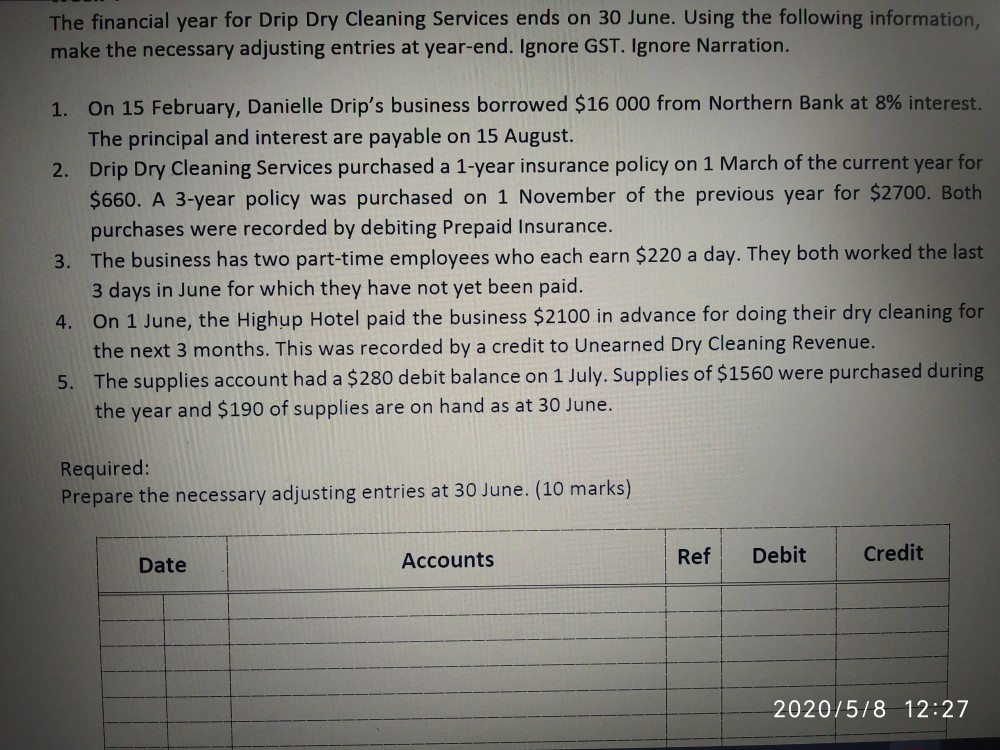

The financial year for Drip Dry Cleaning Services ends on 30 June. Using the following information make the necessary adjusting entries at year-end. Ignore GST. Ignore Narration. 1. On 15 February, Danielle Drip's business borrowed $16 000 from Northern Bank at 8% interest The principal and interest are payable on 15 August. 2. Drip Dry Cleaning Services purchased a 1-year insurance policy on 1 March of the current year for $660. A 3-year policy was purchased on 1 November of the previous year for $2700. Both purchases were recorded by debiting Prepaid Insurance. 3. The business has two part-time employees who each earn $220 a day. They both worked the last 3 days in June for which they have not yet been paid. 4. On 1 June, the Highup Hotel paid the business $2100 in advance for doing their dry cleaning for the next 3 months. This was recorded by a credit to Unearned Dry Cleaning Revenue. 5. The supplies account had a $280 debit balance on 1 July. Supplies of $1560 were purchased during the year and $190 of supplies are on hand as at 30 June. Required: Prepare the necessary adjusting entries at 30 June. (10 marks) Date Accounts Ref Debit Credit 2020/5/8 12:27 Required: Prepare the necessary adjusting entries at 30 June. (10 marks) Date Accounts Ref Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts