Question: answer the question UUninace 0 0 0 0 O MER 10 y 19 the Ma d 25 They'd f5fThe BEY Upton Umbrellas has a cost

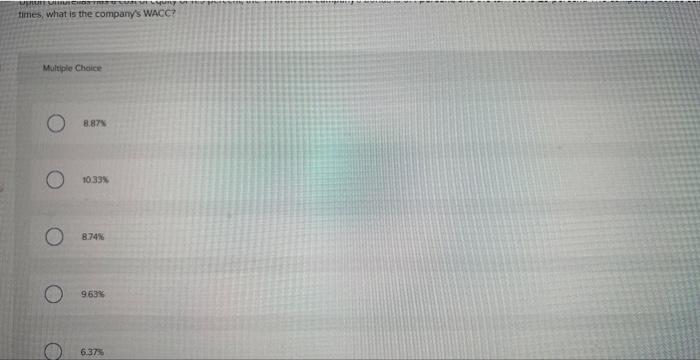

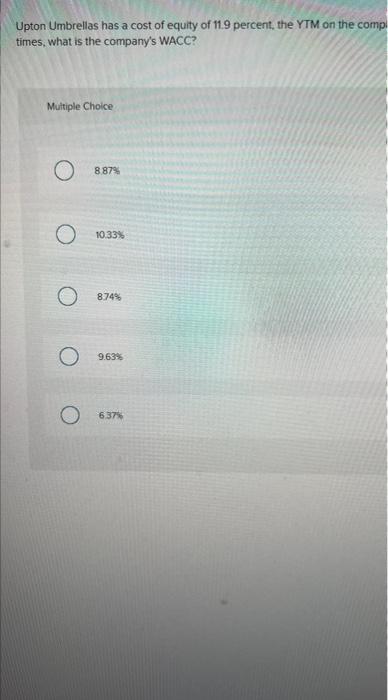

UUninace 0 0 0 0 O MER 10 y 19 the Ma d 25 They'd f5fThe BEY Upton Umbrellas has a cost of equity of 11.9 percent, the YTM on the company's bonds is 6.4 percent. times, what is the company's WACC? Multiple Choice O8.87% O 10.33% 874% 09635 6.37% b percent and the tax rate is 25 percent The company's bonds sell for 1035 percent of pat. The debt has a book value of $417000 and eases have a book val of 15551 Upton Umbrellas has a cost of equity of 11.9 percent, the YTM on the company's bonds is 6.4 percent, and the tax rate is 25 percent. The company's bonds sell for 103.5 percent of par times, what is the company's WACC? Multiple Choice O O 8.87% 10.33% 8.74% 9.63% the company's bonds is 6.4 percent, and the tax rate is 25 percent. The company's bonds sell for 103.5 percent of par The debit has a book value of $412000 and total assets tuve a book value of $955.000 # the make c The debt has a book value of $417,000 and total assets have a book value of $955,000. If the market-to-book ratio is 2.83 upununnnCHOS TRES U L yung set the pre times, what is the company's WACC? Multiple Choice O 8.87% 10.33% 8.74% 9.63% 6.37% Upton Umbrellas has a cost of equity of 11.9 percent, the YTM on the compl times, what is the company's WACC? Multiple Choice 8.87% O 10.33% O 8.74% 9.63% O 6.37% of 11.9 percent, the YTM on the company's bonds is 6.4 percent, and the tax rate is 25 percent. The company's bonds sell for 103.5 percent of par. The 4 -nt of par. The debt has a book value of $417,000 and total assets have a book value of $955,000. If the market-to-book ratio is 2.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts