Question: Answer the questions and show the full work a. Q1: A stock that pays $3 of dividend in perpetuity and is selling at $30. What

Answer the questions and show the full work

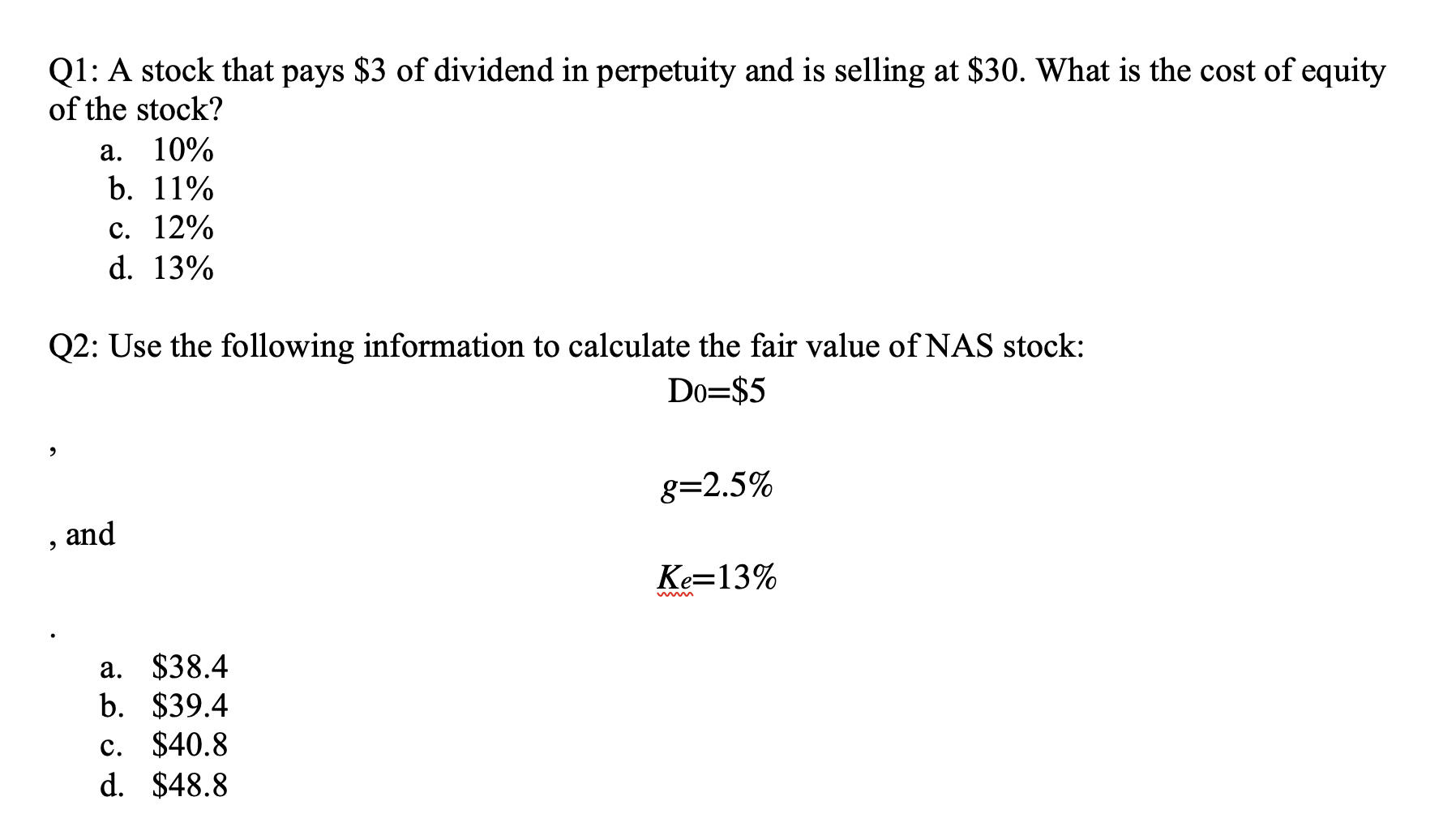

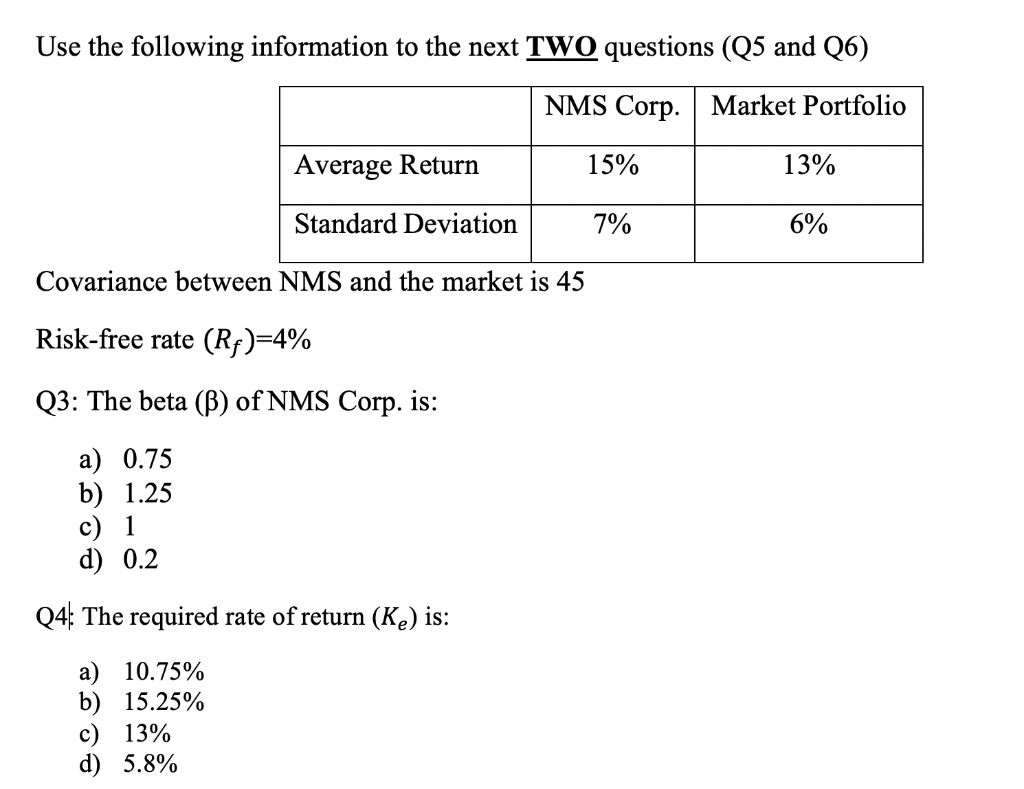

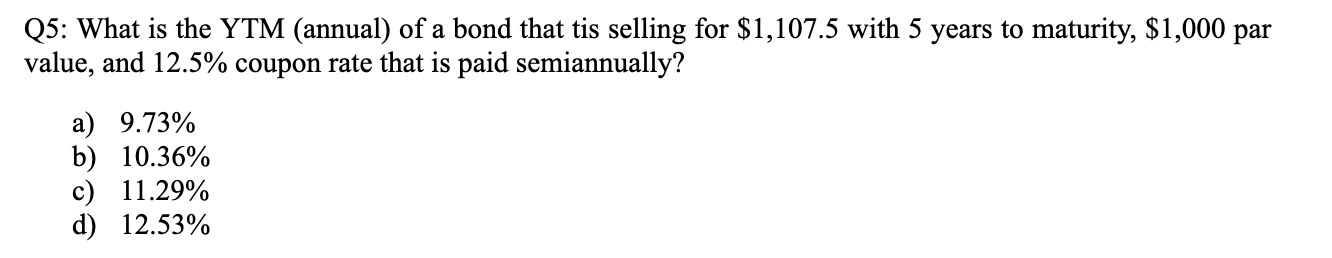

a. Q1: A stock that pays $3 of dividend in perpetuity and is selling at $30. What is the cost of equity of the stock? 10% b. 11% c. 12% d. 13% Q2: Use the following information to calculate the fair value of NAS stock: Do=$5 g=2.5% , and Ke=13% a. $38.4 b. $39.4 c. $40.8 d. $48.8 Use the following information to the next TWO questions (Q5 and 26) NMS Corp. | Market Portfolio Average Return 15% 13% Standard Deviation 7% 6% Covariance between NMS and the market is 45 Risk-free rate (RF)=4% Q3: The beta () of NMS Corp. is: a) 0.75 b) 1.25 c) 1 d) 0.2 Q4The required rate of return (Ke) is: 10.75% b) 15.25% c) 13% d) 5.8% Q5: What is the YTM (annual) of a bond that tis selling for $1,107.5 with 5 years to maturity, $1,000 par value, and 12.5% coupon rate that is paid semiannually? a) 9.73% b) 10.36% c) 11.29% d) 12.53%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts