Question: answer the questions below and explain your reasoning for the answer 1 The following information relates to Company ABC for June 2015. 0.2 Cash balance

answer the questions below and explain your reasoning for the answer

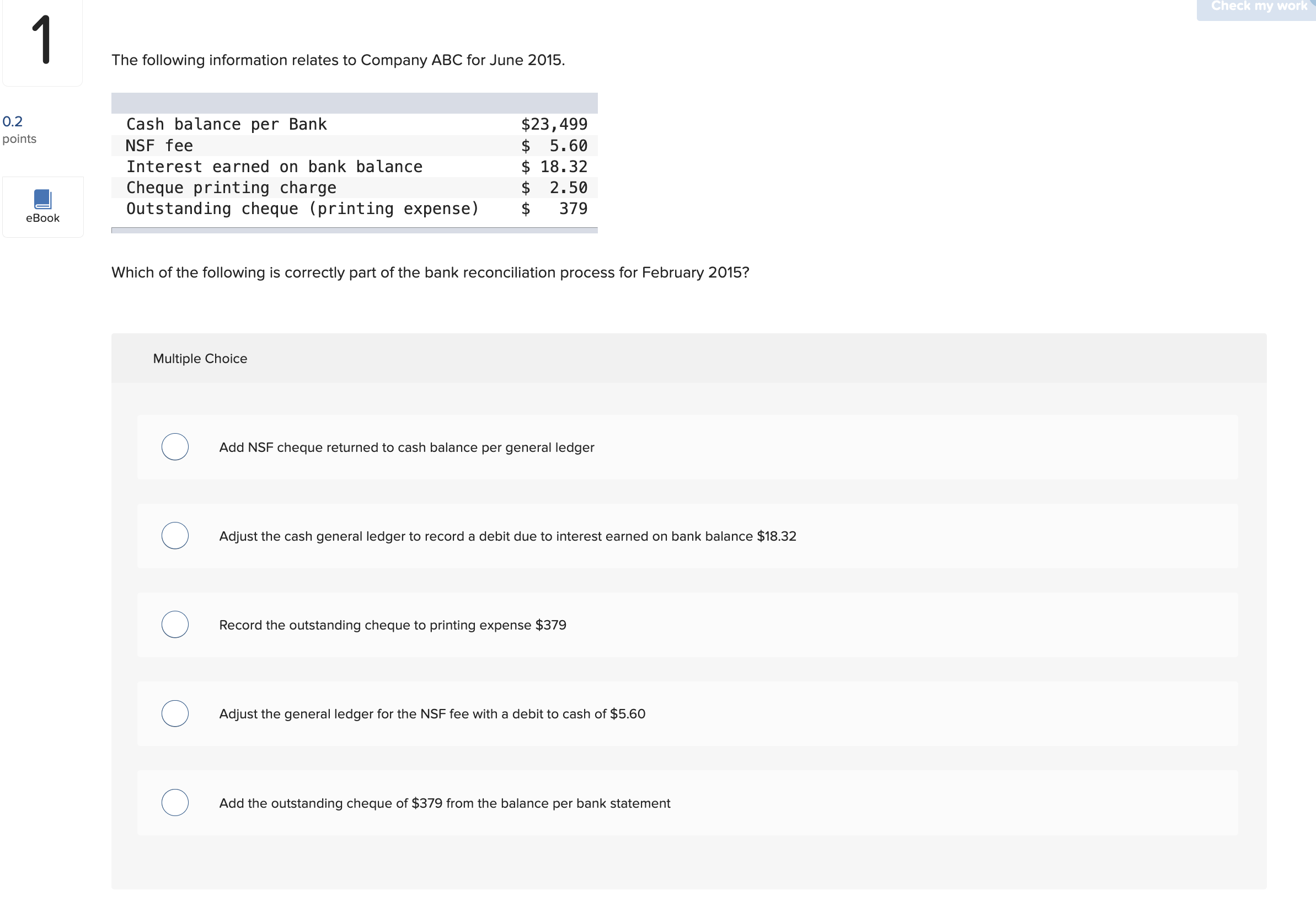

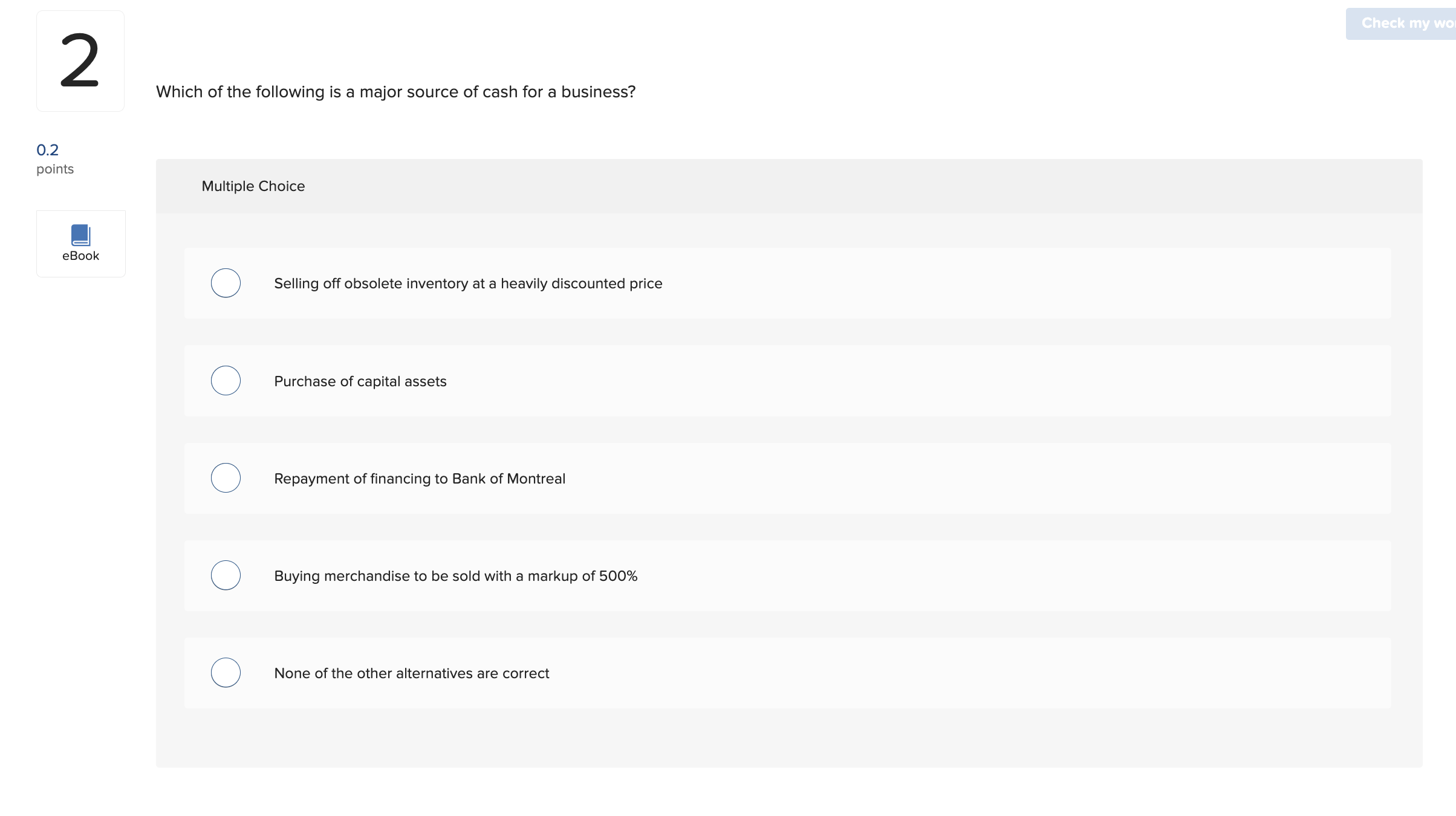

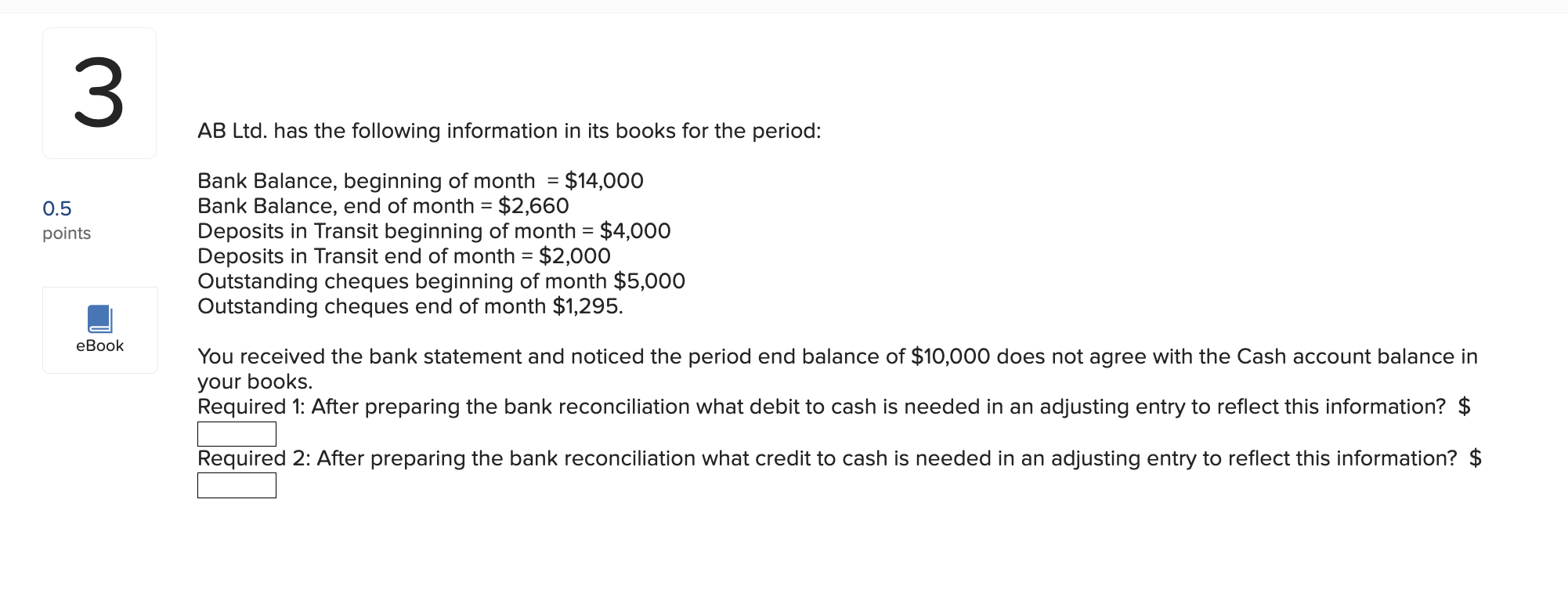

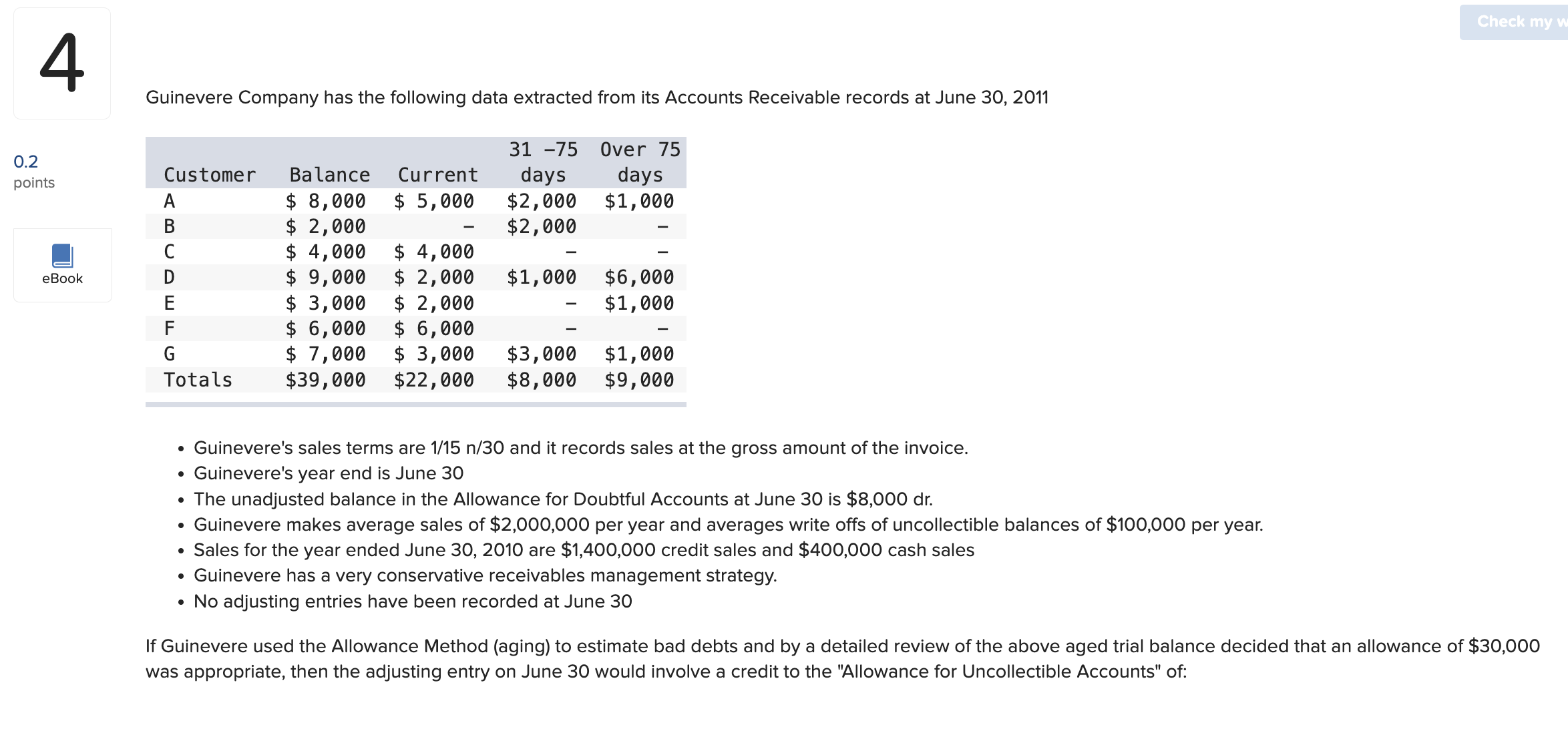

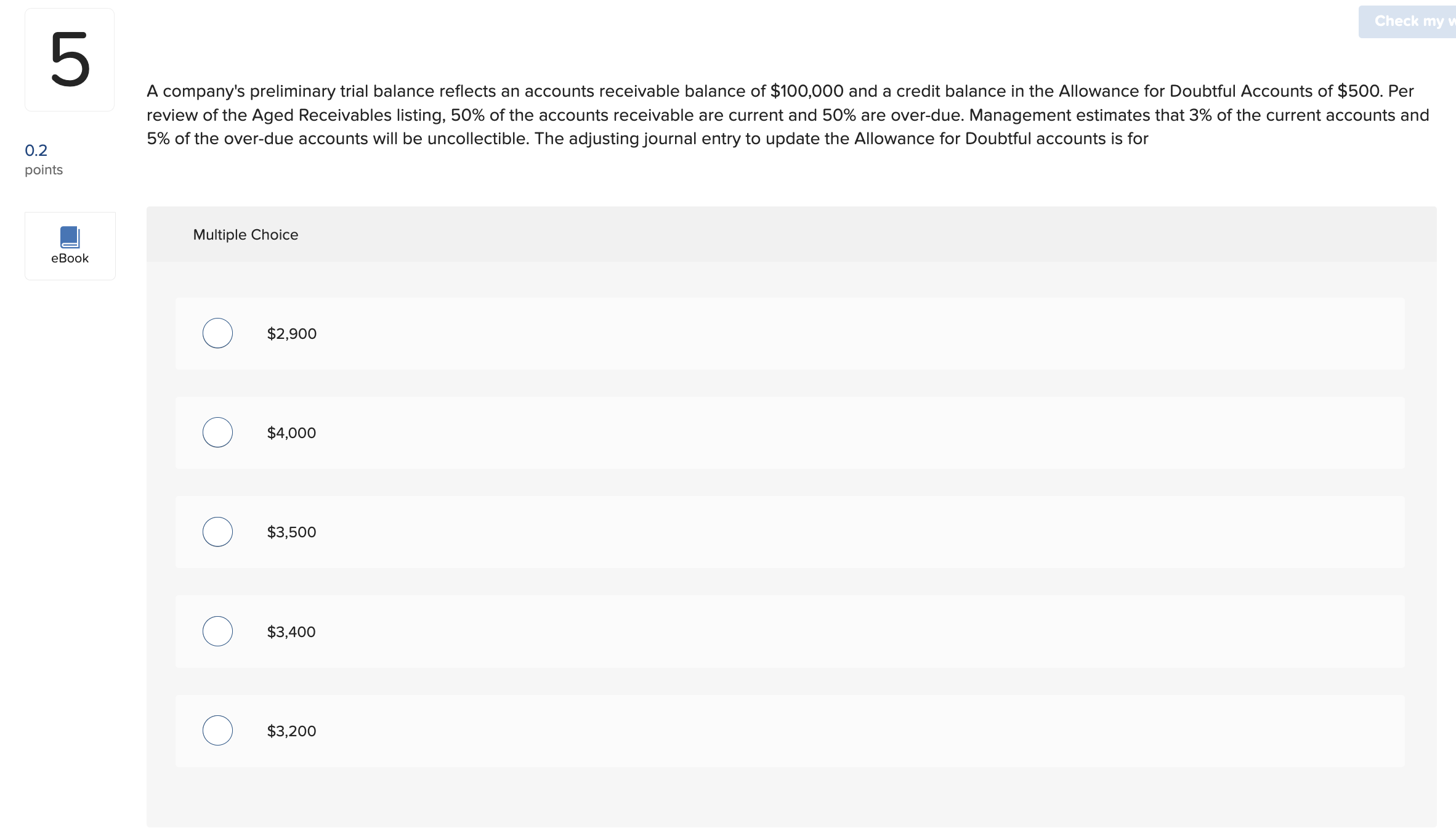

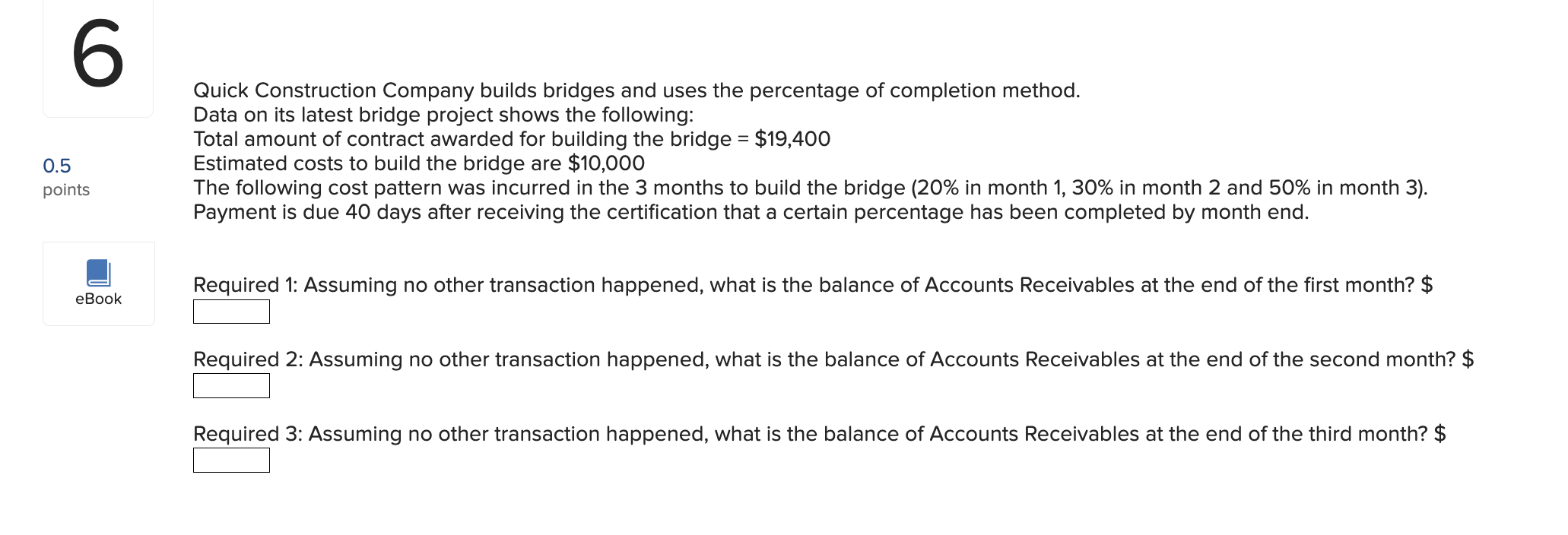

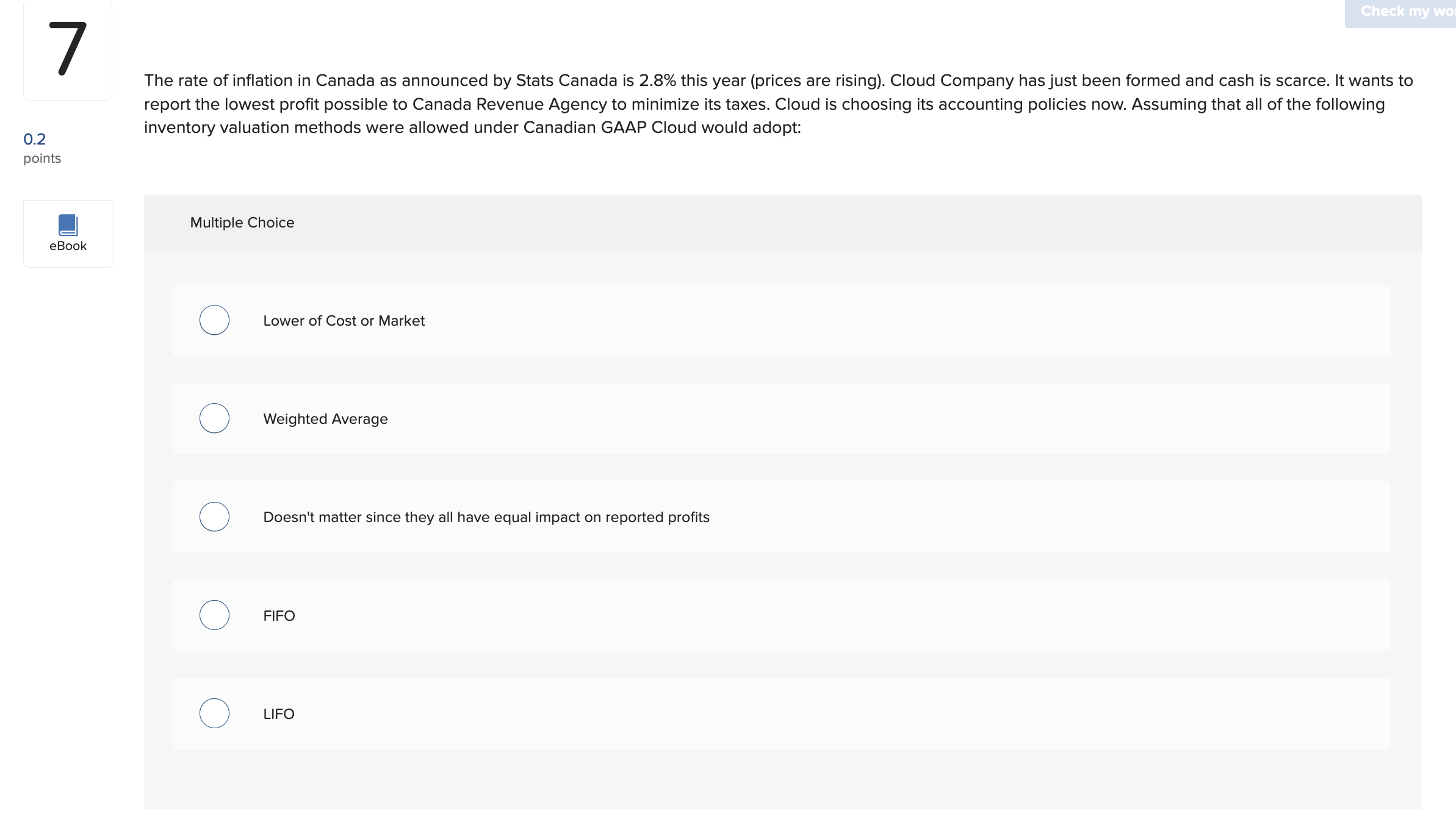

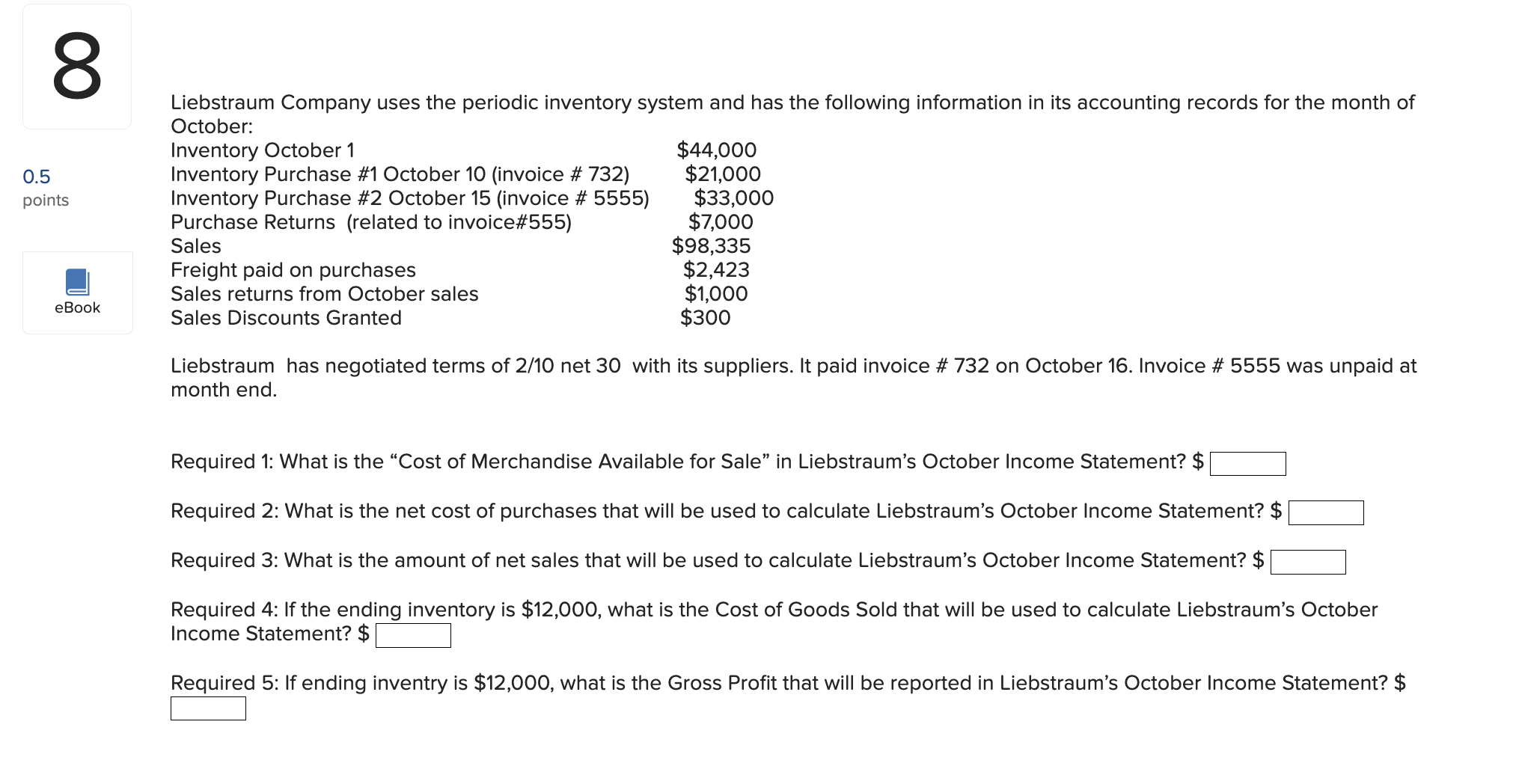

1 The following information relates to Company ABC for June 2015. 0.2 Cash balance per Bank $23,499 ROINE NSF fee $ 5.60 Interest earned on bank balance $ 18.32 Cheque printing charge $ 2.50 Outstanding cheque (printing expense) $ 379 eBook Which of the following is correctly part of the bank reconciliation process for February 2015? Multiple Choice Add NSF cheque returned to cash balance per general ledger Adjust the cash general ledger to record a debit due to interest earned on bank balance $18.32 Record the outstanding cheque to printing expense $379 Adjust the general ledger for the NSF fee with a debit to cash of $5.60 o O O O O Add the outstanding cheque of $379 from the balance per bank statement 2 0.2 points eBook Which of the following is a major source of cash for a business? Multiple Choice ORONONONO Selling off obsolete inventory at a heavily discounted price Purchase of capital assets Repayment of financing to Bank of Montreal Buying merchandise to be sold with a markup of 500% None of the other alternatives are correct AB Ltd. has the following information in its books for the period: Bank Balance, beginning of month = $14,000 0.5 Bank Balance, end of month = $2,660 points Deposits in Transit beginning of month = $4,000 Deposits in Transit end of month = $2,000 Outstanding cheques beginning of month $5,000 !| Outstanding cheques end of month $1,295. eBook You received the bank statement and noticed the period end balance of $10,000 does not agree with the Cash account balance in your books. Required 1: After preparing the bank reconciliation what debit to cash is needed in an adjusting entry to reflect this information? $ Required 2: After preparing the bank reconciliation what credit to cash is needed in an adjusting entry to reflect this information? $ Check my 4 Guinevere Company has the following data extracted from its Accounts Receivable records at June 30, 2011 0.2 31 -75 Over 75 points Customer Balance Current days days $ 8, 000 $ 5, 000 $2, 000 $1, 000 $ 2, 000 $2, 000 $ 4,000 $ 4,000 eBook D $ 9,000 $ 2, 000 $1, 000 $6, 000 E $ 3,000 $ 2, 000 $1, 000 F $ 6, 000 $ 6, 000 G $ 7,000 $ 3, 000 $3, 000 $1, 000 Totals $39, 000 $22, 000 $8, 000 $9, 000 . Guinevere's sales terms are 1/15 n/30 and it records sales at the gross amount of the invoice. . Guinevere's year end is June 30 . The unadjusted balance in the Allowance for Doubtful Accounts at June 30 is $8,000 dr. . Guinevere makes average sales of $2,000,000 per year and averages write offs of uncollectible balances of $100,000 per year. . Sales for the year ended June 30, 2010 are $1,400,000 credit sales and $400,000 cash sales . Guinevere has a very conservative receivables management strategy. . No adjusting entries have been recorded at June 30 If Guinevere used the Allowance Method (aging) to estimate bad debts and by a detailed review of the above aged trial balance decided that an allowance of $30,000 was appropriate, then the adjusting entry on June 30 would involve a credit to the "Allowance for Uncollectible Accounts" of:\f5 0.2 points A company's preliminary trial balance reflects an accounts receivable balance of $100,000 and a credit balance in the Allowance for Doubtful Accounts of $500. Per review of the Aged Receivables listing, 50% of the accounts receivable are current and 50% are over-due. Management estimates that 3% of the current accounts and 5% of the over-due accounts will be uncollectible. The adjusting journal entry to update the Allowance for Doubtful accounts is for Q Multiple Choice eBook $2,900 $4,000 $3,500 $3,400 O OO MO N $3,200 6 Quick Construction Company builds bridges and uses the percentage of completion method. Data on its latest bridge project shows the following: Total amount of contract awarded for building the bridge = $19,400 0.5 Estimated costs to build the bridge are $10,000 points The following cost pattern was incurred in the 3 months to build the bridge (20% in month 1, 30% in month 2 and 50% in month 3). Payment is due 40 days after receiving the certification that a certain percentage has been completed by month end. cBook Required 1: Assuming no other transaction happened, what is the balance of Accounts Receivables at the end of the first month? $ Required 2: Assuming no other transaction happened, what is the balance of Accounts Receivables at the end of the second month? $ Required 3: Assuming no other transaction happened, what is the balance of Accounts Receivables at the end of the third month? $ 7 0.2 points The rate of inflation in Canada as announced by Stats Canada is 2.8% this year (prices are rising). Cloud Company has just been formed and cash is scarce. It wants to report the lowest profit possible to Canada Revenue Agency to minimize its taxes. Cloud is choosing its accounting policies now. Assuming that all of the following inventory valuation methods were allowed under Canadian GAAP Cloud would adopt: Q Multiple Choice eBook Lower of Cost or Market Weighted Average Doesn't matter since they all have equal impact on reported profits FIFO OORONONO LIFO 8 Liebstraum Company uses the periodic inventory system and has the following information in its accounting records for the month of October: Inventory October 1 $44,000 0.5 Inventory Purchase #1 October 10 (invoice # 732) $21,000 points Inventory Purchase #2 October 15 (invoice # 5555) $33,000 Purchase Returns (related to invoice#555) $7,000 Sales $98,335 Freight paid on purchases $2,423 Sales returns from October sales $1,000 eBook Sales Discounts Granted $300 Liebstraum has negotiated terms of 2/10 net 30 with its suppliers. It paid invoice # 732 on October 16. Invoice # 5555 was unpaid at month end. Required 1: What is the "Cost of Merchandise Available for Sale" in Liebstraum's October Income Statement? $ Required 2: What is the net cost of purchases that will be used to calculate Liebstraum's October Income Statement? $ Required 3: What is the amount of net sales that will be used to calculate Liebstraum's October Income Statement? $ Required 4: If the ending inventory is $12,000, what is the Cost of Goods Sold that will be used to calculate Liebstraum's October Income Statement? $ Required 5: If ending inventry is $12,000, what is the Gross Profit that will be reported in Liebstraum's October Income Statement? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts