Question: Answer the question step by step with clear explanation The firm PQR expects to receive cash flow of 23 million in one year's time from

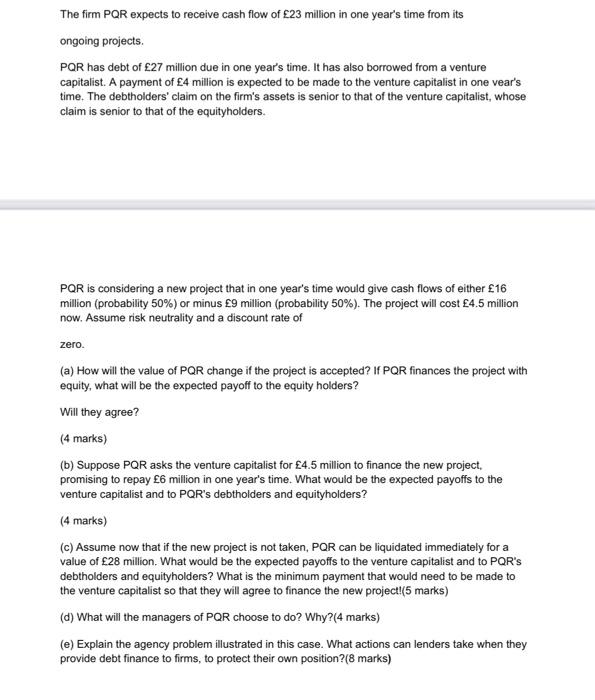

The firm PQR expects to receive cash flow of 23 million in one year's time from its ongoing projects. PQR has debt of 27 million due in one year's time. It has also borrowed from a venture capitalist. A payment of 4 million is expected to be made to the venture capitalist in one vear's time. The debtholders' claim on the firm's assets is senior to that of the venture capitalist, whose claim is senior to that of the equityholders. PQR is considering a new project that in one year's time would give cash flows of either 16 million (probability 50% ) or minus 9 million (probability 50% ). The project will cost 4.5 million now. Assume risk neutrality and a discount rate of zero. (a) How will the value of PQR change if the project is accepted? If PQR finances the project with equity, what will be the expected payoff to the equity holders? Will they agree? (4 marks) (b) Suppose PQR asks the venture capitalist for 4.5 million to finance the new project, promising to repay 6 million in one year's time. What would be the expected payoffs to the venture capitalist and to PQR's debtholders and equityholders? (4 marks) (c) Assume now that if the new project is not taken, PQR can be liquidated immediately for a value of 28 million. What would be the expected payoffs to the venture capitalist and to PQR's debtholders and equityholders? What is the minimum payment that would need to be made to the venture capitalist so that they will agree to finance the new project(5 marks) (d) What will the managers of PQR choose to do? Why?(4 marks) (e) Explain the agency problem illustrated in this case. What actions can lenders take when they provide debt finance to firms, to protect their own position?( 8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts